Get the free Business / Investment Loan Application

Show details

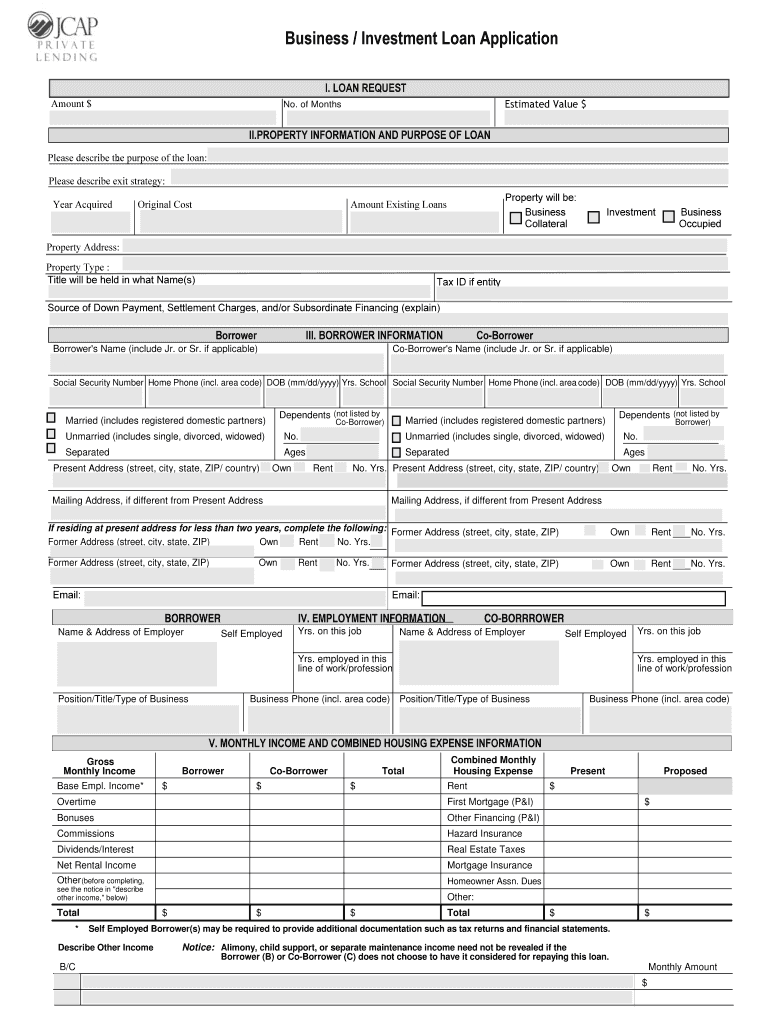

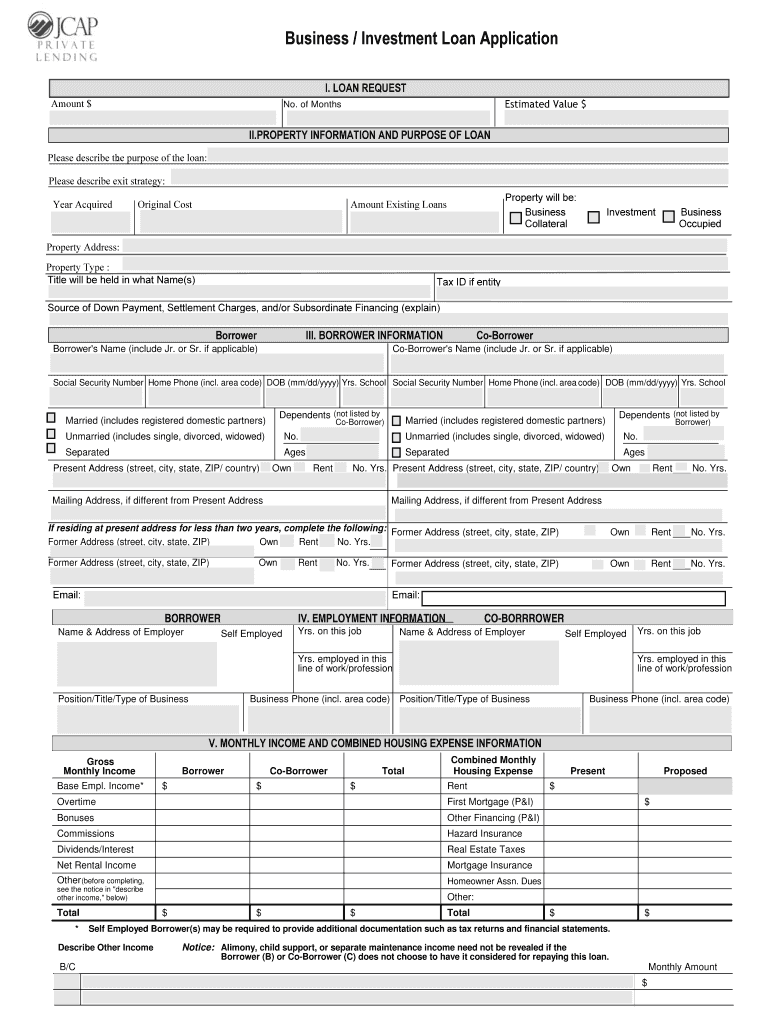

Business / Investment Loan Application

I. LOAN REQUEST

Amount estimated Value no. Of Months. PROPERTY INFORMATION AND PURPOSE OF LOAN

: purpose of the loan:

Please describe the

Please describe exit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business investment loan application

Edit your business investment loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business investment loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business investment loan application online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business investment loan application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business investment loan application

How to fill out business investment loan application

01

Step 1: Start by gathering all the necessary documents, such as your business plan, financial statements, tax returns, and identification.

02

Step 2: Research and choose the right lender or financial institution that offers business investment loans.

03

Step 3: Fill out the loan application form completely and accurately, providing all the required information.

04

Step 4: Attach the necessary documents to support your loan application, such as business financials, collateral details, and personal financial statements.

05

Step 5: Review your application thoroughly before submitting it. Make sure all the information is correct and all the required fields are filled.

06

Step 6: Submit the loan application to the chosen lender or financial institution.

07

Step 7: Wait for the lender's decision. It may take some time as they evaluate your application and conduct a thorough assessment.

08

Step 8: If your application is approved, carefully review the loan terms and conditions offered by the lender. Seek clarification if needed.

09

Step 9: If you agree to the loan terms, sign the necessary documents and complete any additional requirements requested by the lender.

10

Step 10: Once all the paperwork is finalized, the loan funds will be disbursed to your business account.

11

Step 11: Use the funds wisely for your intended business investment purposes.

12

Step 12: Repay the loan according to the agreed-upon repayment schedule and fulfill any other obligations outlined in the loan agreement.

Who needs business investment loan application?

01

Entrepreneurs or business owners looking to expand their existing businesses.

02

Startups seeking capital for their new ventures.

03

Individuals or entities planning to invest in business acquisitions or mergers.

