Get the free Tax Diary System

Show details

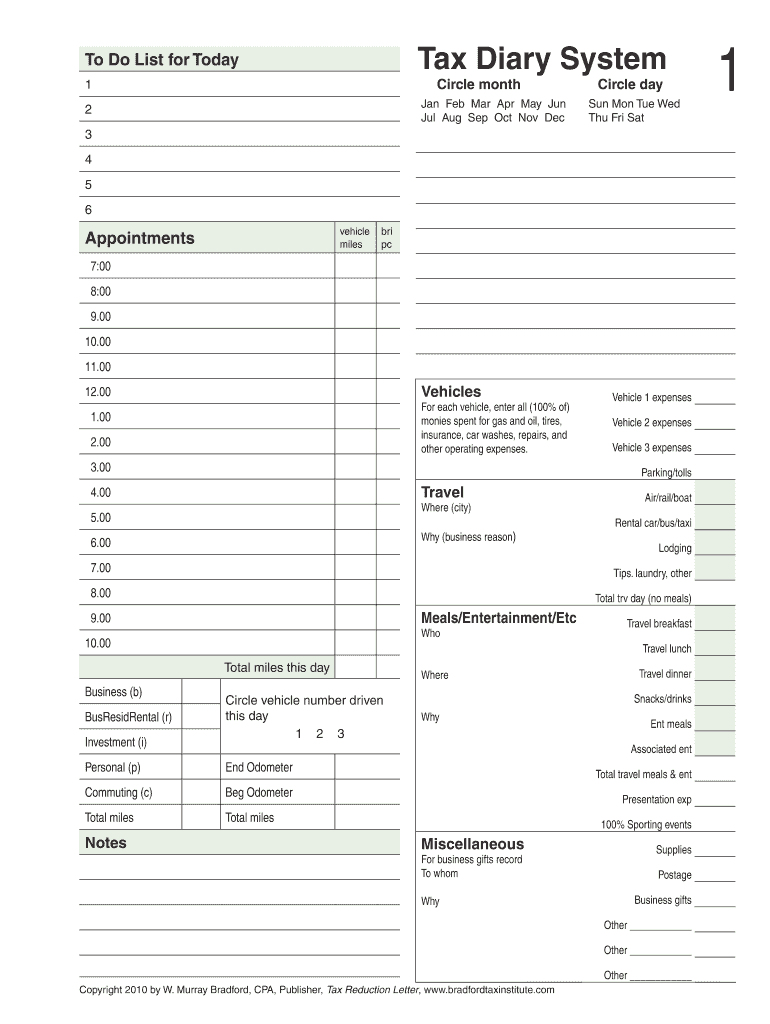

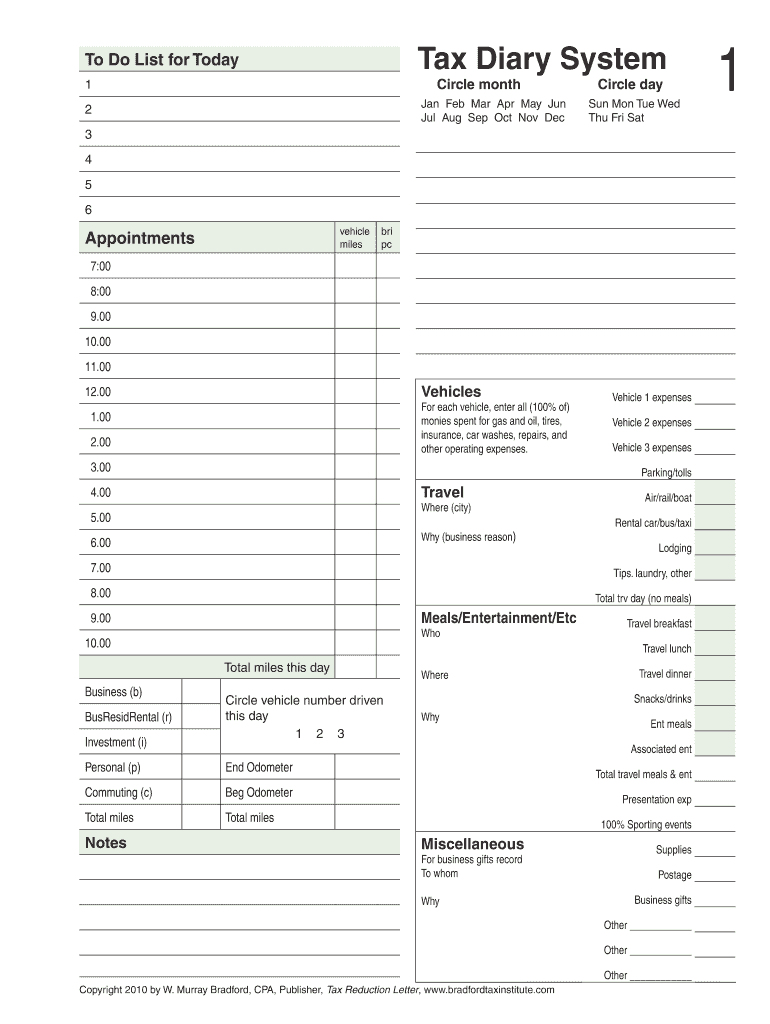

Tax Diary System Do List for TodayCircle month1Jan Feb Mar Apr May Jun

Jul Aug Sep Oct Nov Dec2Circle day Sun Mon Tue Wed

Thu Fri Sat3

4

5

6

vehicle

milesAppointmentsbri

pc7:00

8:00

9.00

10.00

11.00Vehicles12.00For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax diary system

Edit your tax diary system form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax diary system form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax diary system online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax diary system. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax diary system

How to fill out tax diary system:

01

Start by gathering all relevant financial documents, such as receipts and invoices for expenses, income statements, and any other records required for tax purposes.

02

Set up a dedicated folder or digital file to store all your tax-related documents. It's important to keep everything organized and easily accessible.

03

Determine the frequency at which you need to update your tax diary. Some people may choose to update it on a daily basis, while others may prefer a weekly or monthly schedule.

04

Record all your income sources accurately and clearly in the tax diary. This includes any salary, commissions, rental income, or self-employment earnings.

05

Next, record all your expenses that can be claimed as deductions. This may include business expenses, medical expenses, mortgage interest, charity donations, and others. Make sure to categorize each expense correctly.

06

Whenever you make a new entry, note down the date, amount, description, and any supporting documents or reference numbers. This will help you during the tax filing process and ensure accurate reporting.

07

Regularly review and reconcile your tax diary entries with your bank statements, credit card statements, and other financial records to ensure accuracy and detect any discrepancies.

08

As the tax filing deadline approaches, consult with a tax professional or use tax preparation software to ensure you are correctly filling out the relevant tax forms and claiming all eligible deductions.

09

Finally, make sure to keep a copy of your tax diary, along with all the supporting documents, for the required period, usually up to six years. This will serve as evidence in case of tax audits or inquiries.

Who needs tax diary system:

01

Self-employed individuals: Those who run their own businesses or work as freelancers need to keep a detailed record of their income and expenses for tax purposes. A tax diary system helps them stay organized and ensures accurate reporting.

02

