MassMutual F6695 2018-2026 free printable template

Show details

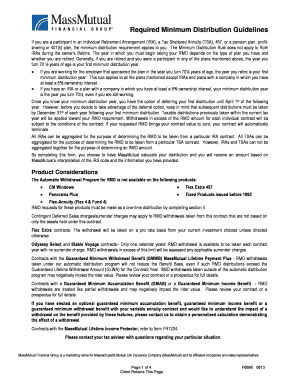

Required Minimum

Distribution Guidelines

If you are a participant in an Individual Retirement Arrangement (IRA), a Tax Sheltered Annuity (TSA), 457, or a pension Plan, profit sharing or 401(k) Plan,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MassMutual F6695

Edit your MassMutual F6695 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MassMutual F6695 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MassMutual F6695 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MassMutual F6695. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MassMutual F6695 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MassMutual F6695

How to fill out requirement minimum distribution rmd

01

To fill out requirement minimum distribution (RMD), follow these steps:

02

Calculate your RMD - Determine the required minimum distribution amount based on your age and account balance using the appropriate IRS life expectancy table.

03

Identify the accounts - Determine which retirement accounts are subject to RMD. Traditional IRAs, SEP IRAs, SIMPLE IRAs, and most employer-sponsored retirement plans like 401(k)s and 457(b)s require RMDs.

04

Determine the deadline - Understand the deadline for taking the RMD. Generally, you must take your first RMD by April 1 of the year following the year you turn 72 (or 70½ if you reached 70½ before 2020). Subsequent RMDs must be taken by December 31 each year.

05

Calculate multiple accounts - If you have multiple retirement accounts subject to RMD, you can calculate the total RMD amount and withdraw that sum from one or more accounts as long as the total meets the requirement.

06

Choose distribution method - Decide how you want to take the RMD. You can take the distribution in one lump sum or spread it out over multiple withdrawals throughout the year.

07

Withhold taxes if necessary - Consider withholding taxes from your RMD to avoid potential penalties for underpayment. Consult with a tax professional to determine the appropriate amount to withhold.

08

Complete the paperwork - Contact your financial institution or retirement plan administrator to request the necessary forms to initiate the RMD. Fill out the required information accurately and submit the forms as instructed.

09

Maintain documentation - Keep copies of all RMD-related documents, including withdrawal confirmations and tax forms, for your records and future reference.

10

Report the RMD - Include your RMD amount in your annual tax return for the corresponding tax year.

11

Seek professional advice - If you are unsure about any aspect of filling out the RMD requirements, consider consulting a financial advisor or tax professional to guide you through the process.

Who needs requirement minimum distribution rmd?

01

Individuals who are 72 years old or older (or 70½ years old or older if they reached 70½ before 2020) with certain types of retirement accounts need to fulfill the requirement minimum distribution (RMD) requirement.

02

The following individuals may need to comply with RMD:

03

- Traditional IRA owners

04

- SEP IRA owners

05

- SIMPLE IRA owners

06

- 401(k) plan participants

07

- 403(b) plan participants

08

- 457(b) plan participants

09

- Profit-sharing plan participants

10

- Keogh plan participants

11

- Other employer-sponsored retirement plan participants

12

It's important to consult with a financial advisor or tax professional to determine if you need to fulfill RMD requirements based on your specific retirement accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MassMutual F6695 for eSignature?

MassMutual F6695 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find MassMutual F6695?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific MassMutual F6695 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the MassMutual F6695 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your MassMutual F6695 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your MassMutual F6695 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MassMutual f6695 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.