Canada E672 E 2017 free printable template

Show details

Government

of CanadaHelpRestoreGouvernement

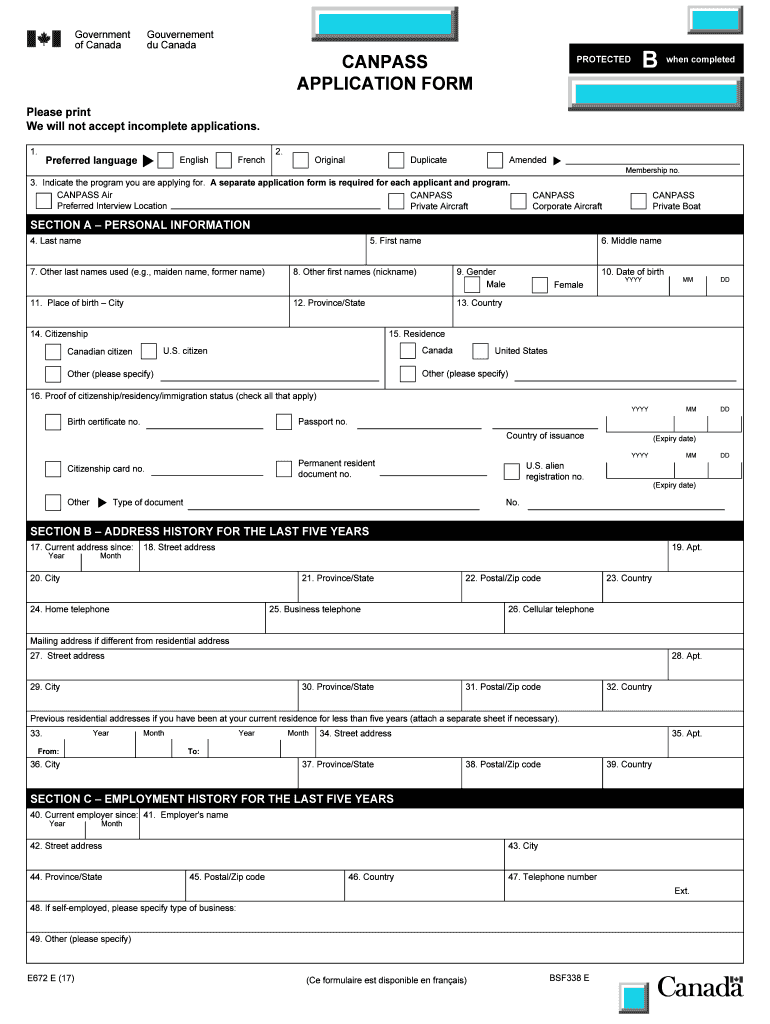

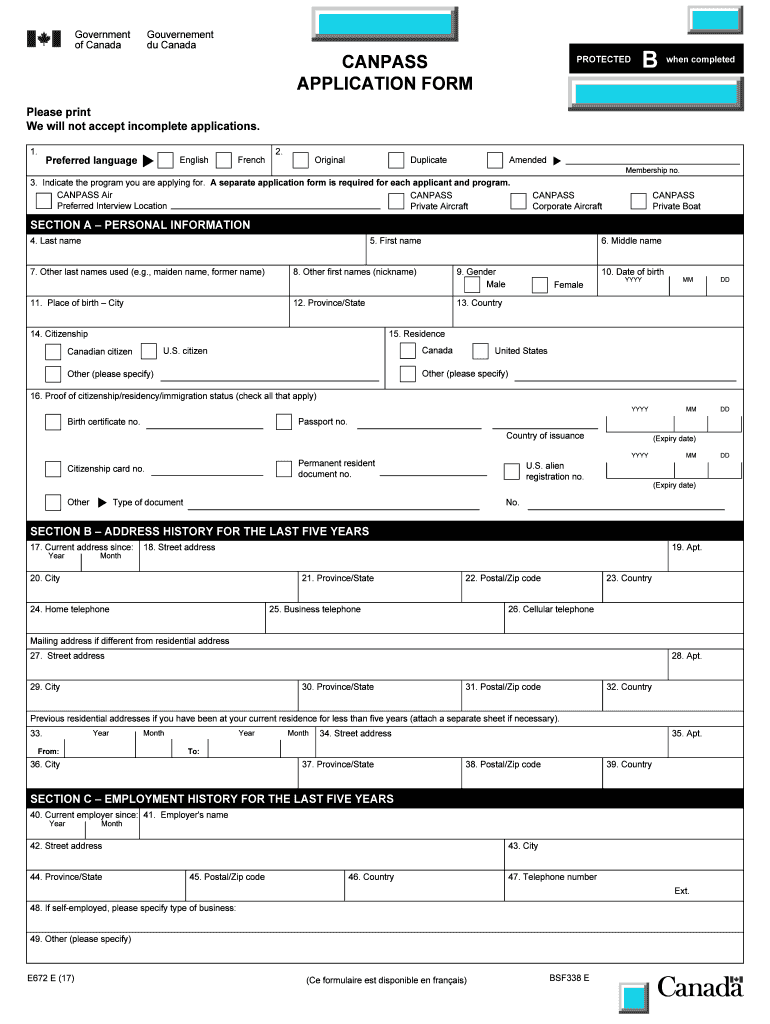

du CanadaCANPASS

APPLICATION FORMPROTECTEDBwhen completed to Complete the ApplicationPlease print

We will not accept incomplete applications.

1. Preferred

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada E672 E

Edit your Canada E672 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada E672 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada E672 E online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada E672 E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada E672 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada E672 E

How to fill out Canada E672 E

01

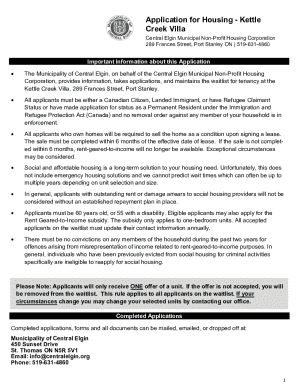

Obtain a copy of the Canada E672 E form, which can be downloaded from the official website or received from your local immigration office.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide details about your immigration status and the specific reason for your application.

05

Attach any necessary supporting documents that are required as per the instructions.

06

Review the completed form for accuracy and completeness to ensure all information is correct.

07

Submit the form along with any applicable fees to the appropriate immigration office or online portal as instructed.

Who needs Canada E672 E?

01

Individuals applying for certain immigration services or benefits in Canada may need to fill out the Canada E672 E form.

02

It is also required for those who are seeking to provide evidence of their immigration status or request information regarding their case.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the CANPASS?

CANPASS members who are also lawful permanent residents of the U.S. (Green Card holders or equivalent valid proof of status in the United States) do not need an Electronic Travel Authorization (eTA) when flying to or transiting through Canada. U.S. and Canadian citizens are exempted.

How do I contact CANPASS?

Contact information General Inquiries: 1 888 CANPASS (1-888-226-7277) (Reporting of arrival) General Inquiries: 1-800-461-9999 (Border Information Services) TTY: 1-800-665-0354.

Is CANPASS still required to enter Canada?

When going into Canada, you must call CANPASS (1-888 CANPASS) and you must be on a Flight Plan (either IFR or an activated VFR). The first landing must be at an Airport of Entry. For more info on CANPASS click here. When returning to the US, file an eAPIS if you did not do a round trip outbound.

