Get the free Tax Incentive Programs for Working with Beginning Farmers ...

Show details

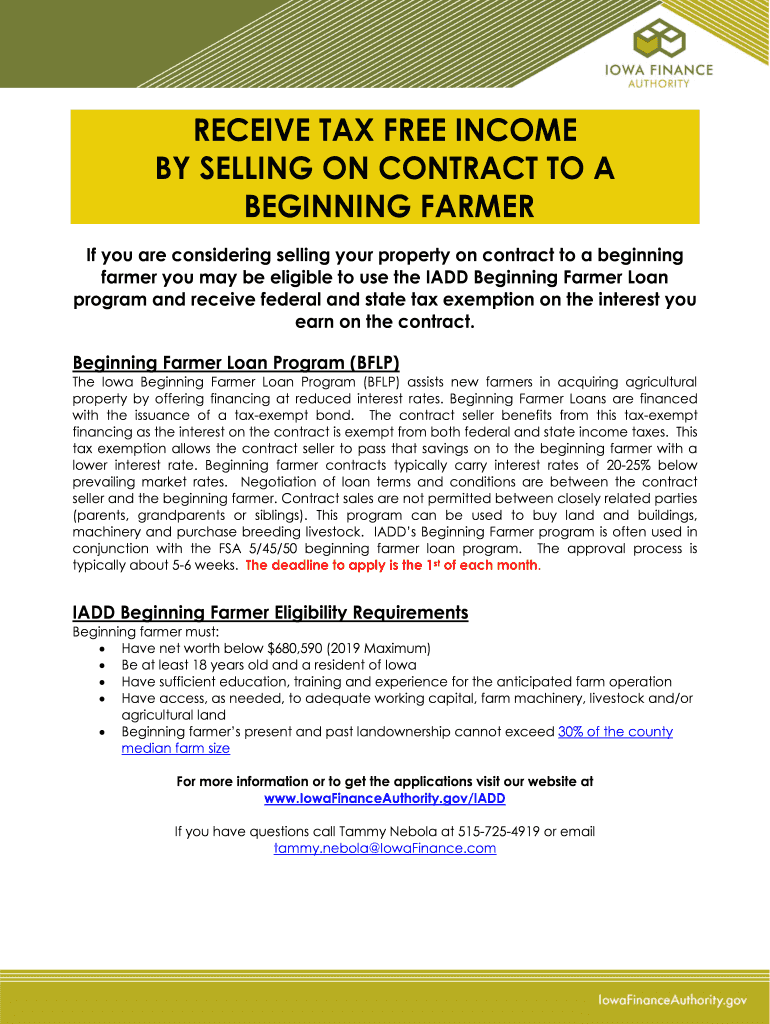

RECEIVE TAX FREE INCOME

BY SELLING ON CONTRACT TO A

BEGINNING FARMER

If you are considering selling your property on contract to a beginning

farmer you may be eligible to use the ADD Beginning Farmer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentive programs for

Edit your tax incentive programs for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentive programs for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax incentive programs for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax incentive programs for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentive programs for

How to fill out tax incentive programs for

01

To fill out tax incentive programs for, you should follow these steps:

02

Research the available tax incentive programs in your jurisdiction.

03

Determine your eligibility for each program based on your business type, location, and other criteria.

04

Collect the necessary documents and information required for each program, such as financial statements, employee details, and investment plans.

05

Carefully read the program guidelines and instructions to understand the specific requirements and deadlines.

06

Fill out the application form accurately and provide all the requested information.

07

Attach any supporting documents or evidence required to support your eligibility and claims.

08

Review your completed application for any errors or missing information.

09

Submit your application within the designated timelines either online or through mail as specified in the program guidelines.

10

Follow up on the status of your application to ensure it is being processed.

11

If approved, fulfill all the obligations and requirements outlined in the program, such as job creation, investment commitments, or reporting obligations.

12

Keep track of tax benefits and credits received through the program by maintaining proper records.

13

Consult with a tax professional or advisor to maximize the benefits and ensure compliance with tax laws and regulations.

Who needs tax incentive programs for?

01

Tax incentive programs are beneficial for various entities and individuals, including:

02

- Businesses looking to expand or invest in specific regions or industries.

03

- Startups and small businesses seeking financial support or tax relief.

04

- Investors looking for opportunities to lower their tax exposure.

05

- Local governments aiming to attract new businesses and promote economic development.

06

- Individuals or companies involved in energy-efficient or environmentally friendly initiatives.

07

- Industries targeted for job creation or economic growth by local or national authorities.

08

- Research and development organizations engaged in innovative projects.

09

Keep in mind that specific eligibility criteria and program availability may vary depending on your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax incentive programs for without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax incentive programs for, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit tax incentive programs for on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing tax incentive programs for right away.

How do I edit tax incentive programs for on an Android device?

With the pdfFiller Android app, you can edit, sign, and share tax incentive programs for on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is tax incentive programs for?

Tax incentive programs are designed to encourage certain behaviors or investment by offering reduced tax liability or other financial benefits.

Who is required to file tax incentive programs for?

Businesses or individuals who are eligible for tax incentives must file the necessary documentation to claim the benefits.

How to fill out tax incentive programs for?

Tax incentive programs can typically be filled out online or by mailing in the required forms to the appropriate tax authority.

What is the purpose of tax incentive programs for?

The purpose of tax incentive programs is to promote specific activities or investments that are deemed beneficial to the economy or society.

What information must be reported on tax incentive programs for?

Taxpayers must report relevant financial and activity-related information in order to claim tax incentives.

Fill out your tax incentive programs for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentive Programs For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.