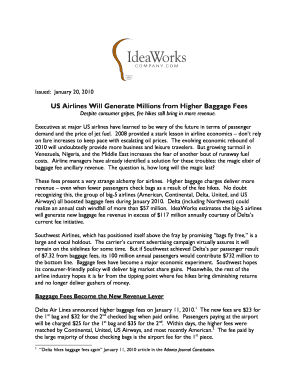

Get the free ICVC regular savings plan Amendment to Direct ... - Invesco Perpetual

Show details

CVC regular savings plan Amendment to Direct Debit Please note a separate form is needed for each account number you hold This form can be used to: change your fund choice or the amount you currently

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign icvc regular savings plan

Edit your icvc regular savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your icvc regular savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit icvc regular savings plan online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit icvc regular savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out icvc regular savings plan

How to fill out an ICVC regular savings plan:

01

Contact the fund provider: Begin by researching different fund providers that offer ICVC regular savings plans. Once you have chosen a provider, reach out to them and inquire about the process of opening a regular savings plan.

02

Review the investment options: The ICVC regular savings plan typically offers a range of investment options. Take the time to carefully review these options and choose one that aligns with your investment goals and risk tolerance.

03

Complete the application form: The fund provider will provide you with an application form to fill out. Make sure to provide accurate and up-to-date information. The form will generally require personal details such as your name, address, and contact information.

04

Determine the contribution amount: Decide on the amount you want to contribute to your ICVC regular savings plan. This can be a monthly or quarterly contribution, depending on your preference and affordability. The fund provider will guide you on the minimum contribution requirement.

05

Set up a direct debit: To ensure regular contributions to your ICVC regular savings plan, you will need to set up a direct debit with your bank. This allows the fund provider to automatically deduct the agreed contribution amount from your bank account on the chosen frequency.

06

Submit the necessary documentation: Along with the application form, you may be required to provide additional documentation such as proof of identity, proof of address, and bank account details. Make sure to submit these documents promptly to avoid any delays in opening your ICVC regular savings plan.

Who needs ICVC regular savings plan:

01

Individuals looking to build wealth over time: The ICVC regular savings plan is ideal for individuals who want to gradually build their savings and investments over a specified period, helping them achieve long-term financial goals.

02

Those who prefer a disciplined savings approach: If you struggle with saving consistently, an ICVC regular savings plan can provide the necessary discipline. Regular contributions help instill a savings habit and ensure continuous investment growth.

03

People seeking diversification: ICVC regular savings plans usually offer a range of investment options, including different asset classes and sectors. This allows individuals to diversify their investments and potentially reduce risk by spreading their money across various opportunities.

04

Investors with long-term goals: ICVC regular savings plans are designed for individuals with long-term financial goals, such as saving for retirement, education expenses, or future major purchases. By contributing regularly, you can benefit from compounding returns over time.

Remember, it is essential to consult with a financial advisor or a representative from the fund provider to understand the specific terms and conditions of an ICVC regular savings plan and ensure it aligns with your financial objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is icvc regular savings plan?

ICVC regular savings plan is a type of investment plan where investors make regular contributions to an Investment Company with Variable Capital (ICVC) to build their savings over time.

Who is required to file icvc regular savings plan?

Investors who participate in ICVC regular savings plan are required to file the plan and report their contributions.

How to fill out icvc regular savings plan?

To fill out an ICVC regular savings plan, investors must provide details of their contributions, investment choices, and personal information as required by the Investment Company.

What is the purpose of icvc regular savings plan?

The purpose of ICVC regular savings plan is to help investors save and grow their money over time through systematic contributions and investment opportunities.

What information must be reported on icvc regular savings plan?

Information such as the investor's name, address, contribution amounts, investment options chosen, and any changes in personal details must be reported on ICVC regular savings plan.

How can I edit icvc regular savings plan from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including icvc regular savings plan, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get icvc regular savings plan?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the icvc regular savings plan in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the icvc regular savings plan electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your icvc regular savings plan in minutes.

Fill out your icvc regular savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icvc Regular Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.