What is a CANPASS airport?

An airport of entry designated for CANPASS private and corporate permit holders only. CANPASS members can land at an AOE any time the airport is open for landing, regardless of the hours of business of the local CBSA office.

How long does it take to get CANPASS?

A CANPASS permit is applied for directly with CBSA and usually takes two to three weeks to process. Permit validity is one year, and then you'll go through the process again.

What is the phone number for CANPASS?

The pilot has to report the estimated time of arrival (ETA) by calling 1-888-226-7277 at least two hours, but no more than 48 hours, before flying into Canada. If the 1-888 service is not available, the pilot can use the normal business numbers for the TRC. However, long-distance charges may apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada E672 E?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada E672 E in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in Canada E672 E without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your Canada E672 E, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit Canada E672 E on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada E672 E.

What is Canada E672 E?

Canada E672 E is a tax form used for reporting specific tax-related information required by the Canada Revenue Agency (CRA). It generally pertains to entities or individuals conducting particular types of financial transactions.

Who is required to file Canada E672 E?

Entities or individuals involved in specific types of financial activities or transactions mandated by the CRA are required to file Canada E672 E.

How to fill out Canada E672 E?

To fill out Canada E672 E, one must carefully complete each section of the form, providing accurate information regarding the financial transactions being reported, along with any necessary supplementary information.

What is the purpose of Canada E672 E?

The purpose of Canada E672 E is to ensure that relevant financial transactions are reported to the CRA for compliance and tax assessment purposes.

What information must be reported on Canada E672 E?

Information that must be reported on Canada E672 E includes details about the transactions, involved parties, amounts, dates, and any other information as specified by the CRA.

Fill out your Canada E672 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada e672 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.