Get the free Michigan Department of Treasury 618 Reset Form Petition to Board of Review L-4035 Th...

Show details

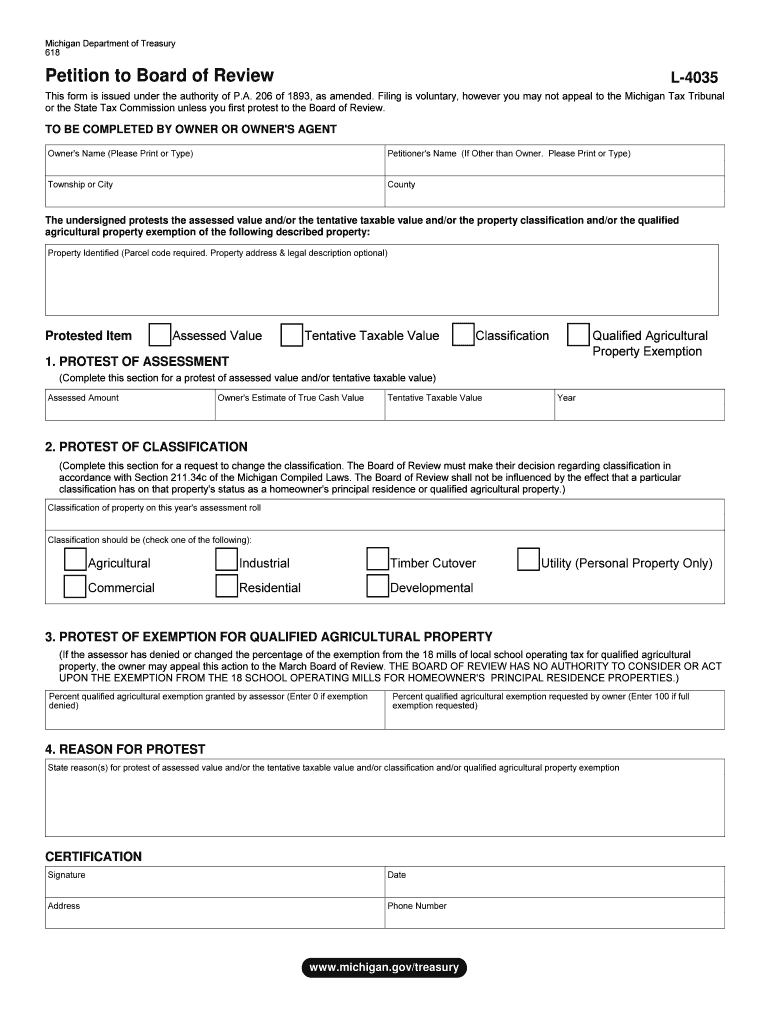

Michigan Department of Treasury 618 Reset Form Petition to Board of Review L-4035 This form is issued under the authority of P.A. 206 of 1893, as amended. Filing is voluntary, however you may not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan department of treasury

Edit your michigan department of treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan department of treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan department of treasury online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit michigan department of treasury. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan department of treasury

How to fill out the Michigan Department of Treasury:

01

Gather all necessary documents: Before beginning the process of filling out the Michigan Department of Treasury forms, it is important to gather all the required documents. This may include tax forms, receipts, W-2s, 1099s, and any other relevant financial information.

02

Determine the specific form(s) to be filled out: The Michigan Department of Treasury offers various forms for different purposes such as income tax, property tax, sales tax, etc. Identify the form(s) that need to be filled out based on your specific needs.

03

Read the instructions carefully: Each form provided by the Michigan Department of Treasury comes with detailed instructions. It is crucial to read and understand these instructions thoroughly before filling out the form. This will ensure accurate completion and minimize errors.

04

Provide accurate and complete information: Fill in all the required fields on the form with accurate and complete information. Double-check your entries to avoid any mistakes or discrepancies.

05

Attach necessary supporting documents: If the form requires any supporting documents, make sure to attach them as indicated. These may include copies of financial statements, proof of income, or any other relevant paperwork.

06

Review the completed form: Before submitting the form, review it carefully to ensure that all information is accurate and complete. Check for any misspellings, incorrect figures, or missing details.

07

Sign and date the form: Once you are satisfied with the accuracy of the filled-out form, sign and date it as required. Failure to sign or date the form may result in delays or rejection.

08

Submit the form: The method of submission may vary depending on the specific form. Some forms can be submitted electronically through the Michigan Department of Treasury website, while others may require mailing or hand-delivery. Follow the instructions provided to submit the form correctly.

Who needs the Michigan Department of Treasury?

01

Individuals and households: Any individual or household residing in the state of Michigan may need to utilize the services of the Michigan Department of Treasury. This includes filing income tax returns, claiming tax credits, or addressing property tax matters.

02

Businesses: Michigan businesses, including sole proprietors, partnerships, corporations, and limited liability companies, may require the services of the Michigan Department of Treasury for tax-related purposes. This may involve filing business tax returns, paying sales tax, or seeking guidance on tax regulations specific to their industry.

03

Property owners: Property owners in Michigan need to interact with the Michigan Department of Treasury regarding property tax assessments, tax payment options, and possible exemptions or relief programs.

In summary, anyone who has tax obligations or administrative needs related to income, sales, property, or other financial matters in the state of Michigan may require the services of the Michigan Department of Treasury. It is advisable to consult the department's website or seek professional assistance for specific guidance based on individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get michigan department of treasury?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific michigan department of treasury and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit michigan department of treasury on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign michigan department of treasury. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete michigan department of treasury on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your michigan department of treasury, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is michigan department of treasury?

The Michigan Department of Treasury is a government agency responsible for collecting and managing taxes and revenue for the state of Michigan.

Who is required to file michigan department of treasury?

Individuals, businesses, and organizations that earn income in Michigan are required to file with the Department of Treasury.

How to fill out michigan department of treasury?

To fill out forms for the Michigan Department of Treasury, taxpayers can use online forms, mail-in forms, or file electronically through approved software providers.

What is the purpose of michigan department of treasury?

The purpose of the Michigan Department of Treasury is to collect revenue to fund state programs and services, as well as to enforce tax laws and regulations.

What information must be reported on michigan department of treasury?

Taxpayers must report income, deductions, credits, and any other relevant financial information on their Michigan Department of Treasury forms.

Fill out your michigan department of treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Department Of Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.