NY IT-2105 2018 free printable template

Show details

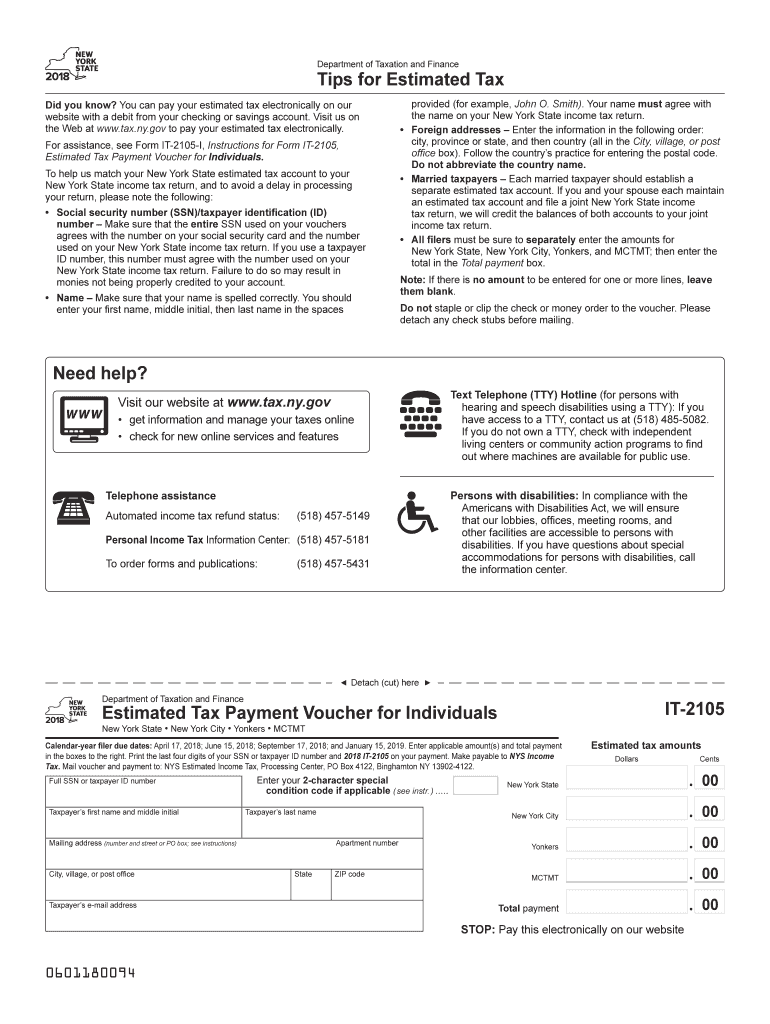

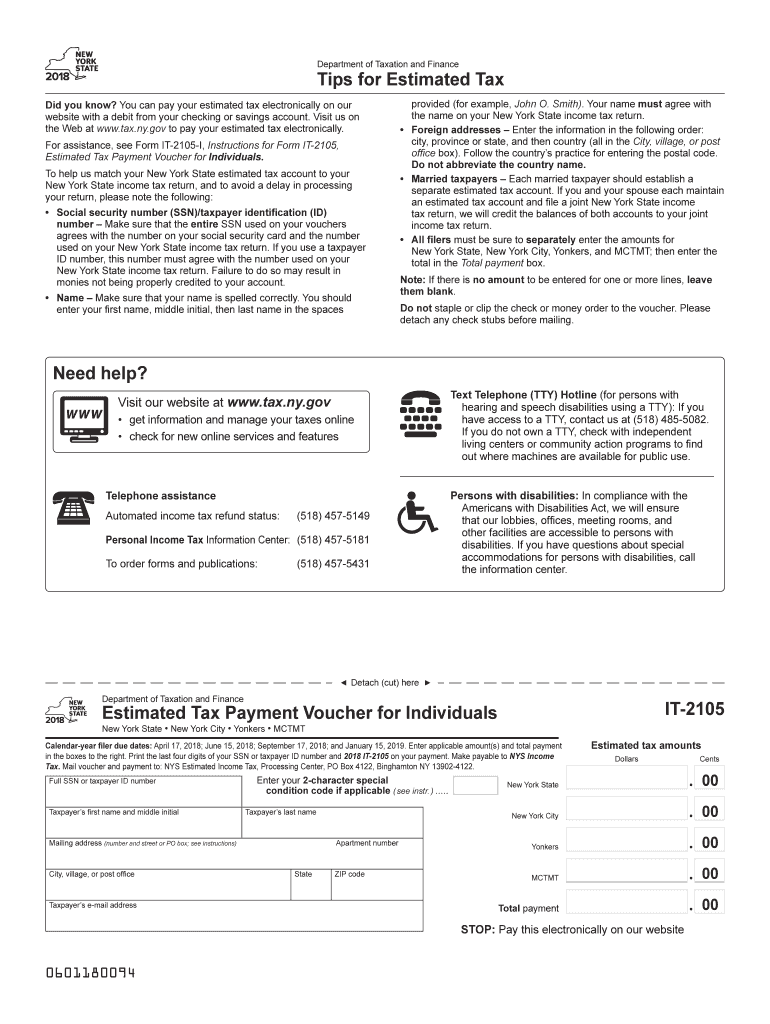

Department of Taxation and Finances for Estimated Tax

Did you know? You can pay your estimated tax electronically on our

website with a debit from your checking or savings account. Visit us on

the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-2105

Edit your NY IT-2105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-2105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-2105 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY IT-2105. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-2105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-2105

How to fill out NY IT-2105

01

Obtain a copy of the NY IT-2105 form from the New York State Department of Taxation and Finance website.

02

Enter your personal information, including your name, address, and Social Security number at the top of the form.

03

Select the correct tax year for which you are filing the form.

04

Provide the total income you received during the year, including wages, pensions, and other sources of income.

05

Calculate the tax owed using the provided tax rates and instructions on the form.

06

Fill out any credits or adjustments you may qualify for, which may reduce your tax liability.

07

Sign and date the form at the bottom to certify the accuracy of the information provided.

08

Submit the completed form either electronically or by mail to the address specified in the instructions.

Who needs NY IT-2105?

01

Individuals who owe New York State income tax due to underwithholding or earned income may need to fill out the NY IT-2105 form.

02

People who are required to make estimated payments for their New York State personal income tax.

Fill

form

: Try Risk Free

People Also Ask about

Do you get a form for estimated tax payments?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Who needs to file 2663?

Married couples who are nonresident transferors/sellers, and who transfer or sell their interest in New York State real property, may file one Form IT-2663 and use one check or money order. The term married includes a marriage between same-sex spouses.

Does NYS require estimated tax payments?

You may be required to make estimated tax payments if: you receive income such as interest, dividends, alimony, capital gains, gambling and lottery winnings, prizes and awards, or income from a pension; you expect to owe income tax of $300 or more to New York State, New York City, or Yonkers; or.