04

Companies aiming to purchase new equipment, machinery, or real estate for their operations.

05

Businesses in need of additional working capital to support day-to-day operations or fund inventory purchases.

06

Entrepreneurs exploring opportunities for research and development.

07

Entities seeking financial support to launch innovative products or services.

08

Organizations planning to expand into new markets or territories.

09

Businesses looking to hire additional staff or invest in employee development programs.

10

Companies aiming to enhance their technological infrastructure or implement new systems.

11

Entrepreneurs wishing to consolidate debt or refinance existing loans for better terms.

12

Businesses in need of funds for marketing and advertising campaigns to boost sales and market reach.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business investment loan application directly from Gmail?

business investment loan application and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send business investment loan application for eSignature?

To distribute your business investment loan application, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete business investment loan application on an Android device?

On an Android device, use the pdfFiller mobile app to finish your business investment loan application. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is business investment loan application?

Business investment loan application is a form that individuals or businesses fill out to request funding for a specific investment.

Who is required to file business investment loan application?

Any individual or business looking to secure funding for a business investment is required to file a business investment loan application.

How to fill out business investment loan application?

To fill out a business investment loan application, individuals or businesses need to provide detailed information about the investment, current financial situation, and future projections.

What is the purpose of business investment loan application?

The purpose of a business investment loan application is to request funding to support a specific investment project that will generate returns in the future.

What information must be reported on business investment loan application?

Information such as the purpose of the investment, amount requested, business plan, financial statements, and collateral may need to be reported on a business investment loan application.

Fill out your business investment loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Investment Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.