FL DoR DR-1N 2018 free printable template

Show details

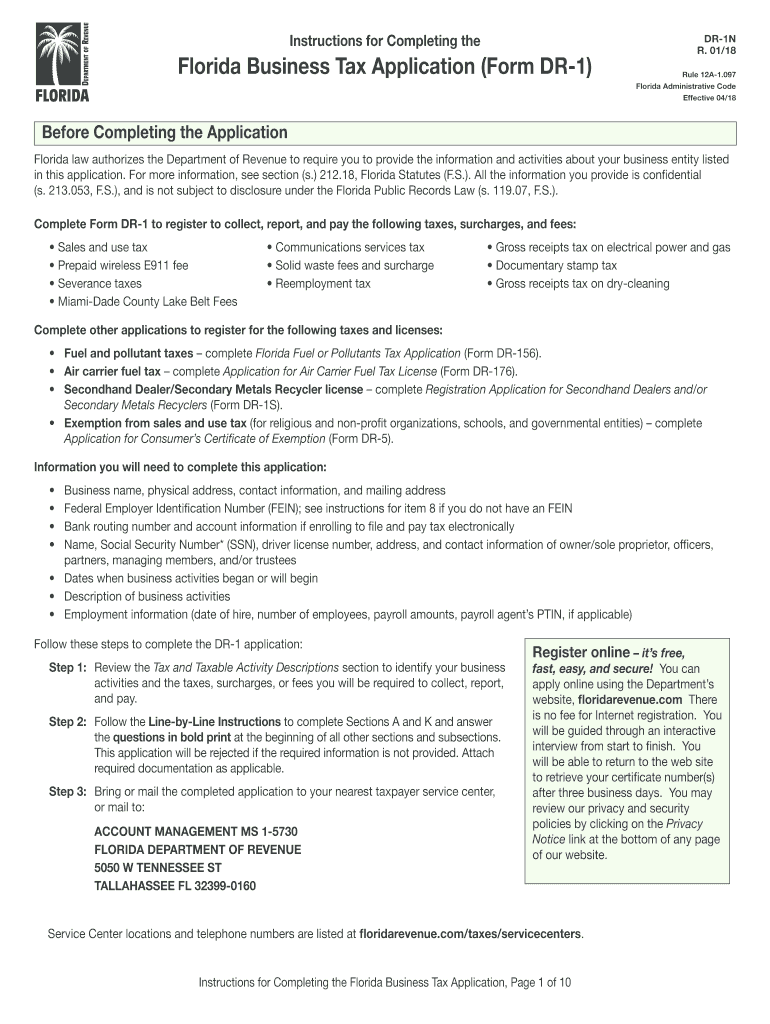

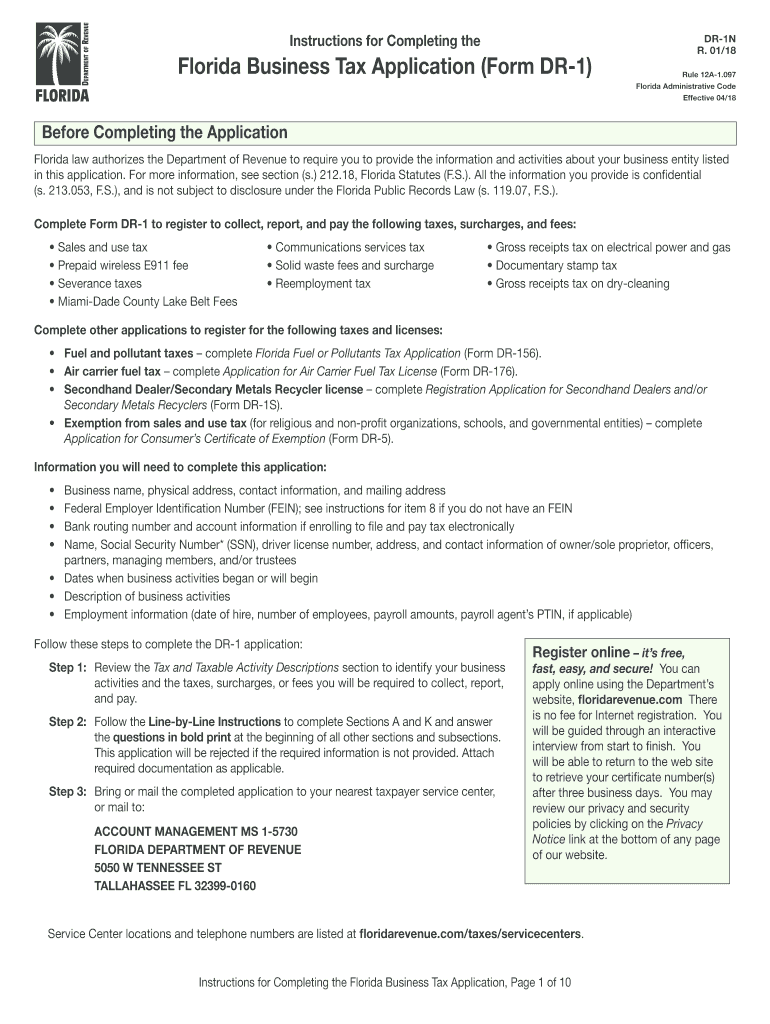

Instructions for Completing the Florida Business Tax Application Form DR-1 DR-1N R. 01/18 Rule 12A-1. 097 Florida Administrative Code Effective 04/18 Before Completing the Application Florida law authorizes the Department of Revenue to require you to provide the information and activities about your business entity listed in this application* For more information see section s. 212. 18 Florida Statutes F*S*. All the information you provide is confidential s. 213. 053 F*S* and is not subject...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR DR-1N

Edit your FL DoR DR-1N form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR DR-1N form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DoR DR-1N online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit FL DoR DR-1N. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-1N Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR DR-1N

How to fill out FL DoR DR-1N

01

Begin by downloading the FL DoR DR-1N form from the Florida Department of Revenue website.

