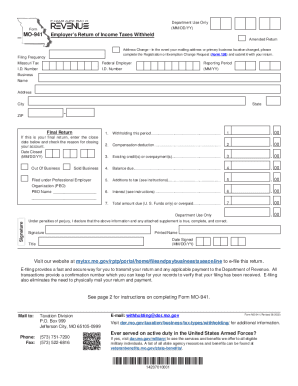

MO MO-941 2015 free printable template

Get, Create, Make and Sign MO MO-941

How to edit MO MO-941 online

Uncompromising security for your PDF editing and eSignature needs

MO MO-941 Form Versions

How to fill out MO MO-941

How to fill out MO MO-941

Who needs MO MO-941?

Instructions and Help about MO MO-941

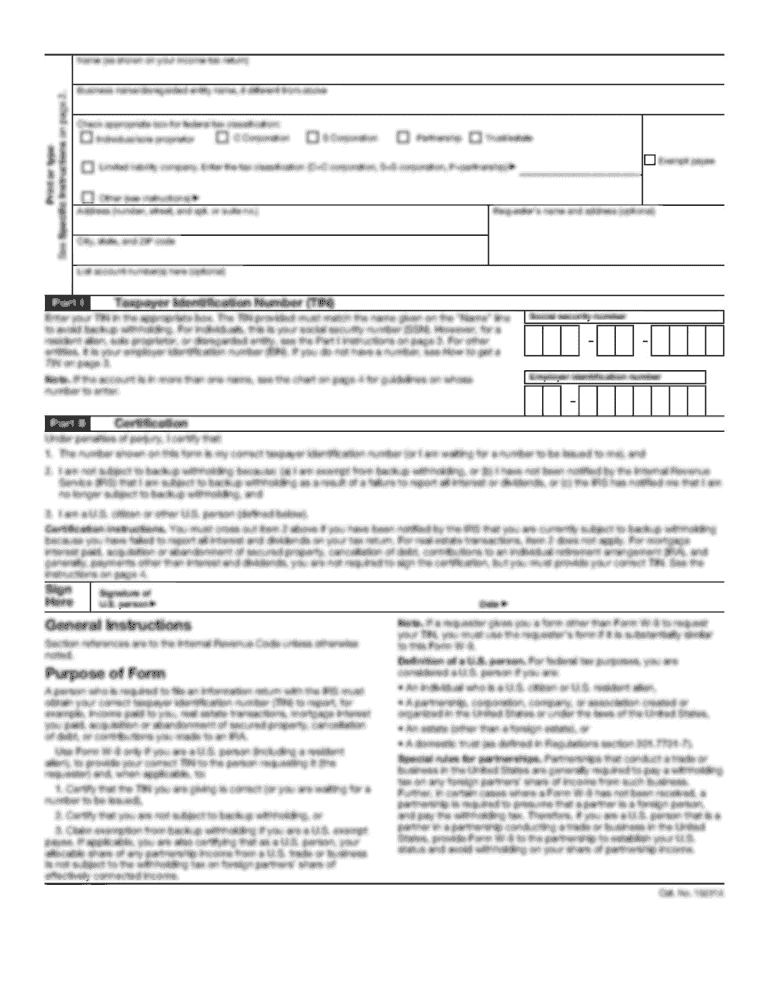

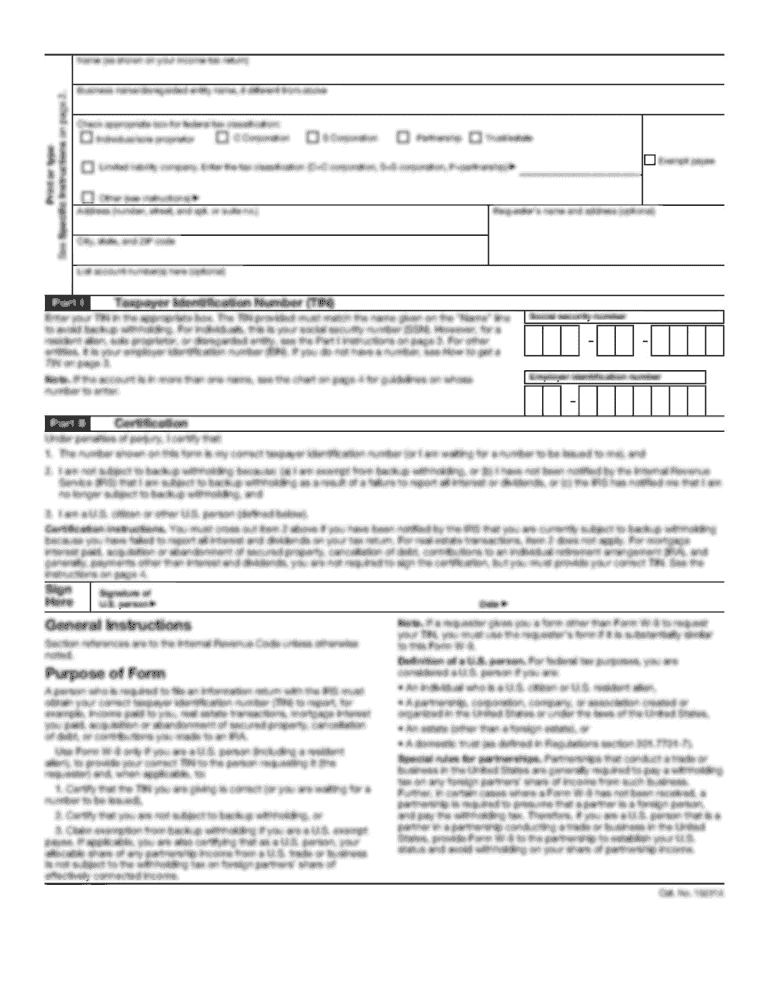

In this presentation we will take a look at form 941 employers quarterly federal tax return for more accounting information and accounting courses visit our website at accounting instruction dot info here's a copy of form 941 this is the 2018 form you can find this on the IRS website at iron these are going to be the components of the form we're gonna focus here on the calculation of the form we note that up top we're going to have the number the name and then the address then we want to know which quarter we are talking about so remember that when we think about the quarters of course three months and a quarter there are 12 months in the year divided by for three months per quarter we will indicate what quarter we are talking about here remember that this is a quarterly form which is different from the yearly form and there is a yearly payroll tax form called 940, and we don't want to get those two mixed up they can seem similar, but they're going to be different the 941 is really the main form, and it's going to be calculating the FI t federal income tax for the employees the Social Security both employer and employee and Medicare both employer and employee because these are larger amounts or this is my guess as to why we need a quarterly form rather than a yearly form because they're larger amounts and important then we have to have an added level of reporting meaning for example if we take a look at our 1040 for individual tax returns that we report at the end of the year for an individual reporting we do that on a yearly basis for the 940 ones for the FI T for the payroll taxes the Social Security Medicare we have to do that on a quarterly basis, so that's what we're doing here the 940 then similar form to