MI 3966 2019 free printable template

Show details

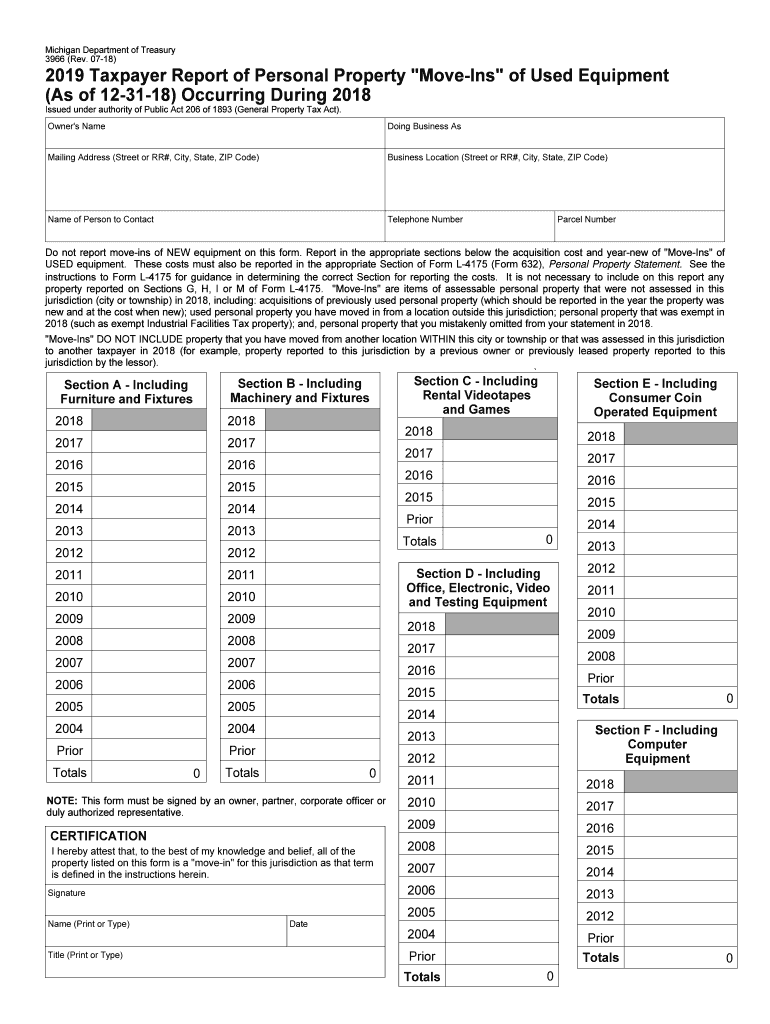

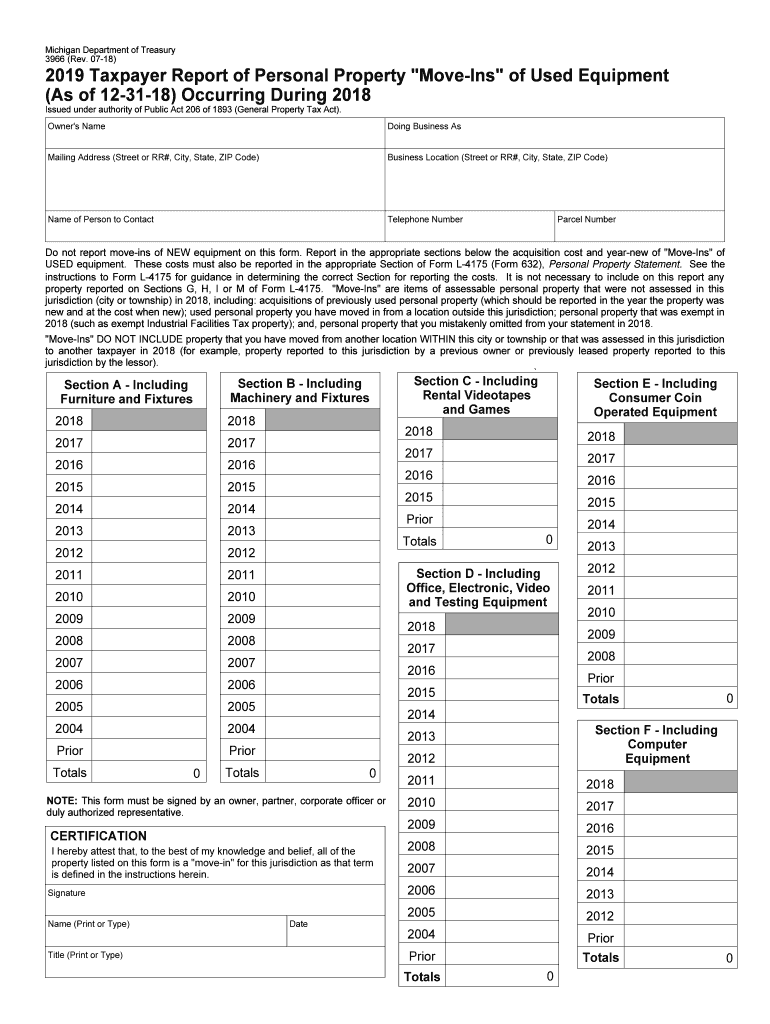

Reset Form Michigan Department of Treasury 3966 (Rev. 0718)2019 Taxpayer Report of Personal Property “Moving” of Used Equipment (As of 123118) Occurring During 2018 Issued under authority of Public

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 3966

Edit your MI 3966 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 3966 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI 3966 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI 3966. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 3966 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 3966

How to fill out MI 3966

01

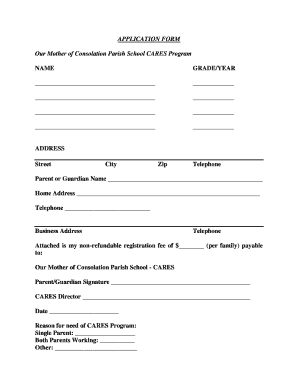

Obtain the MI 3966 form from the designated authority or website.

02

Fill in your personal details, including name, address, and contact information.

03

Provide relevant identification numbers, such as Social Security or tax identification number.

04

Complete the specific sections related to the purpose of the form.

05

Include any necessary documentation or attachments as specified in the instructions.

06

Review the form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs MI 3966?

01

Individuals filing for a specific benefit or claim that requires MI 3966.

02

Those needing to update their personal information related to a specific program.

03

Any entity or individual as required by legal or regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the taxable value of a property in Michigan?

In Michigan, the assessed value is equal to 50% of the market value. Local assessors determine how much a given property could sell for on the market, usually by looking at factors such as size, features and the prices of recently sold comparable properties.

How do I find the taxable value of my homestead in Michigan?

The taxable value is the value on which property taxes are calculated. It can be found on the property tax statement or by contacting your local city/township/village assessor's office.

How do I look up property taxes in Michigan?

You can request copies of property tax statements from your local city/township/village assessor's office.

