TN TR-0020 2018-2025 free printable template

Show details

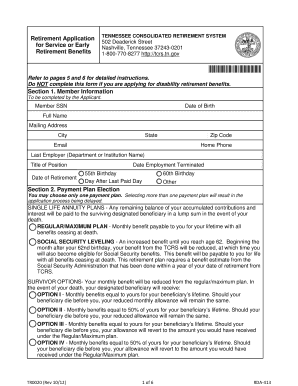

APPLICATION FOR SERVICE OR EARLY RETIREMENT BENEFITS Tennessee Consolidated Retirement System Tennessee Department of Treasury 502 Frederick Street Nashville, TN 372430201 800.922.7772 RetireReadyTN.good

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN TR-0020

Edit your TN TR-0020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN TR-0020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TN TR-0020 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TN TR-0020. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN TR-0020 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN TR-0020

How to fill out TN TR-0020

01

Obtain the TN TR-0020 form from the relevant agency or website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide any required identification numbers or related information as requested.

05

Clearly indicate the purpose for filling out the form.

06

Include any supporting documents if required.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form by the specified method (mail, online, in-person) to the correct department.

Who needs TN TR-0020?

01

Individuals applying for specific permits or licenses that require this form.

02

Businesses that need to fulfill regulatory obligations.

03

Residents needing to report information for compliance with local regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my money from TCRS?

Tennessee Consolidated Retirement System In order to qualify for a refund, a member must (1) have funds in TCRS, (2) no longer be employed by any employer covered by TCRS and (3) complete this application and return it to TCRS at the above address.

How do I contact Tcrs retirement?

please contact RetireReadyTN at 800-922-7772. Use Self Service to: View your account details.

How do I check my Tcrs retirement?

please contact RetireReadyTN at 800-922-7772.Log in to your account View your account details. Update your contact information. Apply for Retirement. Make or check the status of your requests. Change or update Beneficiary(s) Request a benefit estimate. Make service purchase requests and payments.

How many years do you have to work for the state of TN to retire?

The state makes all contributions to your retirement account. Vested members of TCRS become eligible for service retirement upon completion of 30 years of creditable service or upon attainment of age 60.

Do you pay taxes on Tennessee consolidated retirement?

Now that you're retired and have started receiving a monthly benefit payment from TCDRS, you will owe taxes on the money you receive.

Will TN state retirees get a raise in 2023?

Retired teachers and state employees who have been on the TCRS retired payroll for at least 12 consecutive months as of July 1, 2023 will receive a 3% cost-of-living adjustment, the highest increase available under laws governing TCRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TN TR-0020 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign TN TR-0020 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get TN TR-0020?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the TN TR-0020 in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit TN TR-0020 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing TN TR-0020 right away.

What is TN TR-0020?

TN TR-0020 is a specific form used in Tennessee for reporting certain types of transactions or activities, typically related to taxation or regulatory compliance.

Who is required to file TN TR-0020?

Individuals or entities that engage in activities subject to the reporting requirements outlined by the TN TR-0020 must file this form.

How to fill out TN TR-0020?

To fill out TN TR-0020, carefully read the instructions provided with the form, gather all necessary information, complete each section accurately, and ensure that any required signatures and dates are included.

What is the purpose of TN TR-0020?

The purpose of TN TR-0020 is to collect information necessary for compliance with Tennessee state regulations and to facilitate accurate assessment of taxes or other obligations.

What information must be reported on TN TR-0020?

Information required on TN TR-0020 may include details such as entity name, type of transaction, amounts involved, dates of transactions, and any other relevant data specified in the form's instructions.

Fill out your TN TR-0020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN TR-0020 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.