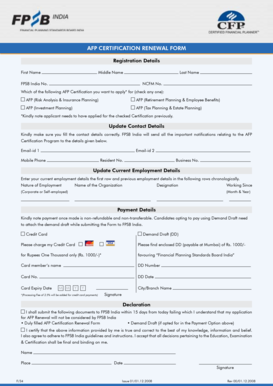

AU SU001 2010 free printable template

Show details

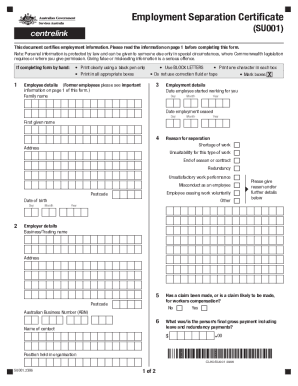

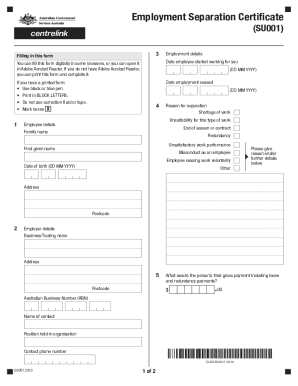

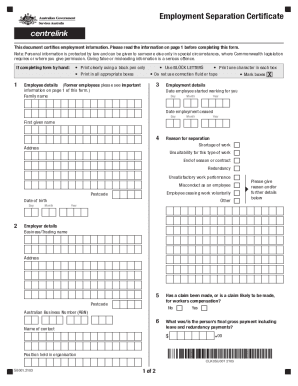

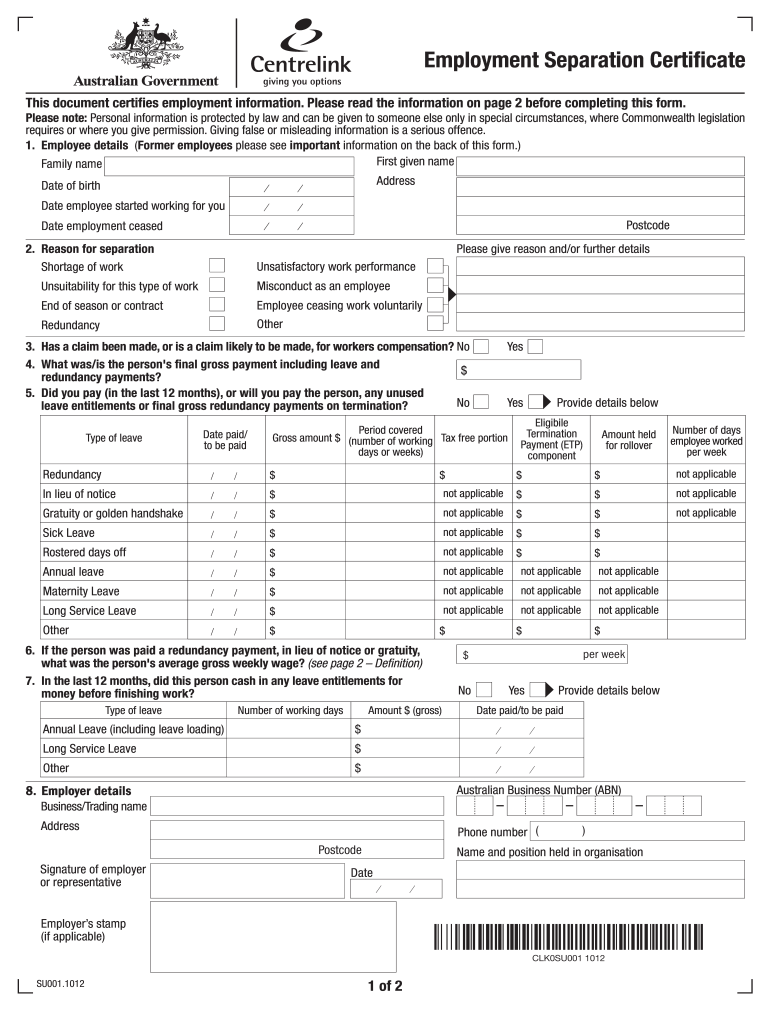

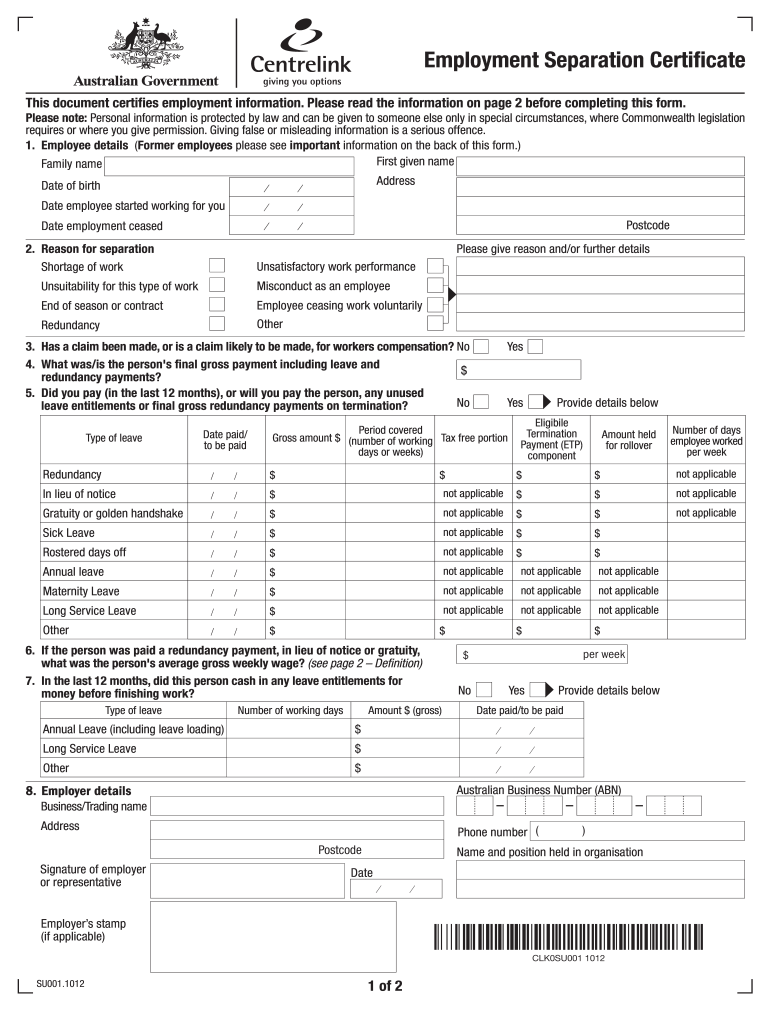

Instructions Employment Separation Certificate This document certifies employment information. Please read the information on page 2 before completing this form. Please note: Personal information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU SU001

Edit your AU SU001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SU001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SU001 online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AU SU001. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SU001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU SU001

How to fill out AU SU001

01

Obtain the AU SU001 form from the relevant authority or agency website.

02

Carefully read the instructions provided with the form.

03

Fill out the personal information section, including your name, address, and contact details.

04

Provide any required identification information as specified.

05

Complete the relevant sections related to your specific circumstances or purpose for filling the form.

06

Review all information for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form as per the instructions, either online or via mail.

Who needs AU SU001?

01

Individuals applying for specific services or benefits within Australia.

02

Organizations that are required to report information to Australian authorities.

03

Anyone required to provide verification or documentation for legal or administrative purposes.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't have a Centrelink separation certificate?

