IRS Instructions for Employee Copies of W-2 Forms 2017 free printable template

Get, Create, Make and Sign IRS Instructions for Employee Copies of W-2 Forms

Editing IRS Instructions for Employee Copies of W-2 Forms online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions for Employee Copies of W-2 Forms Form Versions

How to fill out IRS Instructions for Employee Copies of W-2 Forms

How to fill out IRS Instructions for Employee Copies of W-2 Forms

Who needs IRS Instructions for Employee Copies of W-2 Forms?

Instructions and Help about IRS Instructions for Employee Copies of W-2 Forms

Hi if you're looking to download an employee write-up form which is a form that's used to either discipline warn or terminate an employee did you come right to this webpage you download for free all you have to do is come here click on the Side PDF version, and you will be able to enter the employee's name this is a fillable PDF format so Johnny Appleseed will say their job title is a cashier the Department of make up as you can see you could just go right through this that also you can type in the fence that they committed say they were a little rude it will say yes and disciplinary action you can write the date here type details written report yes or no completed by this is usually completed by another employee or the supervisor employee signature witness and then the form is done, and it could be handed to the director of human resources or any supervisor that's intended to provide and that's it that's how you can download an employee write-up form

People Also Ask about

Can I download a W-2 form?

Can I download and print tax forms?

Can I download my W-2 online?

Can I print tax forms off the Internet?

Can I print my own W-2 forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS Instructions for Employee Copies of W-2 Forms online?

How can I fill out IRS Instructions for Employee Copies of W-2 Forms on an iOS device?

How do I complete IRS Instructions for Employee Copies of W-2 Forms on an Android device?

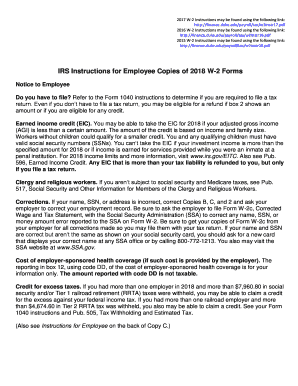

What is IRS Instructions for Employee Copies of W-2 Forms?

Who is required to file IRS Instructions for Employee Copies of W-2 Forms?

How to fill out IRS Instructions for Employee Copies of W-2 Forms?

What is the purpose of IRS Instructions for Employee Copies of W-2 Forms?

What information must be reported on IRS Instructions for Employee Copies of W-2 Forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.