Get the free Complete your Pastel Payroll Administrator Qualification and - pastel co

Show details

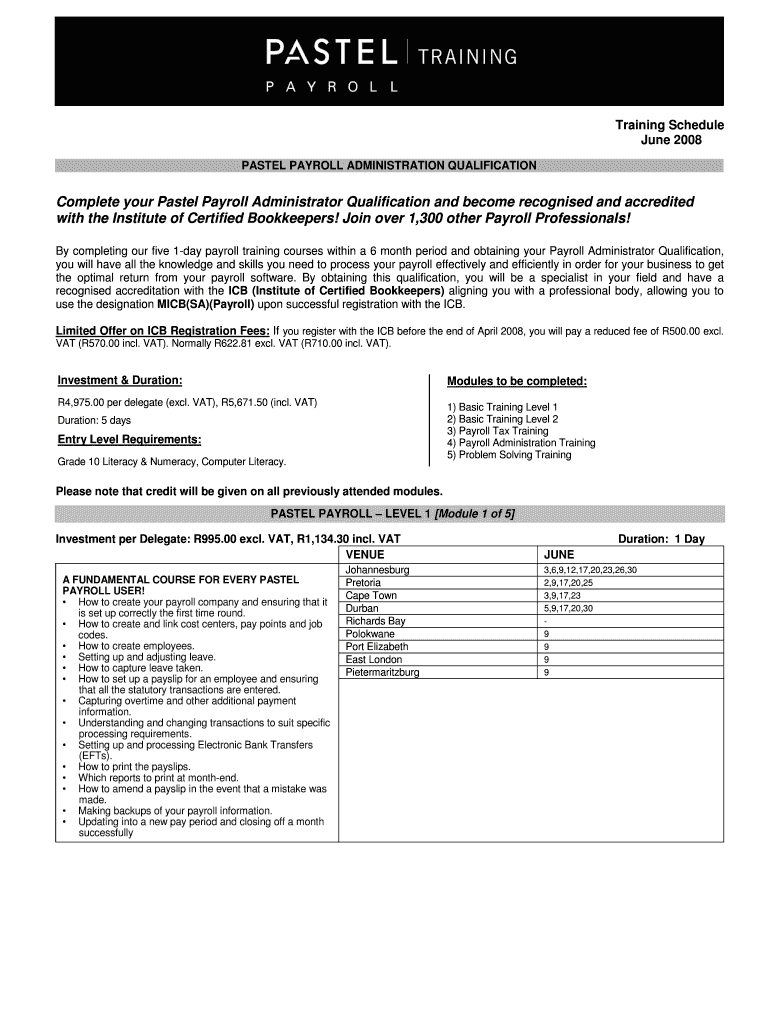

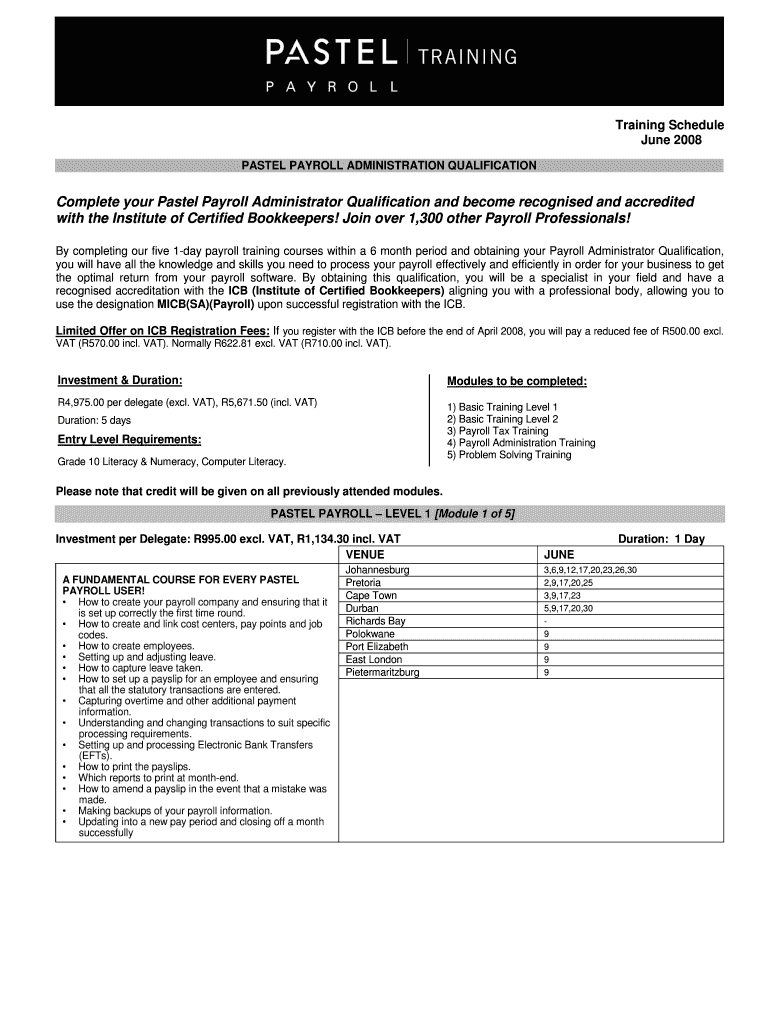

Training Schedule June 2008 PASTEL PAYROLL ADMINISTRATION QUALIFICATION Complete your Pastel Payroll Administrator Qualification and become recognized and accredited with the Institute of Certified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign complete your pastel payroll

Edit your complete your pastel payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your complete your pastel payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing complete your pastel payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit complete your pastel payroll. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out complete your pastel payroll

How to fill out and complete your Pastel Payroll:

01

Gather employee information: Collect all necessary information about your employees, including their full names, addresses, birthdates, tax numbers, employment start dates, and banking details.

02

Set up employee records: Create individual employee records in the Pastel Payroll system. Input all the collected employee information into their respective records.

03

Enter pay period details: Specify the start and end dates of the pay period for which you are processing payroll. This helps ensure the accuracy of calculations and reporting.

04

Input time and attendance data: Enter the number of hours worked by each employee during the pay period. This can be done manually or by integrating with a time and attendance system.

05

Calculate earnings: Determine the amount to be paid to each employee by calculating their basic salary, overtime pay, bonuses, commissions, or any other additional payments.

06

Account for statutory deductions: Consider any statutory deductions required by law, such as income tax, social security contributions, or pension fund deductions. Calculate and deduct these amounts from the gross earnings of each employee.

07

Include voluntary deductions: If employees have requested any voluntary deductions, such as health insurance premiums or retirement savings, make sure to deduct these amounts as well.

08