02

Fill in your name, address, and contact information at the top of the form.

03

Specify your tax identification number, if applicable, in the designated space.

04

Indicate the type of tax you are filing for and provide the relevant period covered.

05

Complete the section concerning your income, including any deductions or credits eligible.

06

Review the instructions for any additional information required based on your specific situation.

07

Double-check all entries for accuracy before signing and dating the form.

08

Submit the completed form to the appropriate address provided in the instructions.

Who needs FL DoR DR-1N?

01

Individuals and businesses in Florida who are applying for a tax exemption.

02

Taxpayers seeking to report changes affecting their eligibility for specific tax benefits.

03

Entities claiming exemption from sales and use tax.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a Florida business tax license?

Do you need a business license in Florida? Florida doesn't require or issue a state-wide business operating license. That means you don't have to have a license from the state of Florida just to run your business in the state.

How long does it take to get a sales tax certificate in Florida?

How long does it take to receive your Florida sales tax permit? You should be able to retrieve your certificate number(s) online after three business days.

What is a Florida tax certificate?

Businesses that register with the Florida Department of Revenue to collect sales tax are issued a Florida Annual Resale Certificate for Sales Tax. The certificate allows business owners, or their representatives, to buy or rent property or services tax free when the property or service is resold or re-rented.

What businesses need a business license in Florida?

In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

Do I have to register my business with the Florida Department of Revenue?

The Florida Department of Revenue administers over 30 taxes and fees. In most cases, you must register with the Department as a dealer before you begin conducting business activities subject to Florida's taxes and fees.

Does a sole proprietor need a business license in Florida?

Not only do sole proprietorships not have to register with the state of Florida before they can start doing business – they can operate without holding annual meetings or other formalities required of corporations. There's no need to appoint a board of directors – after all, this business is entirely yours.

Do all businesses need a business license in Florida?

Do you need a business license in Florida? Florida doesn't require or issue a state-wide business operating license. That means you don't have to have a license from the state of Florida just to run your business in the state.

What is a Dr-1 in Florida?

DR-1 Florida Business Tax Application DR-1N Instructions for Completing the Florida Business Tax Application (Form DR-1)

How do I get a Florida business tax certificate?

To apply for a Florida sales tax license, you may use the online form or download Form DR-1 and submit it to the Department of Revenue or a taxpayer service center. There is no fee to register for a Florida sales tax license.

How do I get a Florida business partner number?

When you register with the Department, you are issued a business partner number as a unique identifying number for your business. The number will be located on the back of your certificate of registration.

Do you need a business license for a at home business in Florida?

Almost all businesses in Florida are required to obtain a business tax receipt (which some people refer to as a general business license). This applies to anyone who provides goods or services, whether you operate a home-based business or a commercial location.

How do I get a Florida tax ID number?

Call 800-829-4933. You can call Monday through Friday, 7 a.m. to 7 p.m. If you're calling from outside of the U.S., use the non-toll-free international number: 267-941-1099. You can complete Form SS-4 to apply for your EIN. Once you fill it out, fax it to 859-669-5760.

Can I run a small business without registering?

You are allowed to operate a sole proprietorship without registering, but you are required to register with your local government to collect and file state taxes. There is nothing wrong with running an unregistered business as long as your business is legal and meets all licensing and tax requirements.

Do I need to register my business in Florida?

To start a business in Florida you need to: Check with your County Tax Collector to see if you need a license. Register your business with the Department of Revenue. Register with the IRS.

Do I need a sellers permit to sell online in Florida?

Any business selling or leasing any tangible property is required to obtain a seller's permit. You can also do this online through this form on the department's website.

Can you run a business without a license in Florida?

Operating a business without being licensed by the state is a first-degree misdemeanor in Florida, punishable by up to one year in jail and a fine of up to $1,000.

How do I get a copy of my Florida sales tax certificate?

Resale certificates are available through the sales and use tax or communications services tax file and pay webpages. To print your resale certificate, use the button below to log in, then select the Print Annual Resale Certificate button from the Choose Activity menu.

Can a business operate without business permit?

The Business Permit is an important compliance document for businesses in the Philippines. Registered businesses should not be operating without having an up-to-date Business Permit or else they will face potential sanctions including fines, penalties and business closure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL DoR DR-1N in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your FL DoR DR-1N as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get FL DoR DR-1N?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the FL DoR DR-1N in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit FL DoR DR-1N in Chrome?

Install the pdfFiller Google Chrome Extension to edit FL DoR DR-1N and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is FL DoR DR-1N?

FL DoR DR-1N is a form required by the Florida Department of Revenue for the reporting of certain income tax information for non-residents and part-year residents.

Who is required to file FL DoR DR-1N?

Individuals who have earned income in Florida but do not reside in the state, as well as part-year residents, are required to file FL DoR DR-1N.

How to fill out FL DoR DR-1N?

To fill out FL DoR DR-1N, gather your income information, complete the form by entering the required details accurately, including your income sources, and then submit it to the Florida Department of Revenue.

What is the purpose of FL DoR DR-1N?

The purpose of FL DoR DR-1N is to provide the Florida Department of Revenue with the necessary information to assess income tax liabilities for non-residents and part-year residents.

What information must be reported on FL DoR DR-1N?

FL DoR DR-1N requires reporting of sources of income earned in Florida, total income, deductions, and any applicable tax credits.

Fill out your FL DoR DR-1N online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR DR-1n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.