UK HMRC IHT421 2017 free printable template

Show details

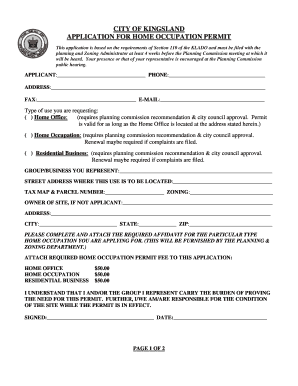

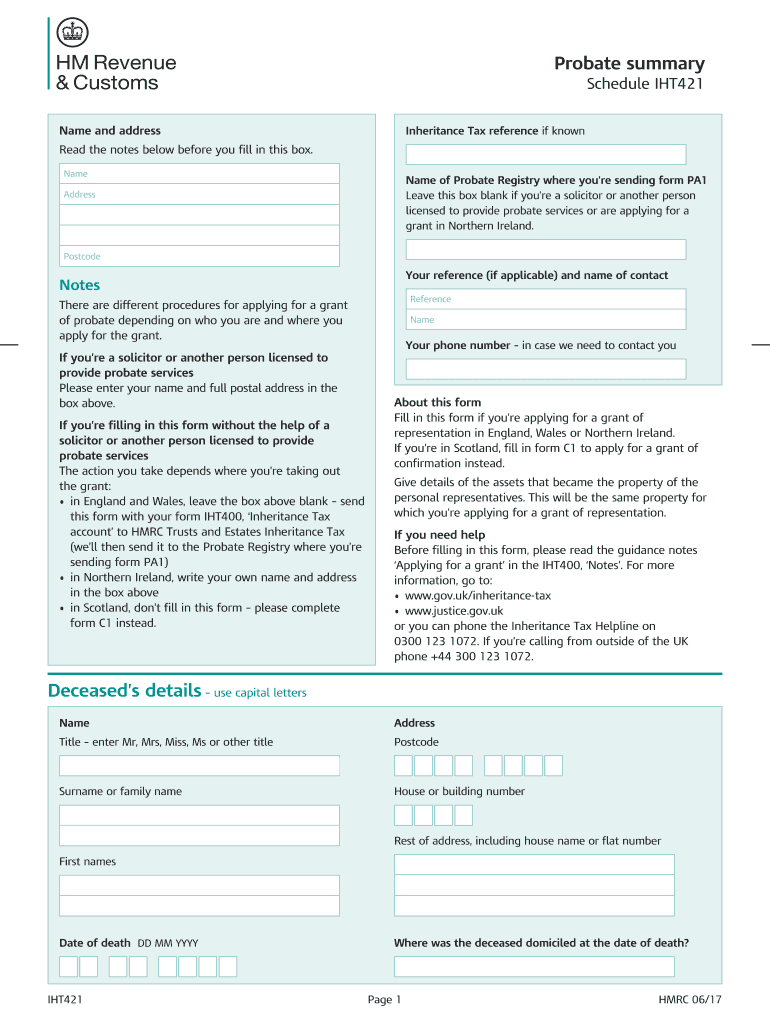

Probate summary

Schedule IHT421

Name and addressInheritance Tax reference if Konrad the notes below before you fill in this box.

Namesake of Probate Registry where you're sending form PA1

Leave this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a new deal for

Edit your a new deal for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a new deal for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a new deal for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a new deal for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC IHT421 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out a new deal for

How to fill out UK HMRC IHT421

01

Gather all necessary financial information about the deceased, including assets, liabilities, and personal details.

02

Obtain a copy of the IHT421 form from the HMRC website or local office.

03

Fill in the deceased's details, including full name, date of birth, and National Insurance number.

04

List all assets and their values, including property, savings, investments, and personal belongings.

05

Provide information on any debts or liabilities the deceased had at the time of death.

06

Complete the section regarding exemptions and reliefs, if applicable.

07

Sign and date the form, confirming the information is accurate to the best of your knowledge.

08

Submit the completed IHT421 form to HMRC along with any necessary supporting documents.

Who needs UK HMRC IHT421?

01

The UK HMRC IHT421 form is required for the personal representatives of a deceased person’s estate to report and pay Inheritance Tax if the estate's value exceeds the tax threshold.

02

It is typically needed by executors or administrators who are managing the deceased's estate.

Fill

form

: Try Risk Free

People Also Ask about

Is form E the same as D81?

In England, divorce proceedings involve Form E for financial disclosure and Form D81 for information on consent order/directions. The need to complete both forms varies by case and legal advice. Consult your legal counsel for guidance on which forms to fill out in your specific situation.

What is the form D81 for divorce?

Provide information about the parties' financial situation to support your application for a consent order: Form D81. Fill in this 'statement of information' to help the court decide whether the financial and property arrangements you've made are fair.

What are liabilities on D81 form?

The Form D81 helps the court understand your overall financial situation so they can decide whether or not the agreement you are asking them to make official is fair and reasonable. It is basically a summary of your assets (things you own) and liabilities (amounts you owe on loans, mortgages, credit cards, etc.)

What is the purpose of the D81 form?

Form D81 is a form used in family law proceedings in England and Wales. It is also known as a “statement of information for a consent order in relation to a financial remedy.” The purpose of Form D81 is to provide a summary of the financial situation of both parties in a divorce or dissolution of a civil partnership.

How many pages is a form E?

At first, filling out Form E can appear quite daunting, as the document itself is 28 pages long, but with sound legal advice, it can be fully completed without any issues.

What is a form E?

Form E is a document which contains information about your financial status and is required should you or your spouse apply to court for a financial settlement following a divorce.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in a new deal for?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your a new deal for and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the a new deal for in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your a new deal for and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete a new deal for on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your a new deal for. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

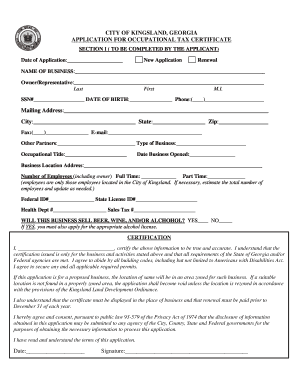

What is UK HMRC IHT421?

UK HMRC IHT421 is a form used for reporting inheritance tax on estates in the UK. It is part of the process to declare the value of an estate and detail any liabilities or exemptions.

Who is required to file UK HMRC IHT421?

The IHT421 form must be filed by the personal representatives, executors, or administrators of an estate when inheritance tax is due, typically when the estate's value exceeds the inheritance tax threshold.

How to fill out UK HMRC IHT421?

To fill out UK HMRC IHT421, personal representatives need to provide details about the deceased's estate, including assets, liabilities, and any exemptions that may apply. It's essential to follow the instructions on the form carefully.

What is the purpose of UK HMRC IHT421?

The purpose of UK HMRC IHT421 is to calculate the inheritance tax owed on an estate, ensure accurate reporting of the estate's value, and comply with legal obligations regarding tax filings.

What information must be reported on UK HMRC IHT421?

UK HMRC IHT421 requires information about the deceased's assets, liabilities, exemptions, any gifts made before death, and the value of the estate. It also includes details like the deceased's identity and the date of death.

Fill out your a new deal for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A New Deal For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.