Get the free Estate Transfer Form and Guidelines (ETRF-2351). Estate Transfer Form and Guidelines...

Show details

CANADA SAVINGS BONDSETRF23512018 Estate Transfer Form (2351) and GuidelinesGUIDELINES FOR COMPLETING THE FORM IMPORTANT INFORMATION When bond(s)/plan(s) are registered in two or more names with the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate transfer form and

Edit your estate transfer form and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate transfer form and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate transfer form and online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estate transfer form and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate transfer form and

How to fill out estate transfer form and

01

To fill out an estate transfer form, follow these steps:

02

Start by obtaining the estate transfer form from the relevant authority or organization. This form can usually be downloaded from their website or obtained in person.

03

Read the instructions on the form carefully to understand the requirements and any supporting documents you may need to gather.

04

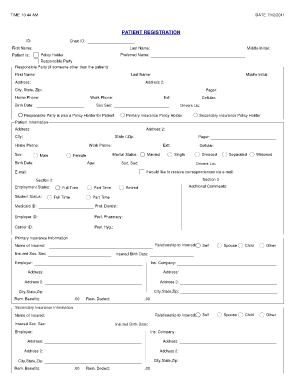

Fill in your personal information, including your full name, contact details, and any other requested identification information.

05

Provide details about the deceased person, including their name, date of death, and any other relevant information.

06

Specify the assets or property that you are transferring as part of the estate. This may include bank accounts, real estate, investments, or other valuable possessions.

07

If required, provide information about any debts or liabilities associated with the estate.

08

Attach any necessary supporting documents, such as death certificates, wills, or letters of administration.

09

Review the completed form for accuracy and make sure all sections are appropriately filled out.

10

Sign and date the form, indicating that the information provided is true and accurate to the best of your knowledge.

11

Submit the completed form to the designated authority or organization, following their specified instructions. It may be necessary to pay any applicable fees or provide additional documents at the time of submission.

12

Keep a copy of the filled-out form and any supporting documents for your records.

Who needs estate transfer form and?

01

The estate transfer form is typically needed by individuals who are responsible for transferring the assets or property of a deceased person to the rightful beneficiaries or heirs. This may include:

02

- Executors or administrators of the deceased person's estate.

03

- Legal representatives or attorneys acting on behalf of the beneficiaries.

04

- Close family members or beneficiaries named in a will.

05

- Individuals inheriting or receiving assets from the estate through intestate succession.

06

It is important to consult with the relevant authority or organization to determine if the estate transfer form is required and who specifically needs to fill it out in a given situation.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I have Canada Savings Bonds?

To find information about Canada Savings Bonds, Canada Premium Bonds, The Canada RSP and The Canada RIF, Government of Canada Market Issue Bonds, Dominion of Canada War Loans and Certificates, visit csb.gc.ca.

What do I do with a savings bond of a deceased person?

If only one person is named on the bond and that person has died, the bond belongs to that person's estate. If two people are named on the bond and both have died, the bond belongs to the estate of the one who died last.

How do I redeem a savings bond for a deceased person?

Cash savings bonds in a non-administered estate Fill out FS Form 5336. WAIT to sign until you are in the presence of a certifying official, as explained on the form. Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Send us the. Mail the package to us at.

How do you redeem Canadian savings bonds after death?

The portion of the proceeds belonging to the deceased must be distributed ing to the deceased's estate. To redeem the bond(s)/plan(s) to the surviving registered owner(s), this Estate Transfer Form 2351 must be completed.

How do you cash savings bonds if owner is deceased?

Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Have each person who is entitled to a distributed bond also fill out and sign the appropriate forms: If they want cash for their bond: FS Form 1522.

What happens to savings bonds when owner dies?

A survivor is named on the bond(s) If only one person is named on the bond and that person has died, the bond belongs to that person's estate. If two people are named on the bond and both have died, the bond belongs to the estate of the one who died last.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete estate transfer form and online?

Completing and signing estate transfer form and online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit estate transfer form and online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your estate transfer form and and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out estate transfer form and on an Android device?

On an Android device, use the pdfFiller mobile app to finish your estate transfer form and. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is estate transfer form?

The estate transfer form is a document used to report the transfer of assets from a deceased person's estate to their beneficiaries or heirs.

Who is required to file estate transfer form?

The executor or administrator of the deceased person's estate is required to file the estate transfer form.

How to fill out estate transfer form?

The estate transfer form must be completed with information about the deceased person, the beneficiaries, and the assets being transferred.

What is the purpose of estate transfer form?

The purpose of the estate transfer form is to provide a record of the assets being transferred from the estate of a deceased person to their beneficiaries.

What information must be reported on estate transfer form?

The estate transfer form must include details about the deceased person's assets, the beneficiaries, and the value of the assets being transferred.

Fill out your estate transfer form and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Transfer Form And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.