If you can't get an Employment Separation Certificate from your employer, you may be able to provide us with this information in another format. For example, a letter from your employer and a copy of your payslip that shows what you were last paid, including any leave or termination payments.

Can you get Centrelink if you quit your job NSW?

If you quit your job, Centrelink may decide you are 'voluntarily unemployed' and you may have to wait eight weeks before you get paid. You won't have to wait though if Centrelink decides the work was unsuitable or that quitting your job was reasonable in the circumstances.

What are the two types of employee separation?

A resignation happens when an employee decides to quit his or her job on his or her own. Most employers ask employees who resign to provide written notice a few weeks in advance. A forced resignation occurs when an employer tells an employee that he or she must either quit or be fired.

How do I get a Centrelink separation certificate?

If you can't use Business Hub, you can download, print and fill out the Employment Separation Certificate form. You can then hand it back to the employee, or fax it to us on 132 115. You can also provide the information on your business letterhead.

Is a separation notice required in Tennessee?

NOTICE TO EMPLOYER Within 24 hours of the time of separation, you are required by Rule 0800-09-01-. 02 of the Tennessee Employment Security Law to provide the employee with this document, properly executed, giving the reasons for separation.

Why does Centrelink need employment separation certificate?

Centrelink will use employment separation certificates to assess the eligibility of income support payment claims. An employer must provide an employment separation certificate if Centrelink requests.

What is the purpose of a separation letter?

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

What is a separation certificate Australia?

An Employment Separation Certificate is a document that is provided by your employer upon request when you have ceased work. Employment Separation Certificates are used by us to ensure any waiting periods or non-payment periods are correctly assessed and you receive your first payment from the right date.

What benefits can I claim if I resign from my job Australia?

If you resign, are retrenched or are considering a redundancy package offered by your employer, you may be entitled to income support payments when you leave work. In most cases, people under the age pension age should apply for Newstart Allowance.

How do I get a separation certificate in Australia?

If you can't use Business Hub, you can download, print and fill out the Employment Separation Certificate form. You can then hand it back to the employee, or fax it to us on 132 115. You can also provide the information on your business letterhead.

What is important when an employee is separating?

Once a company learns about a voluntary separation, it should give the employee a list of tasks to complete to tie up any loose ends, monitor or restrict the employee's emails and seize the employee's virtual and physical files before she can delete or take them.

What is a certificate of employment Australia?

An employment separation certificate ('a certificate') is a form that Services Australia issues. Indeed, it is up to you as the employer to complete the Services Australia form within 14 days after a request. This certificate provides relevant employment information for the terminated employee.

What is a separation letter?

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

Do I need a separation certificate for Centrelink?

A person is NOT required to provide an Employment Separation Certificate if they have NOT been employed in the last 12 months. A person who was employed in the last 12 months should NOT be expected to provide an Employment Separation Certificate if: the person suffered sexual harassment or violence at the workplace, OR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU SU001?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific AU SU001 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the AU SU001 form on my smartphone?

Use the pdfFiller mobile app to complete and sign AU SU001 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out AU SU001 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your AU SU001. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is AU SU001?

AU SU001 is a tax form used in Australia for reporting certain income and expenses related to specific tax obligations.

Who is required to file AU SU001?

Individuals and businesses engaged in certain types of income-generating activities, such as investments or business operations that meet specific criteria, are required to file AU SU001.

How to fill out AU SU001?

To fill out AU SU001, taxpayers should collect all necessary financial information related to income and expenses, complete each section of the form accurately, and ensure all calculations are correct before submitting it to the tax authority.

What is the purpose of AU SU001?

The purpose of AU SU001 is to ensure that taxpayers report all relevant income and deductions accurately, allowing the tax authorities to assess and calculate the correct tax liabilities.

What information must be reported on AU SU001?

AU SU001 requires reporting of various types of income, expenses, deductions, and any other relevant financial information pertaining to the taxpayer's income-generating activities.

Fill out your AU SU001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU su001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.