Get the free adding a joint owner — instructions & authorization form

Show details

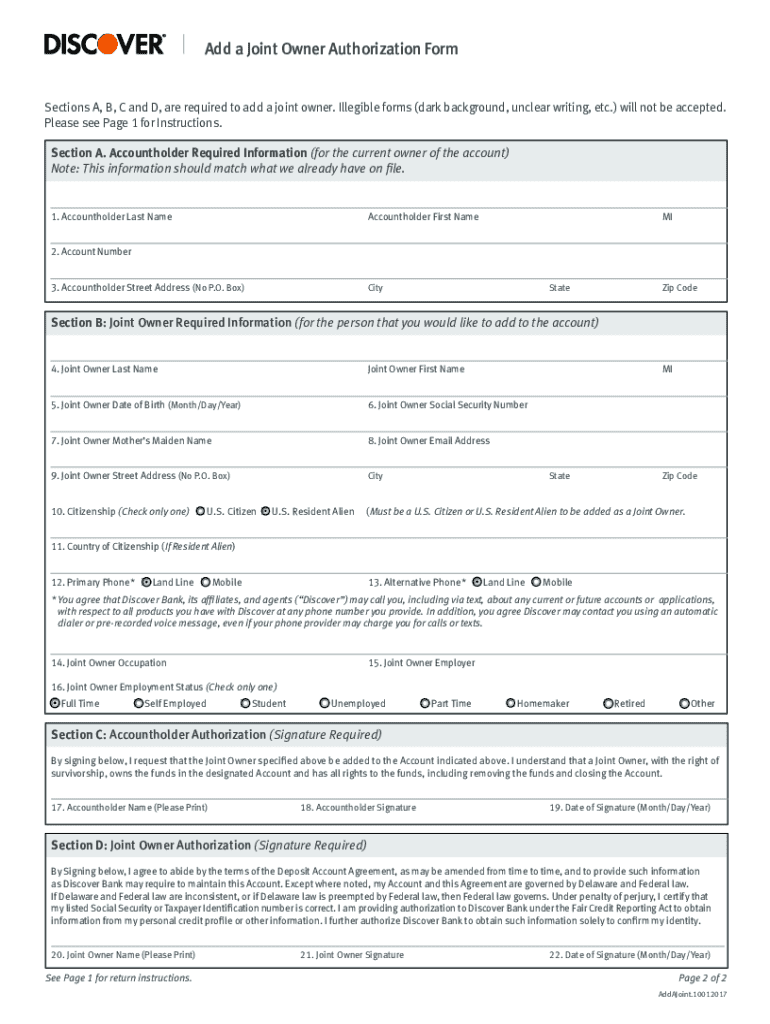

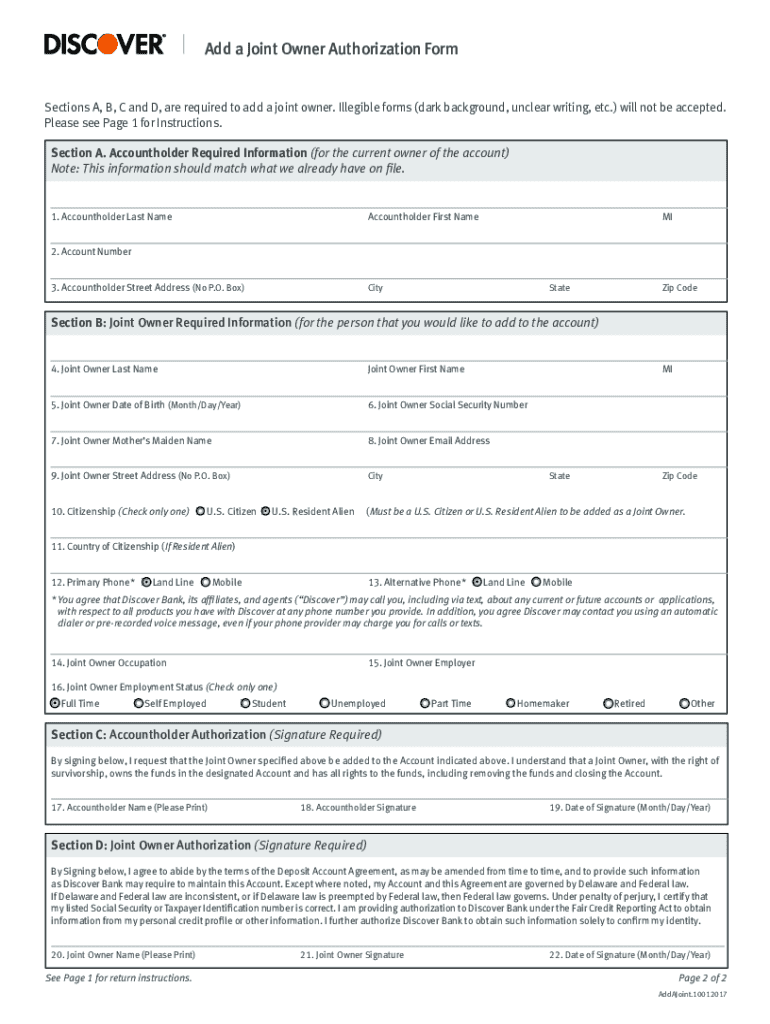

This document provides instructions for adding a joint owner to a Discover checking, money market, savings, or non-IRA CD account, detailing the steps and required signatures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adding a joint owner

Edit your adding a joint owner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adding a joint owner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit adding a joint owner online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit adding a joint owner. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adding a joint owner

How to fill out discover bank add joint?

