NY ELT-1 2017 free printable template

Get, Create, Make and Sign NY ELT-1

Editing NY ELT-1 online

Uncompromising security for your PDF editing and eSignature needs

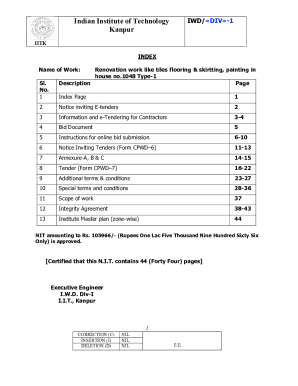

NY ELT-1 Form Versions

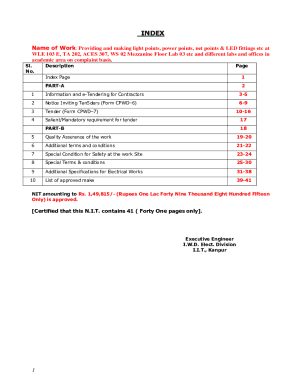

How to fill out NY ELT-1

How to fill out NY ELT-1

Who needs NY ELT-1?

Instructions and Help about NY ELT-1

What is this life if full of care behave no time to stand and stare no time to stand beneath the boughs and stare along as sheep or cows no time to see when woods we pass where squirrels hide their nuts in grass no time to see inroad daylight streams full of starslike skies at night no time to turn studies glance and watch her feet how they can dance no time to wait till vermouth can enrich that smile her eyes began a poor life this if full of care have no time to stand and stareyouwe'’re like fireworks a symphony exploding in the sky with youth

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY ELT-1 online?

How do I make changes in NY ELT-1?

Can I sign the NY ELT-1 electronically in Chrome?

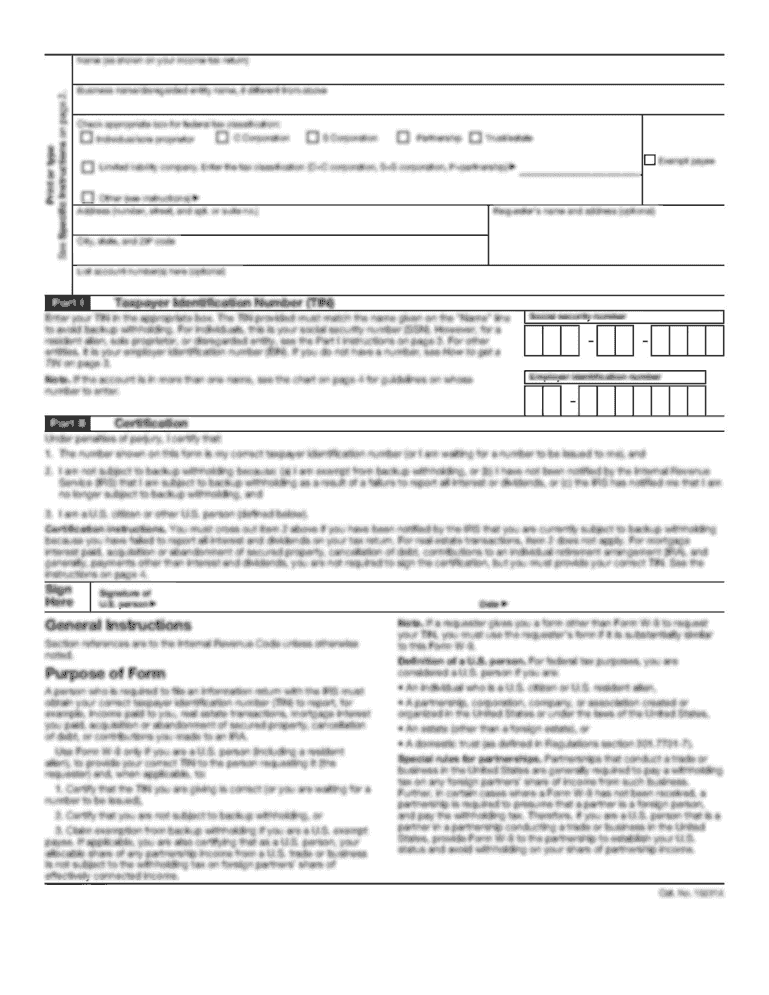

What is NY ELT-1?

Who is required to file NY ELT-1?

How to fill out NY ELT-1?

What is the purpose of NY ELT-1?

What information must be reported on NY ELT-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.