Consent to use tax return information free printable template

Show details

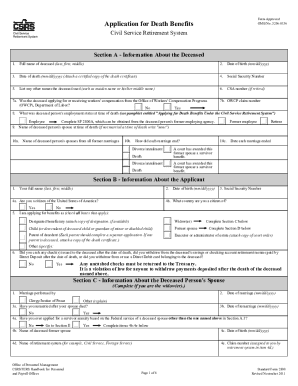

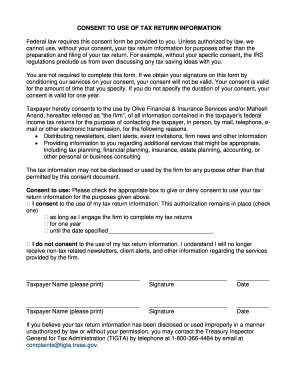

Consent to Use Tax Return Information Taxi L Collins (“we, “us and “our “) Printed name of Tax Preparer Federal law requires this consent form be provided to you. Unless authorized by law,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verify identity tax form

Edit your request form additional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxation revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indemnity trustee online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit requirements preparation tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 848

How to fill out Consent to use tax return information

01

Obtain the 'Consent to Use Tax Return Information' form from the relevant authority or organization.

02

Read the instructions carefully to understand what information is required.

03

Complete the form by filling in your personal information, including your name, address, and Social Security number.

04

Indicate the purpose for which the tax return information will be used.

05

Sign and date the form to give your consent for the use of your tax return information.

06

Submit the completed form according to the instructions provided, ensuring it reaches the designated party.

Who needs Consent to use tax return information?

01

Individuals applying for loans or financial assistance who need to provide proof of income.

02

Tax preparers or financial advisors who require access to tax information to assist clients.

03

Organizations or companies conducting background checks that include verification of income.

Fill

form

: Try Risk Free

People Also Ask about

Do you need proof of receipts for taxes?

You generally must have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses. Additional evidence is required for travel, entertainment, gifts, and auto expenses.

Do I need to print all my receipts for taxes?

Many people often ask if they really need to keep all of their receipts for taxes, and the short answer is yes. If you plan to deduct that expense from your gross income, you need to have proof that you made the purchase.

How do I get a tax receipt from the IRS?

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information.

What is a receipt for tax purposes?

Tax receipts serve as evidence for expenses that you claim on your state and federal income tax returns. You can't just say you made a purchase without having any record of it. In the event of an audit, you have to provide receipts for purchases that you deducted taxes.

Do you actually need receipts for taxes?

Supporting documents include sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. These documents contain the information you need to record in your books. It is important to keep these documents because they support the entries in your books and on your tax return.

What happens if you don't have a receipt for taxes?

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable. Learn more about handling an IRS audit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Consent to use tax return information to be eSigned by others?

To distribute your Consent to use tax return information, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my Consent to use tax return information in Gmail?

Create your eSignature using pdfFiller and then eSign your Consent to use tax return information immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out Consent to use tax return information on an Android device?

Use the pdfFiller Android app to finish your Consent to use tax return information and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Consent to use tax return information?

Consent to use tax return information is a legal authorization that allows a third party to access specific tax return details of an individual or entity for predetermined purposes.

Who is required to file Consent to use tax return information?

Individuals or entities who need to share their tax return information with third parties, such as lenders or tax preparers, generally need to file a Consent to use tax return information.

How to fill out Consent to use tax return information?

To fill out the Consent to use tax return information form, one must provide personal identification details, specify the third party's information, outline the intended use, and sign the document.

What is the purpose of Consent to use tax return information?

The purpose of the Consent to use tax return information is to ensure that taxpayers grant permission for their tax data to be used for specific purposes, thereby maintaining privacy and control over their information.

What information must be reported on Consent to use tax return information?

The information that must be reported includes the taxpayer's name, Social Security number, the tax years for which consent is granted, and details of the third party who will receive access to the information.

Fill out your Consent to use tax return information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent To Use Tax Return Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.