Get the free Industrial Alcohol Report. excise tax form

Show details

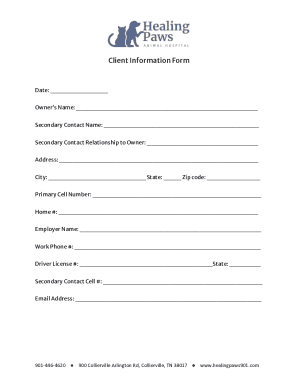

FORM C214 (08/18) TAB USE NONINDUSTRIAL ALCOHOL REPORTENTRYMonthly Report of Alcohol Produced, Used or Possessed for the Purpose of Use for Industrial, Medicinal, Mechanical or Scientific Purposes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign industrial alcohol report excise

Edit your industrial alcohol report excise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your industrial alcohol report excise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing industrial alcohol report excise online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit industrial alcohol report excise. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out industrial alcohol report excise

How to fill out industrial alcohol report excise

01

To fill out the industrial alcohol report excise, follow these steps:

02

Start by gathering all the necessary information and documents, such as the quantity of industrial alcohol produced or imported, the excise duty rates, and any other relevant details.

03

Identify the reporting period for which the report is being filled out. This could be a specific month, quarter, or year as per the regulations of your country or jurisdiction.

04

Calculate the total quantity of industrial alcohol produced or imported during the reporting period. Ensure that the calculations are accurate and based on the designated measurement units.

05

Determine the applicable excise duty rates for industrial alcohol. These rates may vary depending on the type of alcohol, its strength, and any specific exemptions or allowances.

06

Multiply the total quantity of industrial alcohol by the excise duty rate to calculate the excise duty payable for the reporting period.

07

Prepare the report in the prescribed format or using the designated forms provided by the relevant authorities. Ensure that all the required information is accurately filled in, including details about the producer or importer, product specifications, and the calculated excise duty payable.

08

Review the completed report for any errors or omissions. Make sure that all the calculations are correct and all the required fields are filled in.

09

Submit the industrial alcohol report excise to the appropriate authorities within the specified deadline. This could be done electronically or through a physical submission, as per the regulations in your jurisdiction.

10

Keep a copy of the submitted report for your records and future reference. It may be necessary for audits or compliance verification.

11

If any changes or amendments are required after submitting the report, follow the procedures outlined by the authorities to make adjustments and rectify any inaccuracies.

Who needs industrial alcohol report excise?

01

Various entities and individuals may need to file an industrial alcohol report excise depending on the regulations of their country or jurisdiction. Some examples include:

02

- Industrial alcohol producers

03

- Industrial alcohol importers

04

- Government departments or agencies responsible for monitoring and regulating alcohol production and importation

05

- Tax authorities or revenue departments

06

- Auditors or compliance officers

07

- Legal or accounting professionals assisting industrial alcohol producers or importers

08

- Any other party as required by the specific laws and regulations governing industrial alcohol production and excise duties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete industrial alcohol report excise online?

With pdfFiller, you may easily complete and sign industrial alcohol report excise online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the industrial alcohol report excise in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your industrial alcohol report excise right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit industrial alcohol report excise on an Android device?

You can edit, sign, and distribute industrial alcohol report excise on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is industrial alcohol report excise?

Industrial alcohol report excise is a report that must be filed by businesses that manufacture, distribute, or sell industrial alcohol.

Who is required to file industrial alcohol report excise?

Businesses that manufacture, distribute, or sell industrial alcohol are required to file the industrial alcohol report excise.

How to fill out industrial alcohol report excise?

Industrial alcohol report excise can be filled out online through the appropriate government agency's website or by submitting a physical form with the required information.

What is the purpose of industrial alcohol report excise?

The purpose of industrial alcohol report excise is to track the production and distribution of industrial alcohol for regulatory and tax purposes.

What information must be reported on industrial alcohol report excise?

Information such as the quantity of industrial alcohol produced, distributed, and sold, as well as any taxes paid on the alcohol, must be reported on the industrial alcohol report excise.

Fill out your industrial alcohol report excise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Industrial Alcohol Report Excise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.