AU NAT 8676 2017-2026 free printable template

Show details

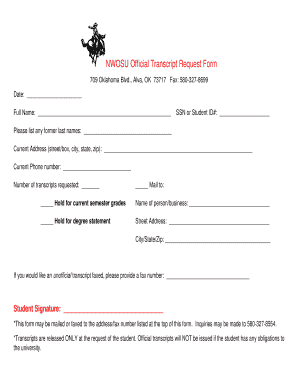

Superannuation fund nomination

Completing this form

Nyquist answers all questions.

X in all applicable boxes.nPlaceSection A: Your details

1Tax file number (TEN)

We are authorized by the Taxation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU NAT 8676

Edit your AU NAT 8676 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NAT 8676 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU NAT 8676 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU NAT 8676. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 8676 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NAT 8676

How to fill out AU NAT 8676

01

Obtain the AU NAT 8676 form from the appropriate government website or office.

02

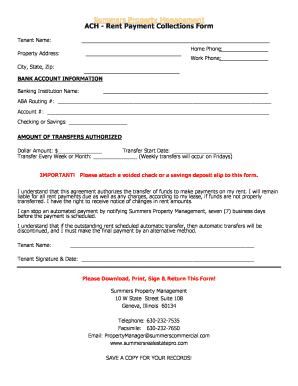

Fill in your personal details, including your name, address, and contact information.

03

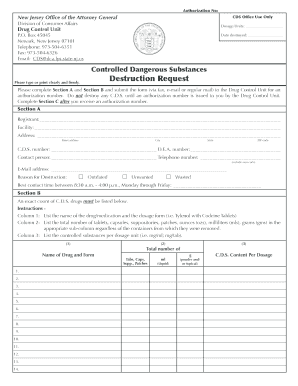

Provide information regarding your immigration status and any relevant background.

04

Complete the sections that pertain to your specific situation, such as employment or education.

05

Review the form for accuracy and completeness before submission.

06

Sign and date the form as required.

07

Submit the completed form to the designated authority, either electronically or by mail.

Who needs AU NAT 8676?

01

Individuals applying for certain types of visas or immigration status in Australia.

02

Persons seeking an Australian citizenship certificate.

03

Applicants who need to provide additional information about their residency or immigration history.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a superannuation form?

The pre-filled online form can be accessed through ATO online services via myGov. Your existing super funds and account details will be displayed in the form if you choose to nominate one of your existing super funds for employers to pay contributions to.

What is a superannuation account?

Superannuation, or super, refers to the money you've saved for retirement. In Australia, when you're working, it's compulsory your employer makes payments into a superannuation account for you. This amount is separate to the income you're paid.

Can I leave my super to anyone?

If you would like to leave your super to someone who is not a dependant under the super laws, contact your provider about making a binding death benefit nomination to have the payment made to your legal personal representative. This will ensure your super is distributed ing to your will.

What is a superannuation nomination form?

Complete a nomination of beneficiaries form to let us know who you want your super benefits or pension to go to. Manage your super.

Is 401K the same as superannuation?

Australia's Superannuation is a Hybrid Retirement Fund Similar to Both Social Security and a 401K. A minimum of 9.5% of your salary will be contributed to a retirement fund or superannuation. The Superannuation Guarantee (SG) and the minimum contribution will increase gradually from 9.5% to 12% in 2025.

What is the meaning of superannuation account?

What is superannuation? Superannuation, or 'super', is money put aside by your employer over your working life for you to live on when you retire from work. Super is important for you, because the more you save, the more money you will have for your retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the AU NAT 8676 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your AU NAT 8676.

How can I fill out AU NAT 8676 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your AU NAT 8676 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit AU NAT 8676 on an Android device?

You can edit, sign, and distribute AU NAT 8676 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is AU NAT 8676?

AU NAT 8676 is a form used by businesses in Australia to report and pay their Goods and Services Tax (GST) and other relevant tax obligations to the Australian Taxation Office (ATO).

Who is required to file AU NAT 8676?

Businesses or entities that are registered for GST and have a tax obligation are required to file AU NAT 8676.

How to fill out AU NAT 8676?

To fill out AU NAT 8676, businesses must provide their business details, including their ABN, GST income, GST credits, and calculate the amount of GST owed or refundable. They must follow the instructions provided by the ATO.

What is the purpose of AU NAT 8676?

The purpose of AU NAT 8676 is to facilitate the reporting and payment of GST and to ensure compliance with the tax laws in Australia.

What information must be reported on AU NAT 8676?

The information that must be reported on AU NAT 8676 includes the business's ABN, total sales, total purchases, amount of GST collected, amount of GST paid, and any adjustments or credits that may apply.

Fill out your AU NAT 8676 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NAT 8676 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.