01

Visit the official website of Discover Bank and login to your account.

02

Navigate to the "Account Management" section or a similar option.

03

Look for the option to add a joint account holder.

04

Click on the option to add a joint account holder and provide the required information.

05

Fill out the joint account holder's personal details such as name, date of birth, and contact information.

06

Enter the joint account holder's Social Security Number or Taxpayer Identification Number.

07

Review the terms and conditions related to adding a joint account holder.

08

Confirm the accuracy of the provided information and submit the application.

Who needs discover bank add joint?

01

Individuals who want to share their financial responsibilities with a trusted person.

02

Couples who want to manage their finances jointly.

03

Parents who wish to provide their children with a joint account for financial education and management purposes.

04

Business partners who require a joint account for their shared financial transactions.

05

Family members who want to support each other financially and have easy access to shared funds.

Note: It is always important to carefully consider the implications and responsibilities of adding a joint account holder before proceeding.

Fill

form

: Try Risk Free

People Also Ask about

Can you have a joint account at Discover bank?

Add a Joint Owner to a Discover Checking, Money Market, Savings or CD Account in two steps: Step 1. Complete the Add a Joint Owner Authorization Form on the following page. Individual forms must be submitted for each Joint Owner added.

Can I add someone to my Discover checking account?

Can I add someone to my Discover Bank account? You can add a Discover authorized user either online or by phone at (800) 347-2683. Online, you'll need to log in to your account with your username and password to add a Discover authorized user.

Does Discover bank allow joint accounts?

Choose your account type. When opening a savings account online, you may have the option of an individual account or a joint account. If you choose a joint account, (perhaps you want to share one with a family member), you'll need to enter the personal information of each account holder.

How do I add my spouse to my Discover account?

Here's how to add a Discover authorized user: Select “Manage,” then “Manage Authorized Users” under the section “Manage Cards.” Click “Add Authorized User” and enter the required information before submitting your request. By phone: Call customer service at (800) 347-2683 to request an authorized user.

Can I add someone to my Discover bank account?

You can add a Discover authorized user either online or by phone at (800) 347-2683. Online, you'll need to log in to your account with your username and password to add a Discover authorized user. You'll then need to enter the user's name, SSN, date of birth and address.

Can you add someone to your bank account online?

As with naming an authorized signer, you'll typically need to visit the bank in person in order to fill out required forms and provide proper identification, however some financial institutions do allow you to designate a beneficiary online. It's also possible to name more than one beneficiary on your accounts.

Can you add a joint owner to a bank account online?

Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the required information for both owners.

Can I add a joint account holder to my existing account?

Visit the bank, with the joint owner, and present the required documents. The bank will generally require both owners to complete and sign a joint application form and signature card, which authorizes both owners to have full access and control of the account.

What is the difference between a joint account holder and an authorized user?

With a joint account, both people can make purchases, and both are fully responsible for the bill; with an authorized user setup, both can make purchases, but only one is legally liable for paying.

Can you add a joint owner to an existing bank account?

Many banks also allow you to add another person to an existing bank account by contacting the bank and providing all the personal information required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get adding a joint owner?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific adding a joint owner and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit adding a joint owner online?

The editing procedure is simple with pdfFiller. Open your adding a joint owner in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out adding a joint owner on an Android device?

On Android, use the pdfFiller mobile app to finish your adding a joint owner. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is adding a joint owner?

Adding a joint owner refers to the process of including another individual as a co-owner of an asset or account, such as a bank account or property, allowing both parties to have equal rights and responsibilities.

Who is required to file adding a joint owner?

Typically, the current owner of the account or asset is required to file the necessary documentation to add a joint owner. This may also involve obtaining the consent and identification of the new joint owner.

How to fill out adding a joint owner?

To fill out the document for adding a joint owner, you generally need to provide information such as the current owner's details, the new joint owner's information, and signature verification. Specific forms may vary by institution.

What is the purpose of adding a joint owner?

The purpose of adding a joint owner is to allow shared access and management of an account or asset, facilitate transfer of rights upon the death of one owner, and to help in situations where one owner might be unavailable to manage the asset.

What information must be reported on adding a joint owner?

The information that must be reported includes the names, addresses, Social Security numbers or taxpayer identification numbers of both owners, the nature of the account or asset, and any specific terms or agreements related to the ownership.

Fill out your adding a joint owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adding A Joint Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.