Get the free Sensible Savings

Show details

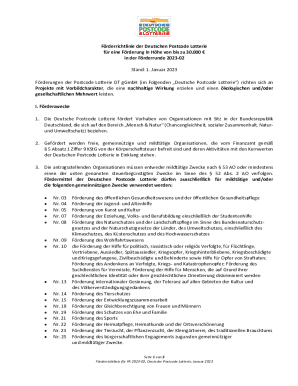

Sensible Savings Fixed Term Savings Bond Application Form1 The Access Bank UK Limited is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sensible savings

Edit your sensible savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sensible savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sensible savings online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sensible savings. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sensible savings

How to fill out sensible savings

01

Start by assessing your current financial situation. Evaluate your income, expenses, and savings goals to determine how much you can save.

02

Set a realistic savings target. Decide how much money you want to save and by when. This will help you stay focused and motivated.

03

Create a budget. Track your expenses and identify areas where you can cut back to free up more money for savings.

04

Automate your savings. Set up automatic transfers from your checking account to a savings account each month. This ensures consistent savings without the temptation to spend the money.

05

Prioritize saving. Make saving a priority by treating it like any other bill or obligation. Pay yourself first by setting aside a portion of your income before spending on other expenses.

06

Look for ways to increase your income. Consider taking on a side job, freelancing, or starting a small business to boost your savings potential.

07

Monitor your progress. Regularly review your savings and adjust your strategy as needed. Celebrate milestones along the way to stay motivated.

08

Stay disciplined. Avoid impulse purchases and unnecessary expenses. Stick to your savings plan and resist the temptation to dip into your savings for non-emergencies.

Who needs sensible savings?

01

Anyone who wants to improve their financial stability and secure their future can benefit from sensible savings.

02

Individuals who have financial goals such as buying a home, starting a family, or retiring comfortably need sensible savings to achieve these objectives.

03

People who want to create an emergency fund to cover unexpected expenses or job loss should prioritize sensible savings.

04

Sensible savings can help individuals avoid debt, build wealth, and have a safety net in times of financial hardship.

05

Whether you are a student, young professional, or nearing retirement, sensible savings is essential for everyone who wants to have a financially secure life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sensible savings?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific sensible savings and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit sensible savings in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sensible savings, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit sensible savings on an iOS device?

You certainly can. You can quickly edit, distribute, and sign sensible savings on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is sensible savings?

Sensible savings is the practice of setting aside a portion of income for future financial needs or emergencies.

Who is required to file sensible savings?

Anyone who has income and wants to ensure financial stability in the future is encouraged to file sensible savings.

How to fill out sensible savings?

To fill out sensible savings, individuals need to track their income, expenses, and set aside a set percentage for savings.

What is the purpose of sensible savings?

The purpose of sensible savings is to build financial security, prepare for unexpected expenses, and achieve long-term financial goals.

What information must be reported on sensible savings?

Sensible savings requires reporting of income sources, expenses, savings contributions, and any other relevant financial information.

Fill out your sensible savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sensible Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.