TX LL-10 2017-2026 free printable template

Show details

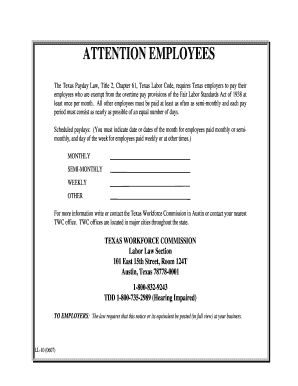

ATTENTION EMPLOYEES

The Texas Payday Law, Title 2, Chapter 61, Texas Labor Code, requires Texas employers to pay their

employees who are exempt from the overtime pay provisions of the Fair Labor Standards

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX LL-10

Edit your TX LL-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX LL-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX LL-10 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX LL-10. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX LL-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX LL-10

How to fill out TX LL-10

01

Obtain a copy of the TX LL-10 form from the Texas Department of Licensing and Regulation website.

02

Fill in your personal information, including name, address, and contact details in the designated sections.

03

Provide a detailed description of the business for which you are applying.

04

Indicate the type of license you are applying for by selecting the appropriate checkboxes.

05

Attach any required documents, including identification, proof of business registration, or any other necessary supporting materials.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form along with any required fees to the appropriate licensing authority.

Who needs TX LL-10?

01

Individuals and businesses seeking to operate in specific regulated industries in Texas.

02

Anyone looking to obtain or renew a license that falls under the jurisdiction of the Texas Department of Licensing and Regulation.

Fill

form

: Try Risk Free

People Also Ask about

Why would the Texas Workforce Commission send me a letter?

If the claimant does not have sufficient wages to qualify for unemployment benefits, you will receive a letter with that information.

What is the Texas Workforce Commission phone number?

Overview. An overpayment is caused when TWC pays unemployment benefits that you were not eligible to receive. State law requires TWC to recover all unemployment benefits overpayments. There is no statute of limitations on debts owed to the state.

Does the Texas Workforce Commission call you?

TWC will only contact you if we need more information. If your employer received a claim notice from TWC indicating a claim was filed using your SSN and you did not file the claim, tell your employer to respond to the notice and indicate the claim was filed by an imposter.

Why am I getting mail from the Texas Workforce Commission?

Individuals who never applied for benefits but receive letters from TWC saying they did are most likely the targets of identity theft fraud and should report it immediately.

Can Texas Workforce Commission take your tax refund?

We cannot deduct the refund from the total amount shown on your 1099-G. The 1099-G shows the total benefit amount we paid to you in that calendar year but does not show the amount you repaid to us. You must indicate on your tax return the amount you repaid to TWC .

What does Texas Workforce Commission do?

What is the Texas Workforce Commission ( TWC )? TWC is the state agency charged with overseeing and providing workforce development services such as job matching, recruiting and training to Texas job seekers and employers. TWC also administers the Unemployment Benefits and Unemployment Tax programs.

What number do I call for Texas unemployment benefits?

Phone: Tele-Serv, our automated telephone system, at 800-558-8321. Select Option 1.

What time does Texas Workforce Commission open?

The standard business days and hours are Monday – Friday, 8:00 a.m. to 5:00 p.m. The hours for some services, such as Workforce Solutions offices and TWC 's unemployment benefits Tele-Centers, may vary. Hours other than 8:00 a.m. to 5:00 p.m. are included with the services' Contact Information.

Why would Texas Workforce Commission call me?

If you sent TWC an email, left a message, or reached out using social media, you should expect a phone call from a TWC Specialist. You may receive calls from TWC on other issues concerning your claim, but always be vigilant when providing personal information. When in doubt, hang up.

Does Texas Workforce Commission call you?

If you have an Unemployment Benefits question you can request for TWC to call you using our UI Contact Request Form.

Why do I owe Texas Workforce Commission?

Overview. An overpayment is caused when TWC pays unemployment benefits that you were not eligible to receive. State law requires TWC to recover all unemployment benefits overpayments. There is no statute of limitations on debts owed to the state.

What services does the Texas Workforce Commission provide?

What is the Texas Workforce Commission ( TWC )? TWC is the state agency charged with overseeing and providing workforce development services such as job matching, recruiting and training to Texas job seekers and employers. TWC also administers the Unemployment Benefits and Unemployment Tax programs.

Is the Texas Workforce a government agency?

Texas Workforce Commission ( TWC ) is the state agency charged with overseeing and providing workforce development services to employers and job seekers of Texas. TWC strengthens the Texas economy by providing the workforce development component of the Governor's economic development strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX LL-10 online?

pdfFiller has made it easy to fill out and sign TX LL-10. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit TX LL-10 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share TX LL-10 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete TX LL-10 on an Android device?

Use the pdfFiller mobile app and complete your TX LL-10 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is TX LL-10?

TX LL-10 is a report used by the Texas Comptroller of Public Accounts to gather information about certain types of business entities for tax purposes.

Who is required to file TX LL-10?

Entities that are subject to franchise tax in Texas and have an annual revenue above the designated threshold are required to file TX LL-10.

How to fill out TX LL-10?

To fill out TX LL-10, you need to provide your business information, including the entity name, taxpayer number, revenue figures, and any applicable deductions or credits.

What is the purpose of TX LL-10?

The purpose of TX LL-10 is to report financial information to the state for the assessment of franchise taxes and to ensure compliance with state tax laws.

What information must be reported on TX LL-10?

TX LL-10 requires the reporting of business name, taxpayer number, gross revenue, deductions, credits, and any other relevant financial details as specified by the Texas Comptroller.

Fill out your TX LL-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX LL-10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.