what we're working with here but will be for FTA which is a much smaller tax, so it's actually it's actually still a federal tax, but it'll be a much smaller one when filling out this form we can pick up this information this is part one of the form line one says the number of employees who received wages tips or other compensation so whatever the number of employees are in our case we have four employees at this quarter then we're gonna and note that the day's, so this is the actual day within the quarter that we can pick up the number of employees, and then we have the wages tips and other compensation this cell we got to be careful on because when we look at the wages total wages then in our case this is coming from our register numbers up here was 96 973, but this wages here is really trying to pick up the FI T wages note that line under it has to deal with federal income tax so really this line to it where we want the FI T wages which can be reduced by things such as an insurance or a retirement plan, so this number is ninety-one for twenty-five ten in this case calculated as the total earnings ninety-six nine seventy-three point five minus those items that could be reduced, and you can think of them when you fill out your form 1040...

People Also Ask about

How often is mo-941 filing?

What is compensation deduction on mo-941?

What is Missouri 2023 income tax?

How do I find my 941 quarterly report online?

What is the Missouri employer withholding for 2023?

What is a MO-941?

How often do I have to file MO-941?

How do I get a copy of my 941 quarterly report?

How is Missouri state withholding tax calculated?

What percentage is taken out of my paycheck in Missouri?

How often do I have to file MO 941?

How much Missouri state tax is withheld?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO MO-941 from Google Drive?

How can I get MO MO-941?

Can I create an electronic signature for signing my MO MO-941 in Gmail?

What is MO MO-941?

Who is required to file MO MO-941?

How to fill out MO MO-941?

What is the purpose of MO MO-941?

What information must be reported on MO MO-941?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.