Get the free BT Life Assurance Scheme

Show details

E

×

P

R

E

S

S

I

O

N

O

FBI Life Assurance Scheme (ATLAS)

Expression of Wish form

Please complete this form in black ink and in BLOCK LETTERS

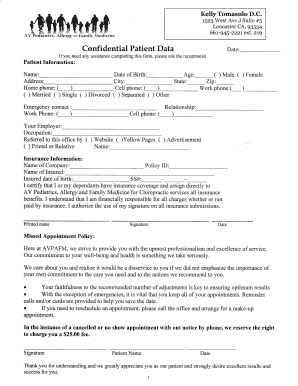

Surname:

Forenames:

IN/EIN: (if known)

National Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bt life assurance scheme

Edit your bt life assurance scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bt life assurance scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bt life assurance scheme online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bt life assurance scheme. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bt life assurance scheme

How to fill out bt life assurance scheme

01

Step 1: Begin by gathering all the necessary information and documents, such as personal details, medical history, and financial information.

02

Step 2: Understand the different types of life assurance schemes offered by BT and choose the one that aligns with your needs and financial goals.

03

Step 3: Fill out the application form carefully, ensuring all the required fields are accurately completed. Double-check the information provided to avoid any mistakes or omissions.

04

Step 4: If there are any additional forms or documents required, make sure to submit them along with the application. This may include medical reports or financial statements.

05

Step 5: Review the completed application form and supporting documents before submission. Make sure everything is in order and meets the requirements.

06

Step 6: Submit the filled-out application form and documents through the specified channel, such as online submission or sending it by mail.

07

Step 7: Wait for the confirmation and approval from BT regarding your life assurance scheme application. This may take some time, so be patient.

08

Step 8: Once your application is approved, make the necessary payments as per the policy terms and conditions.

09

Step 9: Keep a copy of the filled-out application form and all the related documents for your records and future reference.

10

Step 10: Review your life assurance policy periodically and update it as needed to ensure it continues to meet your changing needs and circumstances.

Who needs bt life assurance scheme?

01

Individuals who want to protect their loved ones financially in the event of their death.

02

People with dependents, such as spouses, children, or elderly parents, who rely on their income for financial support.

03

Individuals with outstanding debts, such as mortgages or loans, who want to ensure their loved ones won't be burdened with those debts if they pass away.

04

Business owners or partners who want to protect their business interests and ensure its continuity in case of their untimely demise.

05

Individuals who want to leave a financial legacy for their loved ones, provide for their education, or support charitable causes.

06

People with significant assets or sizable estates who want to minimize inheritance tax, as life assurance schemes can help in wealth preservation and inheritance planning.

07

Anyone concerned about the financial impact of critical illness, where life assurance schemes can provide financial support during challenging times.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bt life assurance scheme directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your bt life assurance scheme and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send bt life assurance scheme to be eSigned by others?

When you're ready to share your bt life assurance scheme, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in bt life assurance scheme without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit bt life assurance scheme and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is bt life assurance scheme?

BT Life Assurance Scheme is a life insurance plan offered by BT to provide financial protection to its employees and their families.

Who is required to file bt life assurance scheme?

All BT employees who are enrolled in the BT Life Assurance Scheme are required to file the necessary paperwork.

How to fill out bt life assurance scheme?

Employees can fill out the BT Life Assurance Scheme forms provided by the company HR department or online via the BT employee portal.

What is the purpose of bt life assurance scheme?

The purpose of the BT Life Assurance Scheme is to provide financial security to employees and their families in case of unexpected events such as death or disability.

What information must be reported on bt life assurance scheme?

The BT Life Assurance Scheme requires the reporting of personal information, beneficiary details, coverage amounts, and any changes in employment status.

Fill out your bt life assurance scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bt Life Assurance Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.