Ally Domestic Wire Transfer Request 2018 free printable template

Show details

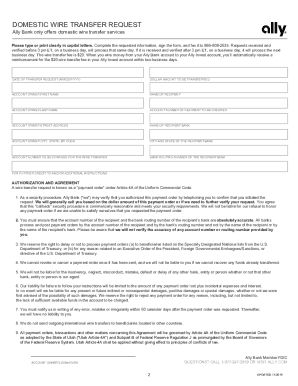

DOMESTIC WIRE TRANSFER REQUEST Ally Bank only offers domestic wire transfer services Attention: Ally Bank Operations Fax Number: 18666082635Instructions Type or print clearly in capital letters the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Ally Domestic Wire Transfer Request

Edit your Ally Domestic Wire Transfer Request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Ally Domestic Wire Transfer Request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Ally Domestic Wire Transfer Request online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Ally Domestic Wire Transfer Request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Ally Domestic Wire Transfer Request Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Ally Domestic Wire Transfer Request

How to fill out Ally Domestic Wire Transfer Request

01

Start by clearly stating the purpose of the wire transfer at the top of the form.

02

Fill in your personal information including name, address, and account number.

03

Provide the recipient's details: name, bank name, address, and account number.

04

Indicate the amount to be transferred.

05

Specify the type of account from which the funds will be withdrawn (checking or savings).

06

Review the details for accuracy to ensure there are no mistakes.

07

Sign and date the form where required to authorize the transfer.

08

Submit the form to your bank, either online or in-person, as per the bank's requirements.

Who needs Ally Domestic Wire Transfer Request?

01

Anyone looking to send funds within the United States to another bank account will need to fill out the Ally Domestic Wire Transfer Request.

02

Individuals or businesses that need to make a payment quickly or require funds to be transferred securely may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for a wire transfer to go through?

Transfers typically happen quickly. Generally, domestic bank wires are completed in three days, at most. If transfers occur between accounts at the same financial institution, they can take less than 24 hours. Wire transfers via a non-bank money transfer service may happen within minutes.

What is wire transfer form?

A wire transfer is an electronic way to transfer money. It is also known as bank transfer. Wire transfers have several advantages. This mode of transfer is fast and secure. A wire transfer happens from one bank to another.

What information is needed for a wire transfer Canada?

financial institution information, including: account number where the funds are going (excluding spaces and special characters) the branch name and address (including postal code) the branch's routing information (3-digit Canadian financial institution number and 5-digit branch transit number)

What is a wire transfer document?

A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. The sender is the one who provides all the instructions for the transfer, which may include the recipient's name, bank, account number, amount, and sometimes a pickup location.

What is required for wire transfer?

What information is needed for a wire transfer? The sender's valid government-issued photo ID or driver's license. The sender's full name and contact information. The sender's bank account and transit number. The recipient's full name and contact information. The recipient's bank account information and transit number.

Are wire transfers reported to IRS?

Yes, it's a legal requirement for US banks and other financial institutions which initiate wire transfers to report payments of over $10,000 to the IRS.

Can you get audited for a wire transfer?

Generally speaking, suspicious activity reports (SARs) and non-disclosure of FATCA related accounts can trigger the IRS to start an audit or criminal investigation against an individual or entity associated with the wire transfer.

What documents are required for wire transfer?

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

What details are needed for wire transfer?

To send a wire transfer by bank, you will typically be asked to provide the following information: Recipient full name. Sender full name. Recipient phone number. Sender phone number. Recipient address. Recipient bank name and information. Recipient checking account information.

Do wire transfers need to be reported?

How much money can you wire without being reported? Financial institutions and money transfer providers are obligated to report international transfers that exceed $10,000. You can learn more about the Bank Secrecy Act from the Office of the Comptroller of the Currency.

Are wire transfers considered cash transactions?

A wire transfer isn't cash.

How do I fill out a wire transfer form?

You'll need to provide the following information in order to send a wire: A Centric Bank Wire Transfer Request Form. Your name, address, and phone number. Your Centric account number. Personal identification (driver's license) The receiving bank's name and address. The receiving bank's Wire ABA/Routing Number.

How much money can you transfer without being reported in India?

Cash Transaction Limit – Section 269ST 2 Lakhs per day. Section 269ST states that no person shall receive an amount of Rs 2 Lakh or more: In aggregate from a person in a day; or. In respect of a single transaction; or.

How do you fill out a wire check?

Information Needed For Wire Transfer sender's bank account number. recipient's bank account number. sender's name and contact information. recipient's name and contact information. photo ID.

What are the steps of a wire transfer?

Decide which provider to use. Banks and money transfer companies offer wire transfers. Gather the information. You'll need your recipient's name, location and bank account information to start. Check costs and choose the transfer method. Read the fine print. Fill out the form carefully. Save the receipt.

What 3 things do you need to send a wire?

Bank and wire transfer services may require: The sender's bank account and transit number. The recipient's full name and contact information. The recipient's bank account information and transit number.

What 3 things do you need to send a wire?

To send a wire transfer by bank, you will typically be asked to provide the following information: Recipient full name. Sender full name. Recipient phone number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Ally Domestic Wire Transfer Request online?

pdfFiller has made it easy to fill out and sign Ally Domestic Wire Transfer Request. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my Ally Domestic Wire Transfer Request in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your Ally Domestic Wire Transfer Request and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit Ally Domestic Wire Transfer Request on an iOS device?

Use the pdfFiller mobile app to create, edit, and share Ally Domestic Wire Transfer Request from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Ally Domestic Wire Transfer Request?

Ally Domestic Wire Transfer Request is a form used to authorize a domestic wire transfer of funds from an Ally account to another financial institution within the United States.

Who is required to file Ally Domestic Wire Transfer Request?

Any customer of Ally who wishes to transfer funds domestically from their Ally account to another bank or financial institution is required to file the Ally Domestic Wire Transfer Request.

How to fill out Ally Domestic Wire Transfer Request?

To fill out the Ally Domestic Wire Transfer Request, a customer must provide their account details, the recipient's bank information, including the bank's routing number, and the amount of money to be transferred, along with any additional required information specified by Ally.

What is the purpose of Ally Domestic Wire Transfer Request?

The purpose of the Ally Domestic Wire Transfer Request is to securely and efficiently process the transfer of funds from an Ally account to another financial institution, ensuring that all necessary details are accurately recorded.

What information must be reported on Ally Domestic Wire Transfer Request?

The information that must be reported on the Ally Domestic Wire Transfer Request includes the sender's account number, recipient's name, recipient's bank name, recipient's bank routing number, the amount to be transferred, and any specific transfer instructions.

Fill out your Ally Domestic Wire Transfer Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ally Domestic Wire Transfer Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.