IRS Publication 4134 2018 free printable template

Show details

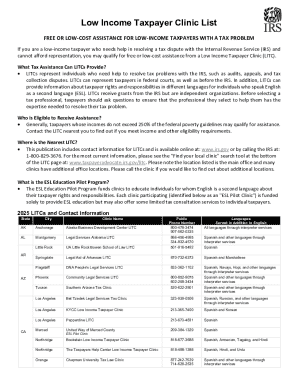

Low Income Taxpayer Clinic Liston Income Taxpayer Clinics (LIT Cs) represent low income individuals in disputes with the Internal Revenue Service (IRS), including audits, appeals, collection matters,

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 4134

Edit your IRS Publication 4134 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 4134 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Publication 4134 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Publication 4134. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 4134 Form Versions

Version

Form Popularity

Fillable & printabley

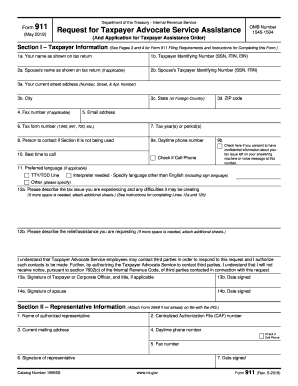

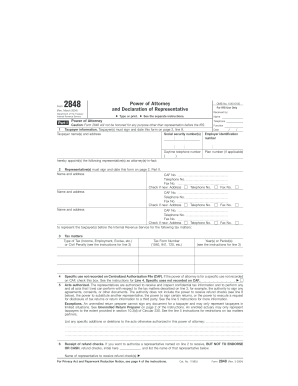

How to fill out IRS Publication 4134

How to fill out IRS Publication 4134

01

Obtain IRS Publication 4134 from the IRS website or your local IRS office.

02

Read the instructions carefully to understand the purpose of the publication.

03

Gather all required personal and financial information, including taxpayer ID numbers and income data.

04

Complete the relevant sections of the publication based on your individual situation.

05

Review your entries to ensure all information is accurate and complete.

06

Sign and date the publication where required.

07

Submit the completed publication with your tax return if applicable.

Who needs IRS Publication 4134?

01

Taxpayers claiming the First-Time Homebuyer Credit for purchases made in 2008.

02

Individuals who need to amend previous tax returns involving the First-Time Homebuyer Credit.

03

Tax professionals assisting clients with claims related to past home purchases.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS low income guidelines?

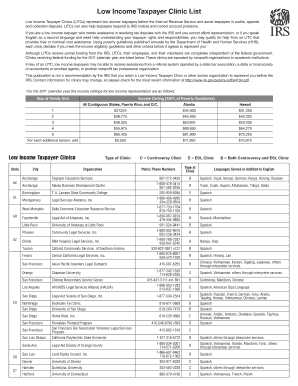

Income Ceiling (250% of Poverty Guidelines) Size of Family48 Contiguous States, Puerto Rico, and D.C.Alaska1$ 36,450$ 45,5252$ 49,300$ 61,6003$ 62,150$ 77,6754$ 75,000$ 93,7505 more rows

Do you have to file taxes if you are below the poverty line?

The minimum income amount depends on your filing status and age. In 2022, for example, the minimum for single filing status if under age 65 is $12,950. If your income is below that threshold, you generally do not need to file a federal tax return.

What is the threshold for LITC?

In order to qualify for assistance from an LITC, generally a taxpayer's income must be below 250 percent of the current year's federal poverty guidelines and the amount in dispute per tax year should be below $50,000.

How much taxes do poor people pay?

Across the income distribution, effective state and local tax rates start at 11.4 percent for the poorest 20 percent of Americans, fall to 9.9 percent for the middle 20 percent, and then decline to 7.4 percent for the top 1 percent.

What is the publication 4134?

IRS Publication 4134, Low Income Taxpayer Clinic List, provides information about LITCs by geographic area, including contact information and details about the languages, in addition to English, in which each LITC offers services.

Do people under the poverty line pay taxes?

People living below the federal poverty level are often eligible for tax deductions and credits for low-income people. But with one exception: the specific income requirements for tax breaks are not tied to the same income thresholds as the poverty guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Publication 4134 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing IRS Publication 4134 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit IRS Publication 4134 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign IRS Publication 4134. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out IRS Publication 4134 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IRS Publication 4134. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS Publication 4134?

IRS Publication 4134, titled 'S Corporation Reporting and Analysis', provides guidance to S Corporations and their shareholders on how to report income, deductions, and credits on their tax returns.

Who is required to file IRS Publication 4134?

S Corporations and their shareholders are required to file IRS Publication 4134 as part of their tax reporting responsibilities, particularly to properly report income and distributions.

How to fill out IRS Publication 4134?

To fill out IRS Publication 4134, taxpayers should follow the instructions provided in the publication, which typically include gathering necessary financial data, reporting income, deductions, and credits, and ensuring compliance with S Corporation guidelines.

What is the purpose of IRS Publication 4134?

The purpose of IRS Publication 4134 is to assist taxpayers in understanding and correctly completing the necessary forms and reporting requirements for S Corporations, ensuring compliance with federal tax laws.

What information must be reported on IRS Publication 4134?

Information that must be reported on IRS Publication 4134 includes details of the S Corporation's income, deductions, credits, and distributions to shareholders, as well as the shareholders' share of these items.

Fill out your IRS Publication 4134 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 4134 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.