IL VSD 275 2018 free printable template

Show details

VSD 275.24.exp×Layout 1 8/7/18 2:26 PM Page 1Surviving Joint Owner Transferring

Title to Another Individual year, make, model, VIN and the new buyers

name, if applicable, and be signed by the

executor.1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL VSD 275

Edit your IL VSD 275 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL VSD 275 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL VSD 275 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL VSD 275. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL VSD 275 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL VSD 275

How to fill out IL VSD 275

01

Obtain the IL VSD 275 form from the official website or relevant authority.

02

Begin filling out the top section with your personal information including your name, address, and contact details.

03

Provide your driver's license number or identification number as required.

04

Complete the section regarding the reason for filing the form, specifying the relevant details.

05

Review the information provided to ensure accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form according to the instructions provided, whether by mail or in-person.

Who needs IL VSD 275?

01

Individuals who have experienced a change in their driving status.

02

People who need to report a motor vehicle accident legally.

03

Individuals required to file a report due to a DUI or other traffic violations.

Fill

form

: Try Risk Free

People Also Ask about

What is a transfer on death deed in WV?

TOD effective on death of last surviving joint owner. Two joint owners can record a West Virginia TOD deed that transfers real estate when the second owner dies. The surviving joint owner retains the right to revoke the TOD deed until his or her death.

How to transfer property after death of parent with will in Tennessee?

Tennessee Executor's Deed An executor's deed—also called a personal representative's deed—transfers real estate from a deceased owner's estate to the owner's heir or beneficiary. A personal representative or executor creates the deed within the court-supervised probate process.

How does TOD work in Indiana?

An Indiana TOD deed form allows Indiana property owners to achieve two goals. It allows the owner to avoid probate at death. Upon the owner's death, the property passes automatically to the beneficiaries named in the deed, without the need for Indiana probate. It allows the owner to retain control during life.

How do I transfer a car title after death in Washington state?

If the person was listed as transfer on death with the vehicle documents, they will only need to present a copy of the death certificate to proceed along with the completed title transfer form. Once the form is processed, the DMV will issue a new car title in the beneficiary's name.

What are the disadvantages of a tod deed?

Paying for a TOD deed could be a complete waste of money. TOD deeds put private estate planning in the public eye. TOD deeds don't completely avoid probate. For most folks, TOD deeds don't offer significant tax benefits. TOD deeds can complicate future estate planning.

How do I transfer land to a family member in Tennessee?

Tennessee real estate owners can transfer ownership or change how property is titled by recording a signed, written deed.

Can you do a transfer on death deed in Tennessee?

Tennessee does not allow real estate to be transferred with transfer-on-death deeds.

How much does it cost to transfer a deed in Tennessee?

In Tennessee, the state charges a transfer tax rate of $0.37 for every $100 of the property sale price. Transfer taxes on a real estate transaction may not exceed $100,000. When a home valued at $300,000 is transferred, the buyer or seller will pay the state about $1,100 in deed transfer taxes.

Do you have to go through probate in Alabama?

Is Probate Required in Alabama? Probate is necessary in Alabama except when the property passes straight to another person. However, you have the possibility of a small estate probate, which is simpler than the full probate process.

How do I transfer property after a death in Tennessee?

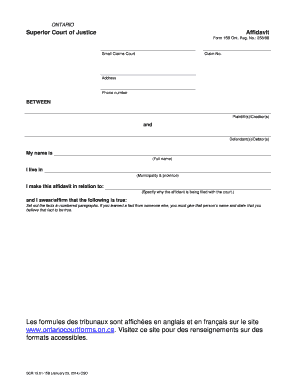

An affidavit of heirship is the simplest way of transferring real property after a person has passed away. When a person dies in Tennessee without a will, real estate immediately vests in the heirs of the decedent.

Do wills have to be probated in Tennessee?

Does Tennessee Law Require Probate? Yes, probate is a requirement for estates in Tennessee. This is the method used to distribute the assets to the heirs and ensure the will is followed.

How do I transfer a deed in Tennessee?

In order to convey any real property or an interest in property in Tennessee, the deed must be in writing, acknowledged by the grantor, and registered in the county where the property is located. The Annotated Code of Tennessee allows for the transfer of real property through the usage of a variety of deeds.

How do I transfer property after death in Alabama?

To transfer ownership from the deceased owner, the surviving owner must bring in the original title and original death certificate of deceased owner for transfer of title. If the names are joined on the title with “and” or nothing separating the names, it is presumed by the state to be “AND”.

Who pays deed transfer tax in Tennessee?

Recordation Tax Realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or other instrument that shows proof of transfer record. The grantee or transferee to the county Register of Deeds pay the realty transfer tax (Tenn. Code Ann. § 67-4-409).

How long do you have to transfer property after death in Tennessee?

In terms of filing for probate, if the estate is small and has a value of $50,000 or less, a small estate affidavit can be filed 45 days after the death of the property owner.

Does NC have a transfer on death deed?

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

How do I change the name on a property after death?

Documents Required to transfer property from father to son Will/ testament. Certified copy of death certificate of the father. Succession Certificate. No-obligation certificate from the other successors/heirs along with the affidavit. Lineage list certificate. Relinquishment deed (if required) Gift deed (if required)

Does South Carolina have a transfer on death deed?

South Carolina does not recognize transfer-on-death (TOD) deeds. TOD deeds—where recognized—serve a purpose similar to life estate deeds without restricting the owner's property rights during life. Another South Carolina deed form relevant to estate planning is called a deed of distribution.

How much are real estate transfer taxes in Tennessee?

Realty Transfer Tax Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing all transfers of realty, whether by deed, court deed, decree, partition deed, or other instrument evidencing transfer of any interest in real estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL VSD 275 for eSignature?

Once you are ready to share your IL VSD 275, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit IL VSD 275 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IL VSD 275 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit IL VSD 275 on an Android device?

You can edit, sign, and distribute IL VSD 275 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IL VSD 275?

IL VSD 275 is an Illinois Vehicle Use Tax form used to report and pay the tax on vehicles that are purchased or received as gifts.

Who is required to file IL VSD 275?

Individuals or businesses that purchase a vehicle from an out-of-state dealer or receive one as a gift and are required to pay the Illinois Vehicle Use Tax must file IL VSD 275.

How to fill out IL VSD 275?

To fill out IL VSD 275, you need to provide information such as the purchaser's name and address, vehicle details (like make, model, and VIN), and the purchase price or fair market value of the vehicle.

What is the purpose of IL VSD 275?

The purpose of IL VSD 275 is to ensure compliance with the Illinois Vehicle Use Tax, allowing the state to collect tax on vehicles that are brought into Illinois for use.

What information must be reported on IL VSD 275?

The information that must be reported on IL VSD 275 includes the purchaser's name, address, vehicle information (make, model, VIN), purchase date, and the amount of tax due, based on the vehicle's value.

Fill out your IL VSD 275 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL VSD 275 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.