What is the difference between taxable value and assessed value in Michigan?

Michigan law requires each city to include both a SEV and taxable value on its Assessment Roll. The SEV represents 50 percent of true cash value. The taxable value is the amount that the owner will pay taxes on.

Is there personal property tax in Michigan?

With several exceptions, all personal property tax assessments are made by the local city and township assessor, typically in the city or township where the property was located on Tax Day. A separate statement must be filed with each assessment jurisdiction where the taxpayer had personal property located on Tax Day.

At what age do you stop paying property taxes in Michigan?

Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MI 3966 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including MI 3966. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in MI 3966 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your MI 3966, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out MI 3966 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign MI 3966 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is MI 3966?

MI 3966 is a form used for reporting certain tax information to the Michigan Department of Treasury.

Who is required to file MI 3966?

Individuals and entities that have specific tax obligations or claim deductions in Michigan are required to file MI 3966.

How to fill out MI 3966?

To fill out MI 3966, taxpayers must provide their personal information, details of income, applicable deductions, and any other required documentation as specified by the form instructions.

What is the purpose of MI 3966?

The purpose of MI 3966 is to ensure that taxpayers report accurate information to the state for tax assessment and compliance.

What information must be reported on MI 3966?

The information that must be reported on MI 3966 includes taxpayer identification details, income sources, deduction claims, and any other relevant financial information.

Fill out your MI 3966 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 3966 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.