NY DTF CT-200-V 2016 free printable template

Show details

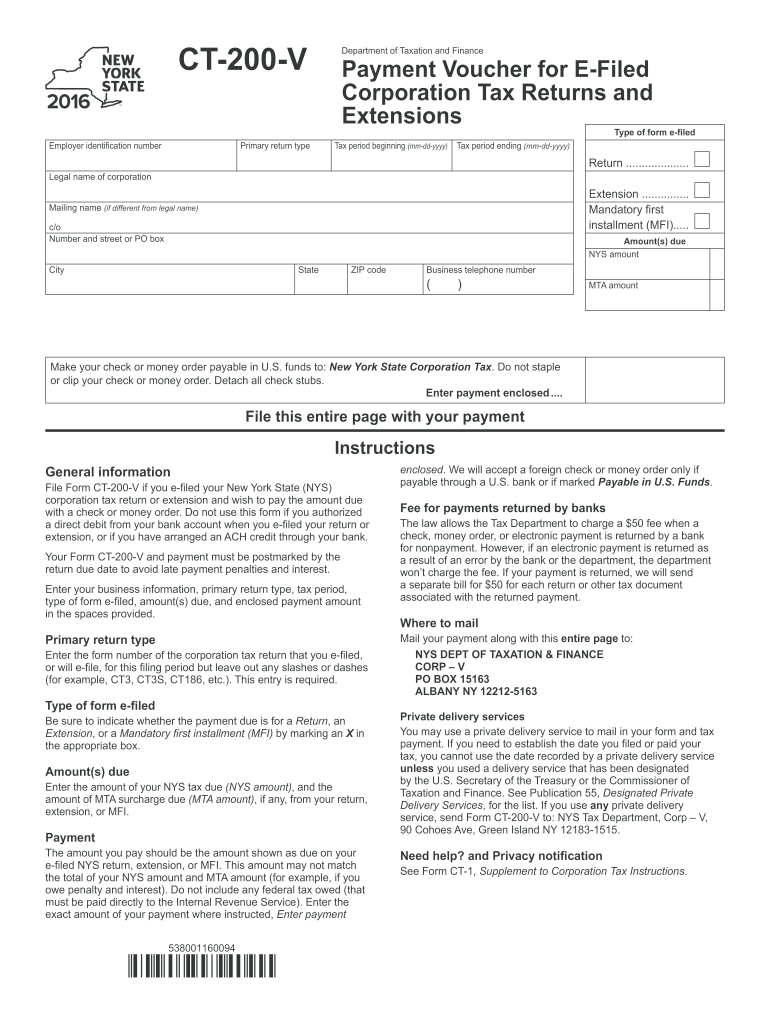

Your Form CT-200-V and payment must be postmarked by the return due date to avoid late payment penalties and interest. See Publication 55 Designated Private Delivery Services for the list. If you use any private delivery service send Form CT-200-V to NYS Tax Department Corp V 90 Cohoes Ave Green Island NY 12183-1515. CT-200-V Department of Taxation and Finance Payment Voucher for E-Filed Corporation Tax Returns and Extensions Type of form e-filed Employer identification number Primary return...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-200-V

Edit your NY DTF CT-200-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-200-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF CT-200-V online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF CT-200-V. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-200-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-200-V

How to fill out NY DTF CT-200-V

01

Obtain the NY DTF CT-200-V form from the New York Department of Taxation and Finance website.

02

Enter your personal information at the top of the form, including your name, address, and social security number or taxpayer identification number.

03

Fill in the details related to your tax type and year, ensuring that all required fields are completed accurately.

04

Calculate the total amount due by adding any applicable penalties or interest.

05

Sign and date the form at the designated area.

06

Submit the form along with your payment by mail or electronically, depending on the instructions provided on the form.

Who needs NY DTF CT-200-V?

01

Individuals or businesses that owe personal income tax in New York State.

02

Taxpayers who are required to make a payment for their tax liability but prefer to do so by filing a paper form.

03

Anyone who has received a notice from the New York Department of Taxation and Finance indicating a balance due.

