ECMC Tax Offset Hardship Request Form free printable template

Show details

P.O. Box 16096

St. Paul, MN 551160096Tax Offset Hardship Refund Request

Hardship refunds are contingent on an active voluntary repayment plan. Contact

CMC or Premiere Credit of North America, LLC

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax offset hardship form

Edit your offset hardship request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax hardship request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax hardship request form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax hardship request form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax hardship request form

How to fill out ECMC Tax Offset Hardship Request Form

01

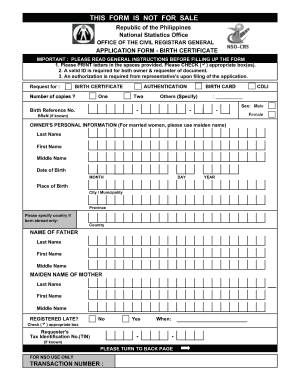

Obtain the ECMC Tax Offset Hardship Request Form from the official ECMC website or your loan servicer.

02

Fill in your personal information, including your name, address, Social Security number, and loan account number.

03

Indicate the specific tax offset or refund you are requesting to be exempted from, along with any relevant details.

04

Provide documentation supporting your hardship claim, such as income statements or proof of financial difficulties.

05

Review all information for accuracy and completeness.

06

Sign and date the form to certify that the information provided is true.

07

Submit the completed form along with any supporting documents to the specified address on the form.

Who needs ECMC Tax Offset Hardship Request Form?

01

Individuals who have experienced significant financial hardship and face a tax offset due to outstanding student loans.

02

Borrowers who have received a notice of tax offset from the government.

03

Those seeking to appeal a tax offset decision due to extenuating circumstances, such as unemployment or medical expenses.

Fill

form

: Try Risk Free

People Also Ask about

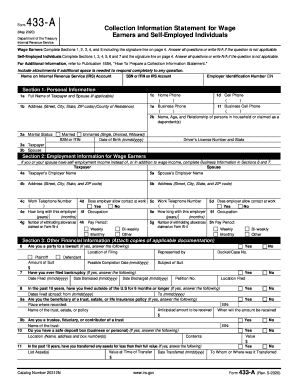

How do I prove financial hardship to the IRS?

To prove tax hardship to the IRS, you will need to submit your financial information to the federal government. This is done using Form 433A/433F (for individuals or self-employed) or Form 433B (for qualifying corporations or partnerships).

How do I claim financial hardship on my taxes?

For the IRS, a hardship is more than not having the finances for dining out and new clothing; financial hardship should show that a taxpayer has difficulty paying for necessary and reasonable living expenses. Taxpayers do not need to show that they are currently experiencing financial difficulty.

Can I file a hardship with the IRS to get my refund?

If you're facing serious financial difficulties and need your refund immediately contact the Taxpayer Advocate Service at 877-777-4778. We may be able to expedite your refund.

What qualifies as an IRS hardship?

An economic hardship occurs when we have determined the levy prevents you from meeting basic, reasonable living expenses. In order for the IRS to determine if a levy is causing hardship, the IRS will usually need you to provide financial information so be prepared to provide it when you call.

Is there a hardship form for taxes?

About Form 8944, Preparer e-file Hardship Waiver Request | Internal Revenue Service.

What is a hardship to get tax refund?

The IRS may agree that you have a financial hardship (economic hardship) if you can show that you cannot pay or can barely pay your basic living expenses. For the IRS to determine you are in a hardship situation, the IRS will use its collection financial standards to determine allowable basic living expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax hardship request form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tax hardship request form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my tax hardship request form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your tax hardship request form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the tax hardship request form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign tax hardship request form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is ECMC Tax Offset Hardship Request Form?

The ECMC Tax Offset Hardship Request Form is a document used by borrowers to request a review of their tax offset due to financial hardship, aiming to prevent the seizure of their tax refunds.

Who is required to file ECMC Tax Offset Hardship Request Form?

Borrowers whose tax refunds are being offset to recover defaulted student loans or other debts are required to file the ECMC Tax Offset Hardship Request Form.

How to fill out ECMC Tax Offset Hardship Request Form?

To fill out the ECMC Tax Offset Hardship Request Form, borrowers should provide their personal information, details of the debt, an explanation of their financial situation, and any supporting documentation that demonstrates their hardship.

What is the purpose of ECMC Tax Offset Hardship Request Form?

The purpose of the ECMC Tax Offset Hardship Request Form is to allow borrowers to formally request a reconsideration of the offset of their tax refund due to demonstrated financial difficulties.

What information must be reported on ECMC Tax Offset Hardship Request Form?

The ECMC Tax Offset Hardship Request Form must include information such as the borrower's name, Social Security number, the amount of debt, details about financial hardship, and any supporting documents that justify the request.

Fill out your tax hardship request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Hardship Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.