Review and verify data: Double-check all entered information, calculations, and deductions to ensure accuracy. Review the payroll summary and reports generated by the Pastel Payroll system for any errors or discrepancies.

09

Generate payslips: Once you are confident in the accuracy of the payroll data, generate payslips for each employee. Payslips should include details on gross earnings, deductions, net pay, and any company-specific information.

10

Distribute payslips and pay employees: Provide each employee with their individual payslip, either electronically or in printed form. Process the salaries according to your company's payment schedule, ensuring employees receive their wages on time.

Who needs to complete their Pastel Payroll?

01

Small businesses: Pastel Payroll is commonly used by small businesses to simplify and streamline their payroll processes. It can cater to the needs of businesses with a few employees up to medium-sized enterprises.

02

Human Resources personnel: HR professionals or payroll administrators responsible for managing employee compensation and payroll functions within an organization.

03

Accountants or bookkeepers: Professionals handling the financial aspects of a business, including payroll, can benefit from using Pastel Payroll to accurately calculate and process employees' earnings and deductions.

04

Business owners: Entrepreneurs or business owners who handle their company's payroll in-house can utilize Pastel Payroll to effectively manage their employees' salaries and associated payroll tasks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify complete your pastel payroll without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like complete your pastel payroll, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send complete your pastel payroll to be eSigned by others?

Once you are ready to share your complete your pastel payroll, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the complete your pastel payroll in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your complete your pastel payroll in minutes.

Fill out your complete your pastel payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Complete Your Pastel Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.