Fill

form

: Try Risk Free

People Also Ask about

When can I file New York State tax return?

New York State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a NY state return). The latest deadline for e-filing New York State Tax Returns is April 18, 2023.

What is the minimum corporate tax in ct?

Connecticut also has a 7.50 percent corporate income tax rate. Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes. Connecticut's tax system ranks 47th overall on our 2023 State Business Tax Climate Index.

What is the minimum tax for a corporation?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

What is the minimum tax for a corporation in CT?

The minimum tax is $250. Form CT‑1120 ATT, Corporation Business Tax Return Attachment, contains the following computation schedules: Schedule H, Connecticut Apportioned Operating Loss Carryover; • Schedule I, Dividend Deduction; and • Schedule J, Bonus Depreciation Recovery.

What will the corporate tax rate be in 2023?

What is Corporate Tax Rate in United States? Corporate Tax Rate in United States remained unchanged at 21 % in 2023. The maximum rate was 52.8 % and minimum was 1 %. Data published Yearly by Internal Revenue Service.

What is the estimated tax rate for corporations in 2023?

To compute estimated tax liability, multiply the estimated net income for tax purposes by the applicable rate: Corporations, use 8.84%. S corporations, use 1.5%. Banks and financial corporations, use 10.84%.

What is the tax change for 2023?

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What is ct 200V?

To pay by check, use Form CT-200-V, Payment Voucher for E-Filed Corporation Tax Returns and Extensions. Your software will produce Form CT-200-V when you prepare your return or extension.

What is the minimum tax for a corporation in ct?

The minimum tax is $250. Form CT‑1120 ATT, Corporation Business Tax Return Attachment, contains the following computation schedules: Schedule H, Connecticut Apportioned Operating Loss Carryover; • Schedule I, Dividend Deduction; and • Schedule J, Bonus Depreciation Recovery.

How do I file an extension on my taxes in CT?

To request this extension, you must file Form CT-1127, Application for Extension of Time for Payment of Income Tax, with your timely filed Connecticut income tax return or extension. Purpose: Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return for individuals.

What is the minimum corporate tax in CT?

The minimum tax is $250. Form CT‑1120 ATT, Corporation Business Tax Return Attachment, contains the following computation schedules: Schedule H, Connecticut Apportioned Operating Loss Carryover; • Schedule I, Dividend Deduction; and • Schedule J, Bonus Depreciation Recovery.

What is CT 200 V form?

To pay by check, use Form CT-200-V, Payment Voucher for E-Filed Corporation Tax Returns and Extensions. Your software will produce Form CT-200-V when you prepare your return or extension.

Can I file an extension on my business taxes?

Business extensions If you need more time to complete your 2022 business tax return, you can request an extension of time to file your return. However, even with an extension, you need to estimate how much you owe (if you owe) and send in that amount by the due date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY DTF CT-200-V?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NY DTF CT-200-V in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the NY DTF CT-200-V electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NY DTF CT-200-V.

How do I fill out NY DTF CT-200-V on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NY DTF CT-200-V. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NY DTF CT-200-V?

NY DTF CT-200-V is a payment voucher used by businesses and individuals in New York State to remit certain tax payments, including corporate franchise taxes.

Who is required to file NY DTF CT-200-V?

Businesses and corporations that owe New York State corporate taxes are required to file NY DTF CT-200-V when making payments for their tax obligations.

How to fill out NY DTF CT-200-V?

To fill out NY DTF CT-200-V, taxpayers must provide their name, address, identification number, tax type, payment amount, and any other relevant information as requested on the form.

What is the purpose of NY DTF CT-200-V?

The purpose of NY DTF CT-200-V is to facilitate the payment process for tax liabilities owed to New York State, ensuring that the payments are properly recorded and credited to the taxpayer's account.

What information must be reported on NY DTF CT-200-V?

The information that must be reported on NY DTF CT-200-V includes the taxpayer's name, address, tax identification number, type of tax being paid, payment amount, and a signature if required.

Fill out your NY DTF CT-200-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-200-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.