Get the free Cash and Internal ControlFinancial Accounting - Lumen Learning

Show details

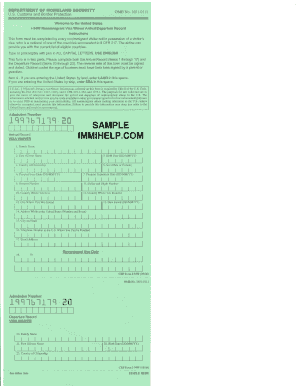

MANUAL FORMS

Receipting SystemsBetter control for cash and payments

Rewrite receipting systems make it easy to control

and record cash and customer payments. OvertheCounter Receipting System

(OTC)

Increase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and internal controlfinancial

Edit your cash and internal controlfinancial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and internal controlfinancial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash and internal controlfinancial online

Follow the steps down below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash and internal controlfinancial. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash and internal controlfinancial

How to fill out cash and internal controlfinancial

01

To fill out cash and internal control financial forms, you need to follow these steps:

02

Begin by gathering all necessary financial documents, such as cash receipts, bank statements, and purchase invoices.

03

Determine the period for which you are filling out the forms, whether it's daily, weekly, monthly, or any other designated time frame.

04

Record all the cash inflows and outflows during the specified period. This includes documenting cash sales, cash payments, and any bank transfers.

05

Calculate the total cash balance at the beginning and end of the period. This can be determined by adding the cash on hand and any cash equivalents, such as petty cash or short-term investments.

06

Verify the accuracy of the recorded transactions by reconciling them with corresponding bank statements or other supporting documents.

07

Prepare a summary of the cash and internal control financial activities, which may include information on sales, expenses, receipts, and payments.

08

Review the filled-out forms for any errors or discrepancies and make sure they comply with the required accounting standards and regulations.

09

Store the completed forms securely and retain them for future reference and auditing purposes.

Who needs cash and internal controlfinancial?

01

Cash and internal control financial practices are essential for various entities, including but not limited to:

02

- Businesses of all sizes, from small startups to large corporations, to ensure accurate financial reporting and prevent fraud.

03

- Nonprofit organizations, to maintain transparency and accountability in their financial operations.

04

- Government agencies, to safeguard public funds and maintain compliance with financial regulations.

05

- Financial institutions, to enforce stringent internal controls and minimize the risk of financial mismanagement.

06

- Auditors and accountants, who rely on cash and internal control financial information to assess the financial health and compliance of entities.

07

In summary, anyone involved in financial management, reporting, or auditing can benefit from implementing cash and internal control financial procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cash and internal controlfinancial?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your cash and internal controlfinancial to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the cash and internal controlfinancial in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your cash and internal controlfinancial and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out cash and internal controlfinancial on an Android device?

Complete your cash and internal controlfinancial and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is cash and internal controlfinancial?

Cash and internal control financial refers to the procedures and policies put in place to safeguard a company's assets, ensure accuracy of financial reporting, and prevent fraud.

Who is required to file cash and internal controlfinancial?

Publicly traded companies are required to file cash and internal control financial reports with the Securities and Exchange Commission (SEC).

How to fill out cash and internal controlfinancial?

Cash and internal control financial reports are typically filled out by the company's management and auditors, who review the company's internal controls related to financial reporting and attest to their effectiveness.

What is the purpose of cash and internal controlfinancial?

The purpose of cash and internal control financial reports is to provide assurance to investors and stakeholders that the company's financial statements are accurate and reliable.

What information must be reported on cash and internal controlfinancial?

Cash flow statements, balance sheets, income statements, and notes to the financial statements are some of the key information that must be reported on cash and internal control financial reports.

Fill out your cash and internal controlfinancial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Internal Controlfinancial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.