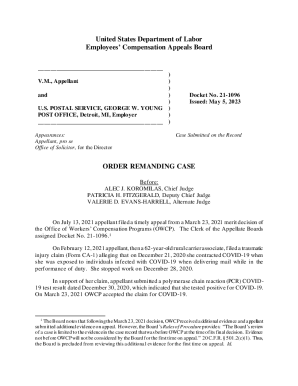

Get the free DON'T LIEN ON ME - Empire Justice Center

Show details

BETSY SMITH 1106 S GOODMAN ST APT 3 ROCHESTER, NY 14620 2017 INCOME TAX RETURN YEAR: 2017 CLIENT:600006789PROCESS DATE: 12/08/2017 BETSY MISADDRESS : 1106 S GOODMAN ST APT 3 : ROCHESTER NY 14620BIRTH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dont lien on me

Edit your dont lien on me form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dont lien on me form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dont lien on me online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dont lien on me. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

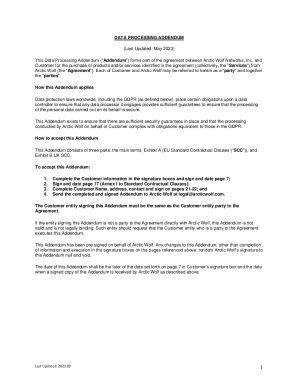

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dont lien on me

How to fill out dont lien on me

01

Gather all necessary information and documentations, such as the name and address of the person or entity you want to place a lien on, the amount owed, and any supporting evidence of the debt.

02

Prepare a lien notice or claim form, which should include your personal information, the debtor's information, details of the debt, and any relevant legal references or requirements.

03

Ensure that the lien notice or claim form is properly formatted and includes all required information as per applicable state or local laws.

04

File the lien notice or claim form with the appropriate authority, usually the clerk's office or the secretary of state's office in the jurisdiction where the property is located or the debtor's business is registered.

05

Pay the necessary filing fees and adhere to any specific filing instructions or deadlines provided by the authority.

06

Once the lien is filed, serve a copy of the lien notice or claim form on the debtor, either personally or by certified mail with return receipt requested.

07

Keep track of important dates, such as the deadline for the debtor to respond or dispute the lien, and any subsequent actions you may need to take to enforce the lien if the debt remains unpaid.

08

Consult with a legal professional if you encounter any complications or have questions regarding the process of filing a lien or enforcing your rights as a lienholder.

Who needs dont lien on me?

01

Anyone who is owed a debt and wants to secure their rights to a particular property or asset can benefit from filing a lien. Typically, contractors, subcontractors, or suppliers who have provided goods or services to a property owner or a construction project might need to file a lien to ensure payment for their work or materials. However, individuals or businesses in various industries, such as landlords, lenders, or even healthcare providers, may also need to file a lien in order to protect their financial interests in certain situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dont lien on me in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing dont lien on me and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit dont lien on me straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing dont lien on me.

How do I fill out dont lien on me using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign dont lien on me. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is dont lien on me?

dont lien on me is a form required for certain individuals to declare that they are not liable for any liens.

Who is required to file dont lien on me?

Individuals who want to declare that they are not liable for any liens.

How to fill out dont lien on me?

The form can be filled out online or submitted in person at the local tax office.

What is the purpose of dont lien on me?

The purpose is to declare that the individual is not responsible for any liens.

What information must be reported on dont lien on me?

Personal information, income details, and details of any existing liens.

Fill out your dont lien on me online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dont Lien On Me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.