Paychex POP002 2017-2025 free printable template

Show details

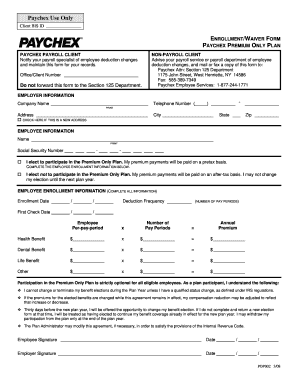

Patches Use Only Client BIS ID ENROLLMENT/WAIVER FORM PATCHES PREMIUM ONLY PLAN PATCHES PAYROLL CLIENT Notify your payroll specialist of employee deduction changes and maintain this form for your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign paychex pop002 only fillable form

Edit your paychex pop002 form fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pop002 enrollment form edit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pop002 enrollment premium fillable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit paychex pop002 waiver fillable form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Paychex POP002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pop002 premium only form

How to fill out Paychex POP002

01

Obtain the Paychex POP002 form from the Paychex website or your HR department.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Enter your employer's name and address in the appropriate section.

04

Specify the type of benefits being requested, including any coverage details needed.

05

Provide any additional required information, such as employee ID or identification numbers.

06

Review the completed form for accuracy before submission.

07

Sign and date the form at the bottom to validate your request.

08

Submit the form to the designated HR personnel or the address provided on the form.

Who needs Paychex POP002?

01

Employees who wish to enroll in or manage benefits provided by Paychex.

02

HR professionals managing employee benefits and compliance.

03

Employers looking to implement employee benefit programs.

Fill

pop002 only plan fillable

: Try Risk Free

People Also Ask about pop002 premium only sample

What is the IRS limit for tuition reimbursement?

If the company you currently work for has provided funds for educational assistance such as tuition reimbursement or employer student loan repayment, you may exclude an amount from your taxable income. This amount goes up to $5,250.

What IRS form do I use for tuition costs?

Form 1098-T requirement. To be eligible to claim the tuition and fees deduction, American opportunity credit, or the lifetime earning credit, the law requires a taxpayer (or a dependent) to have received a Form 1098-T from an eligible educational institution.

What is the federal Form 8917 for 2015?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid in 2015. This deduction is based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). See Qualified Education Expenses, later, for more information.

Who is eligible for Form 8917?

ing to IRS rules, you may be eligible to use Form 8917 if you, your spouse or a dependent claimed on your tax return was enrolled in a qualified educational institution in the relevant tax year. “Qualified” means the institution must be an institute of higher learning.

What is tax form 8917 used for?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pop002 premium only pdf to be eSigned by others?

Once your pop002 enrollment only download is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute paychex pop002 plan create online?

Filling out and eSigning pop002 form premium plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit pop002 form premium plan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share pop002 form premium plan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Paychex POP002?

Paychex POP002 is a specific form used for reporting certain employee benefits and tax information related to payroll processing and benefits administration.

Who is required to file Paychex POP002?

Employers who offer specific employee benefit plans, such as flexible spending accounts or health savings accounts, are usually required to file Paychex POP002.

How to fill out Paychex POP002?

To fill out Paychex POP002, employers need to gather relevant employee information, including payroll data, benefit elections, and contributions, then complete the form as per guidelines provided by Paychex.

What is the purpose of Paychex POP002?

The purpose of Paychex POP002 is to provide a standardized way for employers to report employee benefits and ensure compliance with tax regulations and benefit plan requirements.

What information must be reported on Paychex POP002?

Paychex POP002 must report information such as employee identification details, benefit type, contribution amounts, and any applicable tax information relevant to the benefits being administered.

Fill out your pop002 form premium plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

pop002 Form Premium Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.