WI Affidavit of Ownership and Indemnity Agreement - Waukesha County 2016-2025 free printable template

Show details

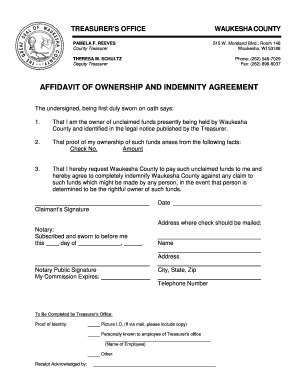

TREASURER\'S OFFICEWAUKESHA COUNTYPAMELA F. REEVES

County Treasurer515 W. Moreland Blvd., Room 148

Waukesha, WI 53188THERESA M. SCHULTZ

Deputy TreasurerPhone: (262) 5487029

Fax: (262) 8968037AFFIDAVIT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign room 148

Edit your room 148 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your room 148 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit room 148 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit room 148. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Affidavit of Ownership and Indemnity Agreement - Waukesha County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out room 148

How to fill out WI Affidavit of Ownership and Indemnity Agreement

01

Obtain the WI Affidavit of Ownership and Indemnity Agreement form from the appropriate authority or website.

02

Review the instructions provided on the form carefully.

03

Fill in the name and address of the owner at the top of the form.

04

Provide the vehicle identification number (VIN) and any other relevant vehicle details.

05

Indicate the reason for filling out the affidavit in the specified section.

06

Sign and date the form where indicated, ensuring that the signature matches any identification provided.

07

If applicable, have the affidavit notarized according to the instructions.

08

Submit the completed affidavit to the appropriate department or office.

Who needs WI Affidavit of Ownership and Indemnity Agreement?

01

Individuals who have lost their vehicle title and need to prove ownership.

02

People who are purchasing a vehicle without a title.

03

Owners of vehicles that have been inherited or otherwise acquired without a title.

04

Anyone seeking to register a vehicle for which they can’t provide traditional proof of ownership.

Fill

form

: Try Risk Free

People Also Ask about

How much are property taxes in Boston?

The residential rate is now $10.74 per $1,000 of value for residential property, down from $10.88 per $1,000 in 2022, and $24.68 for commercial and industrial, as opposed to $24.98 in 2022. That means that the owner of a $500,000 house pays $5,370 this year, not counting the city's homeowner exemption.

How often are properties reassessed in Boston?

well as Appendix A for assessed values by class for fiscal years 2015 to 2021. Chapter 40, Section 56, of the Massachusetts General Laws, requires all cities and towns to conduct a revaluation every five years.

Why are property taxes so high in Massachusetts?

It's the high market values of real estate in Massachusetts that push the state toward the top of the list in property taxes. Massachusetts home values hit a high-water mark in 2021, topping out at $750,000 for an average single-family, up 10.5% from 2020.

What is City of Boston residential exemption?

The residential exemption reduces your tax bill by excluding a portion of your residential property's value from taxation. This fiscal year, the residential exemption will save qualified Boston homeowners up to $3,456.50 on their tax bill.

How do I get the deed to my house in Massachusetts?

A copy or certified copy of your deed can be obtained at the Suffolk Registry of Deeds, located in the Edward W. Brooke Courthouse, 24 New Chardon St. 1st Floor, Boston, MA 02114.

What is property tax for Massachusetts?

The average single-family property tax bill in Massachusetts in 2022 is $6,719, up $347 from the previous year, ing to a recent report conducted by the Division of Local Services, Massachusetts Department of Revenue. The average tax rate in Massachusetts is now $14.58 for every $1,000 in assessed property value.

Is there property tax in Boston?

The City of Boston operates under a property tax classification system. This allows us to charge different rates for residential and commercial property. The tax rate is the amount a taxpayer owes for each one thousand dollars of property value in a given year.

How do I remove a name from a deed in Massachusetts?

The person whose name you want to remove must sign a new deed that conveys their interest in the property to someone else (you, most likely). See the answer above to learn about creating a new deed. Surprisingly, you don't have to do anything. You still own the property no matter what you call yourself.

Where are deeds recorded in Massachusetts?

Documents related to the ownership of real estate within the district are recorded at the Registry of Deeds. Recorded documents are assigned a sequential identifying number (known as the book and page number) and are then scanned into the registry's computer system.

What is property tax in Boston?

The residential rate is now $10.74 per $1,000 of value for residential property, down from $10.88 per $1,000 in 2022, and $24.68 for commercial and industrial, as opposed to $24.98 in 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my room 148 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your room 148 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make edits in room 148 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit room 148 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out room 148 using my mobile device?

Use the pdfFiller mobile app to fill out and sign room 148 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is WI Affidavit of Ownership and Indemnity Agreement?

The WI Affidavit of Ownership and Indemnity Agreement is a legal document used in Wisconsin to affirm ownership of property or a vehicle and to indemnify the state or other entities against any claims or disputes regarding that ownership.

Who is required to file WI Affidavit of Ownership and Indemnity Agreement?

Individuals or entities who are claiming ownership of a vehicle or property that lacks a title or has a lost title in Wisconsin are required to file the WI Affidavit of Ownership and Indemnity Agreement.

How to fill out WI Affidavit of Ownership and Indemnity Agreement?

To fill out the WI Affidavit of Ownership and Indemnity Agreement, individuals must provide their personal information, details about the property or vehicle in question, a description of the circumstances regarding the lost or missing title, and signatures affirming the assertions made in the document.

What is the purpose of WI Affidavit of Ownership and Indemnity Agreement?

The purpose of the WI Affidavit of Ownership and Indemnity Agreement is to establish legal ownership of a property or vehicle and to provide assurance to the state and other parties that the filer will indemnify against any ownership disputes or claims.

What information must be reported on WI Affidavit of Ownership and Indemnity Agreement?

The information that must be reported on the WI Affidavit of Ownership and Indemnity Agreement includes the name and address of the owner, a full description of the property or vehicle, the Vehicle Identification Number (VIN) where applicable, details of the circumstances regarding the lack of title, and signatures from the owner and witnesses if required.

Fill out your room 148 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Room 148 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.