Small business owners: If you own a small business, maintaining a tax diary system is crucial. It helps track income, expenses, and deductions, making the tax filing process smoother and minimizing the risk of errors or missing deductions.

03

Rental property owners: Individuals who earn rental income need to keep track of rental payments received and expenses incurred related to the property. A tax diary system makes it easier to report rental income and claim deductions such as property taxes, mortgage interest, repairs, and maintenance.

04

Individuals with various sources of income: If you have multiple income streams, such as investments, part-time jobs, or side gigs, a tax diary system helps ensure you keep track of all your income sources and related expenses, allowing for accurate reporting and maximizing eligible deductions.

05

Anyone looking to optimize tax planning: Beyond tax compliance, a tax diary system can be useful for tax planning purposes. By keeping detailed records throughout the year, you can identify potential deductions, estimate future tax liabilities, and make informed financial decisions to optimize your tax situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax diary system?

The editing procedure is simple with pdfFiller. Open your tax diary system in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the tax diary system electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax diary system in minutes.

How do I fill out tax diary system using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tax diary system and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is tax diary system?

The tax diary system is a method of recording daily financial transactions and expenses for tax purposes.

Who is required to file tax diary system?

Individuals or businesses who need to keep track of their financial activities and report them to the tax authorities are required to file a tax diary system.

How to fill out tax diary system?

To fill out a tax diary system, one needs to record all income, expenses, and other financial transactions on a daily basis using a designated format or software.

What is the purpose of tax diary system?

The purpose of the tax diary system is to accurately track financial activities and report them to the tax authorities for tax assessment, compliance, and auditing purposes.

What information must be reported on tax diary system?

The information that must be reported on a tax diary system includes all income, expenses, deductions, credits, and other financial transactions related to taxable activities.

Fill out your tax diary system online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Diary System is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.