Get the free Guide to Loss and Damage Claims - FedEx

Show details

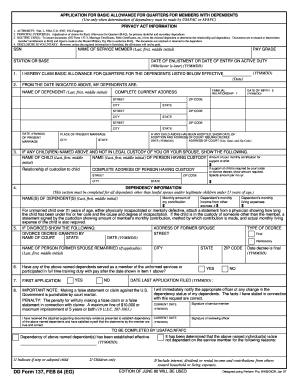

VICE Bill of Lading ALL SERVICES ARE SUBJECT TO THE TERMS AND CONDITIONS OF THE DXF 100 SERIES RULES TARIFF. SEE FEDEX.COM FOR DETAILS. QUESTIONS? CALL 1.866.393.4585SHIP FROM Name: Bill of Lading

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to loss and

Edit your guide to loss and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to loss and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guide to loss and online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit guide to loss and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to loss and

How to fill out guide to loss and

01

Step 1: Begin by reading through the guide to loss document to familiarize yourself with the content and purpose.

02

Step 2: Identify the specific loss scenario that you are dealing with, such as a financial loss, personal loss, or loss of material possessions.

03

Step 3: Clearly outline the details of the loss, including any relevant dates, times, and locations.

04

Step 4: Gather any supporting documentation or evidence related to the loss, such as receipts, photographs, or witness statements.

05

Step 5: Fill out the required sections of the guide to loss form, providing accurate and concise information for each prompt.

06

Step 6: Review the completed guide to loss form for any errors or missing information, making sure all sections are properly filled out.

07

Step 7: If necessary, seek assistance from a supervisor or expert in the field to verify the accuracy and completeness of the guide to loss form.

08

Step 8: Submit the filled-out guide to loss form to the appropriate individual, department, or organization as instructed.

09

Step 9: Keep a copy of the completed guide to loss form for your records, in case further documentation or follow-up is required.

10

Step 10: Follow any additional instructions or procedures provided by the recipient of the guide to loss form, such as attending hearings or providing additional documentation.

Who needs guide to loss and?

01

Individuals who have experienced a loss and need to document it for insurance or legal purposes.

02

Employees or professionals in industries where loss documentation is required, such as insurance companies, law firms, or accounting firms.

03

Victims of accidents, theft, or natural disasters who need to report the loss to relevant authorities or insurance providers.

04

Business owners or managers who need to keep track of financial or material losses for accounting or auditing purposes.

05

Anyone involved in a legal dispute or claim that requires accurate and detailed documentation of loss as evidence.

06

Government agencies or organizations that deal with loss-related matters, such as disaster management agencies or social welfare departments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my guide to loss and in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign guide to loss and and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get guide to loss and?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the guide to loss and in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit guide to loss and online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your guide to loss and to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

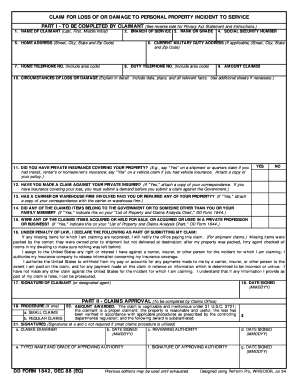

What is guide to loss and?

Guide to loss and is a document that provides instructions and information on how to report losses for tax purposes.

Who is required to file guide to loss and?

Individuals or businesses who have experienced losses and want to claim them on their tax return are required to file guide to loss and.

How to fill out guide to loss and?

To fill out guide to loss and, you will need to provide detailed information about the losses incurred, including the date and nature of the loss, the amount of the loss, and any insurance reimbursement received.

What is the purpose of guide to loss and?

The purpose of guide to loss and is to allow individuals or businesses to claim deductions for losses on their tax return, potentially reducing their taxable income.

What information must be reported on guide to loss and?

The information that must be reported on guide to loss and includes details about the loss, any insurance reimbursements received, and other relevant information for tax reporting purposes.

Fill out your guide to loss and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Loss And is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.