Get the free CitiFirst Self Funding Instalments - ASX

Show details

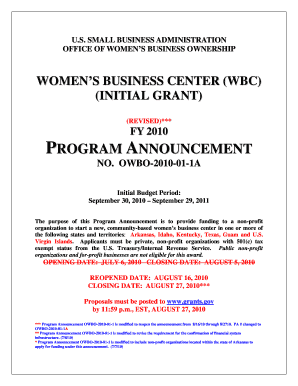

Citified Self Funding Installments Product Disclosure Statement SON and SO Series City Regular and High Yield Self Funding Installments 6 June 2017 Issued by Citigroup Global Markets Australia Pty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign citifirst self funding instalments

Edit your citifirst self funding instalments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your citifirst self funding instalments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing citifirst self funding instalments online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit citifirst self funding instalments. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out citifirst self funding instalments

How to fill out citifirst self funding instalments

01

Start by visiting the Citifirst website or contacting a Citifirst representative.

02

Gather all the required information and documents, such as personal identification, financial statements, and proof of income.

03

Understand the terms and conditions of the self funding instalments and the fees associated with it.

04

Fill out the application form accurately, providing all the necessary details.

05

Review your application before submitting it, ensuring all the information is correct and complete.

06

Submit the application along with the required documents.

07

Wait for the approval process to be completed.

08

Once approved, follow the instructions provided by Citifirst to complete the funding instalments process.

09

Make regular payments according to the agreed schedule to repay the funding instalments.

Who needs citifirst self funding instalments?

01

Citifirst self funding instalments can be beneficial for individuals or businesses looking for financing options to fund their projects or investments.

02

Anyone who meets the eligibility criteria and requires financial assistance can consider applying for Citifirst self funding instalments.

03

It is particularly useful for those who prefer a flexible repayment schedule and competitive interest rates.

04

Both individuals and businesses can benefit from Citifirst self funding instalments depending on their specific funding needs and objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send citifirst self funding instalments to be eSigned by others?

citifirst self funding instalments is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in citifirst self funding instalments?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your citifirst self funding instalments to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit citifirst self funding instalments on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as citifirst self funding instalments. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is citifirst self funding instalments?

Citifirst self funding instalments are a type of financial instrument that allows investors to invest in a diversified portfolio of assets.

Who is required to file citifirst self funding instalments?

Investors who hold citifirst self funding instalments in their portfolio are required to file them.

How to fill out citifirst self funding instalments?

Citifirst self funding instalments can be filled out by providing information about the holdings and performance of the investment portfolio.

What is the purpose of citifirst self funding instalments?

The purpose of citifirst self funding instalments is to provide investors with a way to access a diversified portfolio of assets.

What information must be reported on citifirst self funding instalments?

Information such as the value of the investment, any income earned, and any changes in the portfolio composition must be reported on citifirst self funding instalments.

Fill out your citifirst self funding instalments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Citifirst Self Funding Instalments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.