How do I pay estimated taxes for New York State?

Ready? Log in to (or create) your Individual Online Services account. Select the ≡ Services menu from the upper left corner of the page. Select Payments, bills and notices, then select Make a payment from the expanded menu.

What is an IT 2663 form?

Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT‑2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

Do I have to pay NY state income tax if I work remotely?

So if you work remotely a few days a week from your home in say, New Jersey or Connecticut, or five days a week in a state farther away, the New York tax authorities still want your employer to have New York income tax withheld from your paycheck — as though you were in the New York office for five full days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NY IT-2105?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your NY IT-2105 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the NY IT-2105 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY IT-2105 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit NY IT-2105 on an Android device?

You can make any changes to PDF files, such as NY IT-2105, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY IT-2105?

NY IT-2105 is a form used by non-residents of New York State to report their estimated tax liability and make estimated tax payments on income generated from New York sources.

Who is required to file NY IT-2105?

Non-resident individuals who expect to owe tax on income earned in New York State are required to file NY IT-2105.

How to fill out NY IT-2105?

To fill out NY IT-2105, taxpayers must provide their identification information, report their estimated income and deductions from New York sources, calculate the estimated tax due, and indicate any payments made.

What is the purpose of NY IT-2105?

The purpose of NY IT-2105 is to ensure that non-residents pay the appropriate amount of tax on income sourced from New York, avoiding underpayment of taxes throughout the year.

What information must be reported on NY IT-2105?

The information that must be reported on NY IT-2105 includes the taxpayer's name, address, Social Security number, estimated income from New York sources, deductions, and the calculated estimated tax payment.

Fill out your NY IT-2105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-2105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.