Get the free Chapter 13 bmonthlyb business boperatingb statement - Russell Brown bb - chapter13

Show details

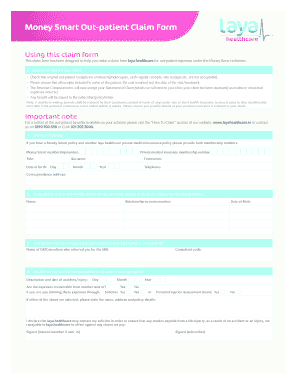

CHAPTER 13 MONTHLY BUSINESS OPERATING STATEMENT Case Number: Debtor(s) Name(s): Financial Report for: (month and year) 1. INCOME. Gross Business Receipts / Sales $ Sales Taxes Collected $ TOTAL INCOME.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 bmonthlyb business

Edit your chapter 13 bmonthlyb business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 bmonthlyb business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 13 bmonthlyb business online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapter 13 bmonthlyb business. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 bmonthlyb business

How to fill out chapter 13 monthly business:

01

Gather all necessary financial documents: Before you begin filling out the chapter 13 monthly business form, make sure you have all the required financial documents handy. This may include your income statements, expense records, debt obligations, and any other relevant financial information.

02

Provide accurate and up-to-date income information: It is crucial to accurately report your monthly business income on the chapter 13 form. Include all sources of revenue, such as sales, service fees, or any other income generated by your business. Make sure to provide the most recent and accurate financial figures.

03

List all business expenses: In this section, you need to carefully list and categorize all your monthly business expenses. This may include rental or lease payments, utility bills, payroll expenses, insurance premiums, and any other regular business costs. It is important to be thorough and include every expense to ensure an accurate representation of your financial situation.

04

Declare business assets and liabilities: Provide a detailed list of your business assets, such as equipment, inventory, or property, along with their estimated values. Additionally, disclose any outstanding debts or liabilities related to your business, such as loans, leases, or outstanding bills.

05

Calculate disposable income: Chapter 13 bankruptcy requires debtors to have a certain level of disposable income to repay their creditors. To determine your disposable income, subtract your monthly business expenses from your business income. This figure will play a significant role in the repayment plan proposed during the chapter 13 bankruptcy process.

Who needs chapter 13 monthly business?

01

Business owners facing financial difficulties: Chapter 13 bankruptcy can be beneficial for business owners who are struggling with overwhelming debt and want to reorganize their finances. It allows them to create a repayment plan that suits their business income and obligations.

02

Sole proprietors or small business owners: Chapter 13 bankruptcy is commonly sought by sole proprietors or small business owners who want to continue operating their business while repaying their debts. It provides them with an opportunity to protect their business while addressing their financial challenges.

03

Those seeking debt relief for their business: By filing chapter 13 bankruptcy, business owners can gain temporary relief from aggressive debt collection actions and creditors' lawsuits. It allows them to negotiate manageable repayment terms while protecting their business assets.

In summary, filling out chapter 13 monthly business involves gathering financial documents, reporting accurate income and expenses, listing assets and liabilities, calculating disposable income, and proposing a feasible repayment plan. This bankruptcy option is utilized by business owners facing financial difficulties, sole proprietors or small business owners, and those seeking debt relief and asset protection for their business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapter 13 bmonthlyb business?

Chapter 13 bankruptcy is a type of bankruptcy that allows individuals with regular income to develop a plan to repay all or part of their debts.

Who is required to file chapter 13 bmonthlyb business?

Individuals with regular income who have unsecured debts less than $394,725 and secured debts less than $1,184,200 are eligible to file for Chapter 13 bankruptcy.

How to fill out chapter 13 bmonthlyb business?

To fill out Chapter 13 bankruptcy forms, individuals need to gather information about their income, expenses, assets, and creditors, and then work with an attorney to complete and file the necessary paperwork.

What is the purpose of chapter 13 bmonthlyb business?

The purpose of Chapter 13 bankruptcy is to provide individuals with a structured way to repay their debts over a period of time while keeping their assets.

What information must be reported on chapter 13 bmonthlyb business?

The information that must be reported on Chapter 13 bankruptcy forms includes income, expenses, assets, debts, and a proposed repayment plan.

How can I modify chapter 13 bmonthlyb business without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like chapter 13 bmonthlyb business, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit chapter 13 bmonthlyb business online?

The editing procedure is simple with pdfFiller. Open your chapter 13 bmonthlyb business in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the chapter 13 bmonthlyb business in Gmail?

Create your eSignature using pdfFiller and then eSign your chapter 13 bmonthlyb business immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your chapter 13 bmonthlyb business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Bmonthlyb Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.