Get the free 2017 IL-2210, Computation of Penalties for Individuals - tax illinois

Show details

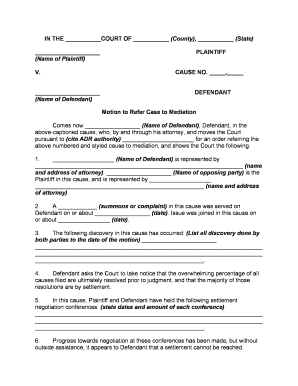

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of RevenueAttach to your Form IL10402017 IL2210 Computation of Penalties

We are not affiliated with any brand or entity on this form

Instructions and Help about 2017 il-2210 computation of

How to edit 2017 il-2210 computation of

How to fill out 2017 il-2210 computation of

Instructions and Help about 2017 il-2210 computation of

How to edit 2017 il-2210 computation of

To edit the 2017 IL-2210 Computation of Tax Form, first, obtain a copy of the form from the Illinois Department of Revenue website or a tax form provider. You can use pdfFiller to upload the form for editing. Once the form is uploaded, utilize the various editing tools available on pdfFiller to fill in or adjust any information as necessary. Once completed, save the updated form for submission.

How to fill out 2017 il-2210 computation of

Filling out the 2017 IL-2210 Computation of Tax Form involves several steps:

01

Step 1: Gather your financial documents, including income statements and previous tax returns.

02

Step 2: Enter your full name, address, and Social Security Number at the top of the form.

03

Step 3: Calculate your total income and adjusted gross income as instructed on the form.

04

Step 4: Complete the sections for tax liability, calculating any penalties or interest owed if necessary.

05

Step 5: Review all entries for accuracy before submission.

Latest updates to 2017 il-2210 computation of

Latest updates to 2017 il-2210 computation of

For the 2017 IL-2210 Computation of Tax Form, ensure you are using the latest version of the form as provided by the Illinois Department of Revenue, as there may have been amendments or clarifications in instructions. Always check the official website for any updates related to tax laws that might affect the submission process.

All You Need to Know About 2017 il-2210 computation of

What is 2017 il-2210 computation of?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2017 il-2210 computation of

What is 2017 il-2210 computation of?

The 2017 IL-2210 Computation of Tax Form is designed for individuals and entities in Illinois to calculate their underpayment of estimated tax and any associated penalties. This form is particularly essential for those who did not pay enough tax throughout the year through withholding or estimated payments.

What is the purpose of this form?

The primary purpose of the 2017 IL-2210 Computation of Tax Form is to assist taxpayers in determining whether they owe any penalties for underpayment of estimated tax. It provides a structured way to calculate whether the total payments on a taxpayer's account were sufficient based on their tax liability for the year.

Who needs the form?

The 2017 IL-2210 Computation of Tax Form is required for taxpayers in Illinois who do not meet the safe harbor provision for estimated tax payments or who believe they have underpaid. This includes individuals, corporations, and other entities that have income tax liabilities and insufficient prior payments.

When am I exempt from filling out this form?

You are exempt from needing the 2017 IL-2210 Computation of Tax Form if you did not owe any tax in the previous year and were a resident of Illinois for the entire year. Additionally, if your total tax withheld and estimated payments were at least equal to your current year's tax liability, filing this form would not be necessary.

Components of the form

The 2017 IL-2210 Computation of Tax Form includes several key components, such as:

01

Personal information sections including name and Social Security Number.

02

Calculation of annual income and estimated tax due.

03

Details regarding errors in payments and justification for underpayment (if applicable).

04

Assessment of penalties owed based on the amount of tax shortfall.

What are the penalties for not issuing the form?

If you fail to submit the 2017 IL-2210 Computation of Tax Form when required, you may be subject to penalties. Typically, this could lead to an underpayment penalty that could be calculated as a percentage of the underpaid amount. The exact penalty rate and calculations can be found in the tax guidelines provided by the Illinois Department of Revenue.

What information do you need when you file the form?

When filing the 2017 IL-2210 Computation of Tax Form, you need to gather the following information:

01

Your total income for the tax year.

02

The total amount of estimated tax payments you made.

03

Any credits or deductions you are eligible for.

04

Last year’s tax return information for comparison and calculation.

Is the form accompanied by other forms?

The 2017 IL-2210 Computation of Tax Form can sometimes be accompanied by other tax forms, particularly if you are claiming credits or have other payments to report. Typically, it should be filed alongside your annual state tax return (Form IL-1040).

Where do I send the form?

The completed 2017 IL-2210 Computation of Tax Form should be sent to the Illinois Department of Revenue. Depending on whether you are filing electronically or via mail, ensure you use the correct submission address provided in the form’s instructions. Additionally, you might utilize pdfFiller for electronic submission if preferred.

See what our users say