Get the free Manage Your Finances on the Go - 1st MidAmerica Credit Union - 1stmidamerica

Show details

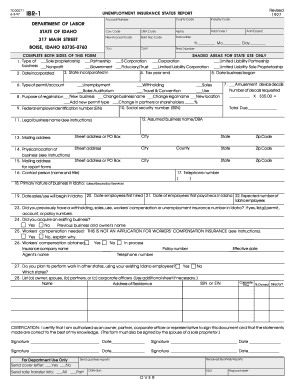

FORTUNE Teller A publication for members of 1st mid-America Credit Union IN THIS ISSUE P R E PA I D V I S A TRAVEL CARD 2011 SCHOLARSHIP A P P L I C AT I O N S Manage Your Finances on the Go Easy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manage your finances on

Edit your manage your finances on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manage your finances on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manage your finances on online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit manage your finances on. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manage your finances on

How to fill out manage your finances on:

01

Start by gathering all relevant financial documents, such as bank statements, investment statements, credit card statements, and other pertinent financial records.

02

Create a budget by carefully analyzing and categorizing your income and expenses. This will help you understand where your money is coming from and where it is going. Make sure to allocate funds for savings and emergency expenses as well.

03

Track your spending habits by keeping a record of every expense you make. This can be done using a spreadsheet, mobile app, or even pen and paper. Regularly reviewing your spending habits will help you identify areas where you can cut back or make improvements.

04

Evaluate and prioritize your financial goals. Whether it's saving for retirement, paying off debt, or purchasing a new home, having clear goals will guide your financial decisions and help you stay focused.

05

Review your debt situation and develop a plan to pay it off. Prioritize high-interest debts and consider consolidation options if necessary. Making consistent payments and avoiding unnecessary debt will contribute to your financial well-being.

06

Regularly monitor your credit report and score. This will help you identify any inaccuracies, detect potential identity theft, and maintain a good credit standing. You can access a free credit report annually from each of the major credit bureaus.

Who needs manage your finances on:

01

Individuals who want to gain control over their financial situation and improve their financial well-being.

02

Young adults just starting their financial journey and wanting to establish good money management habits.

03

People who want to save for specific financial goals, such as buying a house, starting a business, or retiring comfortably.

04

Those who are burdened with significant debt and want to develop a plan to pay it off efficiently.

05

Individuals experiencing financial hardship or facing unexpected expenses that require careful financial planning and budgeting.

06

Anyone who wants to have a better understanding of their financial situation and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify manage your finances on without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like manage your finances on, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit manage your finances on online?

The editing procedure is simple with pdfFiller. Open your manage your finances on in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit manage your finances on on an Android device?

With the pdfFiller Android app, you can edit, sign, and share manage your finances on on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is manage your finances on?

Manage your finances is based on tracking income, expenses, and budgeting.

Who is required to file manage your finances on?

Anyone who wants to have a better understanding of their financial situation can benefit from managing their finances.

How to fill out manage your finances on?

You can fill out your finances by recording all sources of income, tracking expenses, setting a budget, and monitoring your financial goals.

What is the purpose of manage your finances on?

The purpose of managing your finances is to have better control over your money, make informed financial decisions, and work towards financial stability.

What information must be reported on manage your finances on?

Information such as income sources, expenses, debts, savings, investments, and financial goals should be reported on manage your finances.

Fill out your manage your finances on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manage Your Finances On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.