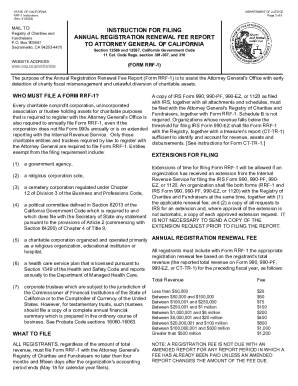

CA RRF-1 Instructions 2017 free printable template

Show details

MAIL TO:Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 942034470

(916) 2106400INSTRUCTION FOR FILING

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA SITE ADDRESS:

www.ag.ca.gov/charities/Section

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA RRF-1 Instructions

Edit your CA RRF-1 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RRF-1 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA RRF-1 Instructions online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA RRF-1 Instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RRF-1 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RRF-1 Instructions

How to fill out CA RRF-1 Instructions

01

Gather the necessary information about your charity, including its name, address, and Federal Employer Identification Number (FEIN).

02

Begin filling out the form by entering your organization name in the provided section.

03

Provide your organization's address, ensuring it's the current and correct address.

04

Fill in the FEIN in the designated field; this is essential for identification purposes.

05

Complete the questions related to your organization’s annual revenue and assets.

06

Indicate if your organization is subject to the California Attorney General's oversight.

07

Review all the information entered to ensure accuracy and completeness.

08

Sign and date the form at the bottom to certify the information is correct.

09

Submit the completed form to the California Attorney General’s office either by mail or electronically, adhering to the submission guidelines.

Who needs CA RRF-1 Instructions?

01

All charitable organizations operating in California that receive $50,000 or more in annual revenue and are required to file with the California Attorney General's Registry of Charitable Trusts need to complete the CA RRF-1.

Instructions and Help about CA RRF-1 Instructions

How to create a registration form with Google Docs. Go to Google Docs Select Forms Go to Google Forms Click the PLUS button Rename your new form Let’trcreatedtaan registration form SAVE FORM Enter the email addresses to which you want to get notifications when someone fills up the form. Don't forget to copy the Form Link DONE How to create a registration form with Google Docs.

Fill

form

: Try Risk Free

People Also Ask about

Is there a fee to file CT-TR-1?

Remember to file Form RRF-1 with either Form CT-TR-1 or IRS Form 990(EZ/PF). Initial Registration fee required from charity registration applicants on Form CT-1 updated to $50. Raffle Registration fee is updated on Form CT-NRP-1 to $30.

Is there a fee for CT-TR-1?

Remember to file Form RRF-1 with either Form CT-TR-1 or IRS Form 990(EZ/PF). Initial Registration fee required from charity registration applicants on Form CT-1 updated to $50. Raffle Registration fee is updated on Form CT-NRP-1 to $30.

Who files CT 1?

Every charitable corporation, unincorporated association and trustee holding assets for charitable purposes or doing business in California, unless exempt, is required to register with the Attorney General within thirty days after receipt of assets (cash or other forms of property).

Do I have to file RRF-1?

Yes. Unincorporated entities are required to annually file the Registration Renewal Fee Report (Form RRF-1), with applicable fees. A copy of IRS Form 990/990-EZ/990-PF is also required if gross annual revenue is $50,000 or above.

Who is required to file Form RRF-1?

Only those charitable entities and trustees required by law to register with the Attorney General are required to file Form RRF-1.

What is a state charity registration number in California?

State Charity Registration Number – Unique alphanumeric ID assigned to registrants by the Registry. For Charity Registrations, older Registration Numbers may be six numbers long, many with leading zeros that must be included in the search. Those issued since 2007 begin with 'CT' followed by seven numbers.

What is a charitable trust in California?

A trust is a fiduciary relationship with respect to property. A charitable trust is created by the expression of a charitable intent in a will, trust instrument, or corporate charter and requires the trustee to use the property for a charitable purpose such as relig- ion, education, or public welfare.

Do I have to file RRF 1?

Yes. Unincorporated entities are required to annually file the Registration Renewal Fee Report (Form RRF-1), with applicable fees. A copy of IRS Form 990/990-EZ/990-PF is also required if gross annual revenue is $50,000 or above.

What is an RRF 1 form?

The purpose of the Annual Registration Renewal Fee Report (Form RRF-1) is to assist the Attorney General's Office with early detection of charity fiscal mismanagement and unlawful diversion of charitable assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in CA RRF-1 Instructions without leaving Chrome?

CA RRF-1 Instructions can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the CA RRF-1 Instructions form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA RRF-1 Instructions and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit CA RRF-1 Instructions on an Android device?

You can make any changes to PDF files, like CA RRF-1 Instructions, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is CA RRF-1 Instructions?

CA RRF-1 Instructions are guidelines provided by the California Secretary of State's office for nonprofit organizations in California to fulfill their reporting obligations.

Who is required to file CA RRF-1 Instructions?

Nonprofit organizations that are registered in California and are exempt from federal income tax under Internal Revenue Code Section 501(c)(3) must file the CA RRF-1 Instructions.

How to fill out CA RRF-1 Instructions?

To fill out the CA RRF-1 Instructions, organizations should gather their financial data, ensure compliance with nonprofit regulations, and accurately complete the required sections of the form pertaining to their financial status and activities.

What is the purpose of CA RRF-1 Instructions?

The purpose of CA RRF-1 Instructions is to provide a standardized reporting mechanism for nonprofit organizations to disclose their financial information and maintain transparency with the state.

What information must be reported on CA RRF-1 Instructions?

CA RRF-1 Instructions require the reporting of information such as the organization's name, address, federal ID number, financial data, and a summary of activities conducted during the fiscal year.

Fill out your CA RRF-1 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RRF-1 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.