IA Brown Fagen & Rouse Lawyers Rental Income Worksheet - Dallas Center 2017-2025 free printable template

Show details

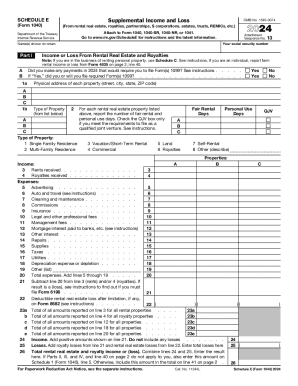

RENTAL INCOME WORKSHEET Taxpayer's Name Kind & Location of Rental PropertyDays Rented B C D E Property Tax Year 2017Days of Personal Use Property Does Owner Actively Participate in Operation?YES YES

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign schedule e rental income

Edit your schedule e rental income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule e rental income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule e rental income online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule e rental income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA Brown Fagen & Rouse Lawyers Rental Income Worksheet - Dallas Center Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (200 Votes)

4.2 Satisfied (39 Votes)

How to fill out schedule e rental income

How to fill out IA Brown Fagen & Rouse Lawyers Rental

01

Gather necessary personal information (name, address, contact details).

02

Prepare financial information (income, employment details, bank statements).

03

Review the rental application form provided by IA Brown Fagen & Rouse Lawyers.

04

Fill out each section of the application accurately and completely.

05

Attach any required documents (ID, pay stubs, reference letters).

06

Double-check for any errors or missing information before submission.

07

Submit the completed application form and documents to IA Brown Fagen & Rouse Lawyers.

Who needs IA Brown Fagen & Rouse Lawyers Rental?

01

Individuals seeking to rent a property.

02

Tenants requiring legal assistance in the rental application process.

03

Landlords needing to verify tenant applications legally.

04

Anyone needing assistance with rental agreements or disputes.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate rent income?

The formula for calculating rent to income ratio is very straightforward: Rent to Income (RTI) Ratio = Monthly Rent Price / Monthly Gross Income.

How do you calculate rental income from Schedule E?

Method for Calculating the Income When Schedule E is used to calculate qualifying rental income, the lender must add back any listed depreciation, interest, homeowners' association dues, taxes, or insurance expenses to the borrower's cash flow.

How do you calculate monthly income on a rental property?

Divide the gross annual income by 12 to get their monthly income figure: $86,000 ÷ 12 = $7,166.68 is their monthly income. Now multiply your rent by 3 to see if that total is less than the tenant's total monthly income: $3,000 x 3 = $9,000 per month.

How do you manually calculate rental income?

To calculate, first multiply the monthly rent amount by the number of months in the year to determine the income from rent; then, divide the income from rent by the appreciated home value. For example, if the monthly rent is $900, the total income from rent for the year would equal $10,800.

Is rental income on Schedule E?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as on Schedule E.

How do you calculate rental income percentage?

How to calculate net rental yield. Take the 'Annual rental income' and subtract the 'Annual expenses'. Then divide this number by the 'Property value' and then multiply by 100 to get a percentage value.

How do you calculate 75 of rental income?

Typically, lenders use a vacancy factor of 75 percent across the board when counting rental income, regardless of property type or income amount. They multiply the monthly rent you receive by 0.75. The resulting figure, or net cash flow, is added to any other income you may have, such as salary from employment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit schedule e rental income in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your schedule e rental income, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit schedule e rental income on an iOS device?

Use the pdfFiller mobile app to create, edit, and share schedule e rental income from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit schedule e rental income on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute schedule e rental income from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IA Brown Fagen & Rouse Lawyers Rental?

IA Brown Fagen & Rouse Lawyers Rental refers to a rental agreement or legal document related to the rental properties managed by the law firm Brown Fagen & Rouse. It outlines terms, conditions, and responsibilities pertaining to rental agreements.

Who is required to file IA Brown Fagen & Rouse Lawyers Rental?

Individuals or entities that are renting properties managed by Brown Fagen & Rouse are required to file the IA Brown Fagen & Rouse Lawyers Rental to establish their rental agreements and terms.

How to fill out IA Brown Fagen & Rouse Lawyers Rental?

To fill out IA Brown Fagen & Rouse Lawyers Rental, you should provide complete and accurate information about the rental property, parties involved, rental terms, duration, and any special clauses agreed upon. Ensure to read the form instructions carefully before submission.

What is the purpose of IA Brown Fagen & Rouse Lawyers Rental?

The purpose of IA Brown Fagen & Rouse Lawyers Rental is to formalize rental agreements, protect the rights of landlords and tenants, and outline expectations and responsibilities to prevent disputes.

What information must be reported on IA Brown Fagen & Rouse Lawyers Rental?

The information that must be reported on IA Brown Fagen & Rouse Lawyers Rental typically includes names of the landlord and tenant, property address, rental price, security deposit details, duration of the lease, and any special conditions or agreements.

Fill out your schedule e rental income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule E Rental Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.