Get the free cma t5 form

Show details

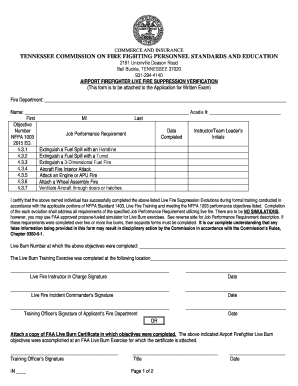

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

(Statutory body under an Act of Parliament)

CMA Shawn, 3 Institutional Area, Lodi Road, New Delhi 110003

FORM T5

CERTIFICATE OF TRAINING IMPARTED BY PRACTICING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t5 form cma download

Edit your t5 form cma form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cma t5 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

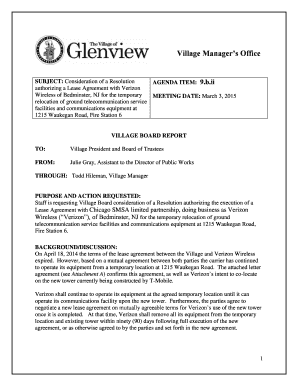

Editing cma t5 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cma t5 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

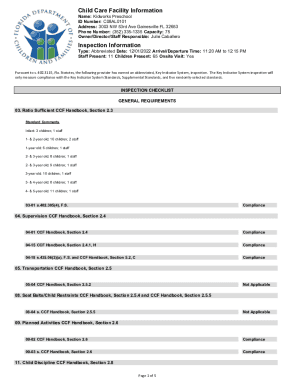

How to fill out cma t5 form

How to fill out t5 form cma?

01

Obtain a copy of the t5 form cma from the appropriate source, such as the Canada Revenue Agency website or your employer.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Fill in the personal information section, providing accurate details such as your name, address, social insurance number, and contact information.

04

Enter the relevant tax year and period for which the form is being filed.

05

Report the income earned by providing the necessary information in the appropriate sections, such as employment income, dividends, interest, and other income sources. Provide accurate amounts and details for each source.

06

Deduct any allowable expenses or deductions, such as employment expenses, carrying charges, and interest expenses, if applicable.

07

Calculate the total income and deductions and determine the taxable income.

08

Calculate the amount of income tax owed based on the tax rates and brackets for the particular tax year.

09

Complete any additional sections or schedules that may be required based on your specific circumstances, such as reporting foreign income or capital gains.

10

Review the form thoroughly to ensure all information is accurate and complete. Make any necessary corrections or additions before submission.

11

Sign and date the form to certify its accuracy.

12

Keep a copy of the completed form for your records.

Who needs t5 form cma?

01

Individuals who receive certain types of income, such as dividends, interest, or royalties, from Canadian sources may be required to file a t5 form cma.

02

Employers or payers who make the payments that need to be reported on the t5 form cma must also provide the form to the recipients of the income.

03

Self-employed individuals or those who operate a business may need to complete the t5 form cma if they paid dividends or interest to shareholders or debt holders.

Fill

form

: Try Risk Free

People Also Ask about

What is the full form of CMA intern?

Cost and Management Accountancy (CMA) is a professional course specifically designed to build and test the critical accounting and financial management knowledge. It involves three stages – Foundation, Intermediate and Final besides the mandatory trainings as a part of the course.

What is the salary of CMA trainee in India?

CMA Trainee salary in India ranges between ₹ 0.2 Lakhs to ₹ 8.0 Lakhs with an average annual salary of ₹ 1.8 Lakhs. Salary estimates are based on 456 latest salaries received from CMA Trainees.

What is the full form of CMA trainee?

Cost and Management Accountancy (CMA) is a professional course specifically designed to build and test the critical accounting and financial management knowledge.

How many years is CMA training?

CMA Course Details Course NameCMA IndiaCMA Full FormCost and Management AccountantsRegulating BodyThe Institute of Cost Accountants of IndiaCourse duration3 YearsFeesINR 100,0002 more rows

What is CMA Articleship?

What is CMA Articleship? CMA articleship refers to the practical training one has to go through in order to complete his/her CMA course and be eligible to become an official member of The Institute of Cost Accountants of India.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cma t5 form directly from Gmail?

cma t5 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit cma t5 form in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your cma t5 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete cma t5 form on an Android device?

Use the pdfFiller mobile app to complete your cma t5 form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is t5 form cma?

The T5 form CMA is a tax document used in Canada to report various types of investment income, such as dividends, interest, and other earnings that a person or business has received throughout the year.

Who is required to file t5 form cma?

Any individual or entity that makes payments of interest, dividends, or other investment income totaling $50 or more in a calendar year is required to file a T5 form CMA.

How to fill out t5 form cma?

To fill out the T5 form CMA, gather the necessary information about the recipient, including their name, address, and social insurance number. Next, report the total amount of investment income paid to them in the relevant boxes on the form, and ensure all totals are accurate.

What is the purpose of t5 form cma?

The purpose of the T5 form CMA is to ensure that the Canada Revenue Agency is informed about various types of income paid to individuals and businesses, allowing for correct income reporting and taxation.

What information must be reported on t5 form cma?

The T5 form CMA must report the recipient's name, address, social insurance number, and the amount of investment income received, along with the type of income, such as interest or dividends.

Fill out your cma t5 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cma t5 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.