Asheville Rent Co-Signer Agreement free printable template

Show details

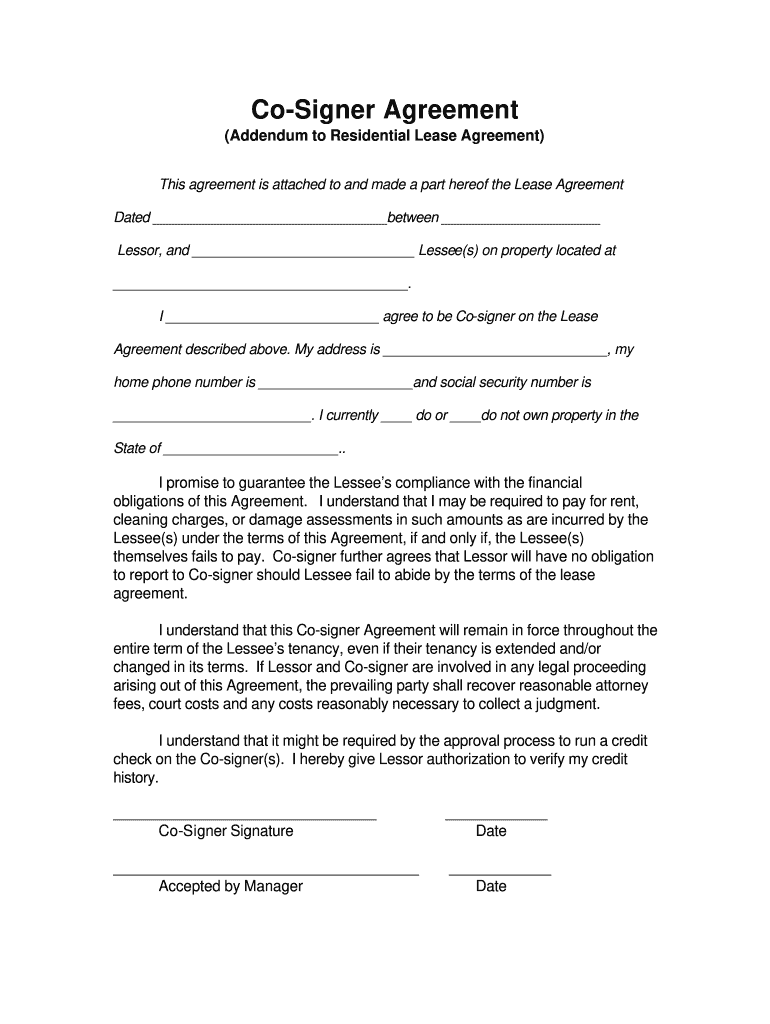

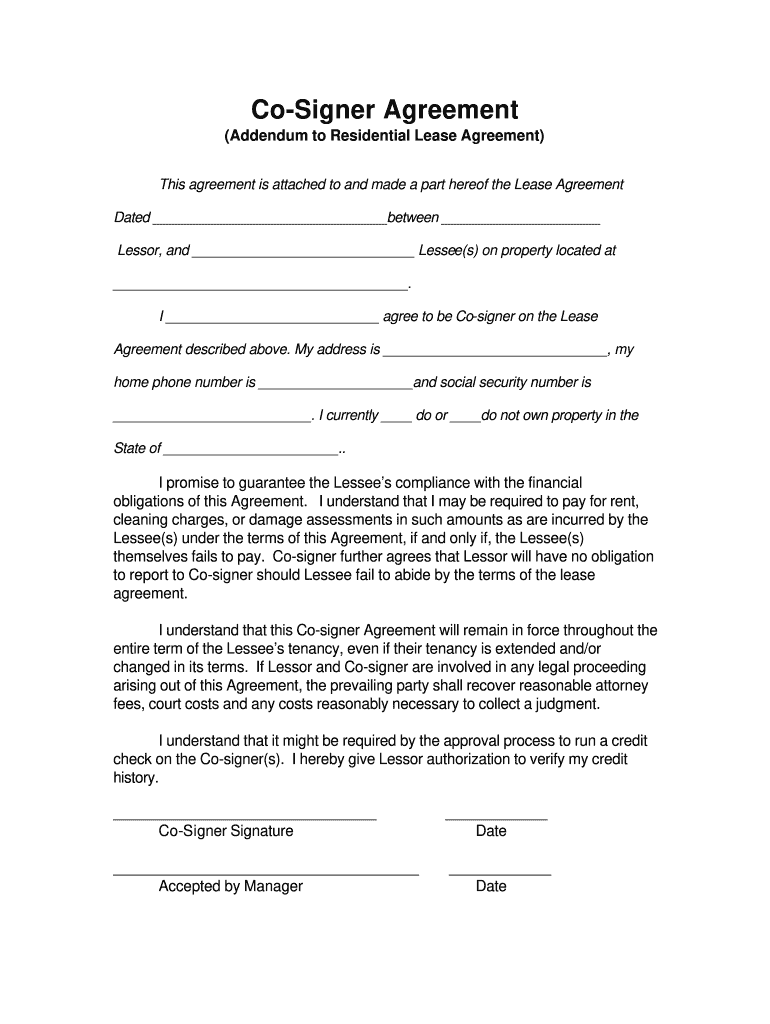

This agreement serves as an addendum to the lease agreement, providing a co-signer's commitment to guarantee the lessee's financial obligations and allowing for credit verification.

pdfFiller is not affiliated with any government organization

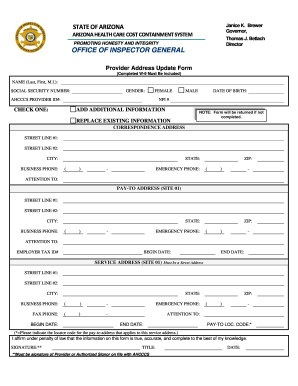

Get, Create, Make and Sign cosigner agreement template form

Edit your co signer rental application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cosigner release form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit co signer form template online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit co signer application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co signer agreement form

How to fill out Asheville Rent Co-Signer Agreement

01

Obtain the Asheville Rent Co-Signer Agreement form from your landlord or property management company.

02

Read through the entire agreement to understand its terms and conditions.

03

Fill in the name and contact information of the primary tenant.

04

Provide your information as the co-signer, including your full name, address, and phone number.

05

Review your financial responsibilities outlined in the agreement.

06

Sign and date the agreement where indicated.

07

Provide copies of any required identification or proof of income as specified.

08

Return the completed signed agreement to the landlord or property management.

Who needs Asheville Rent Co-Signer Agreement?

01

Individuals who want to rent a property but require financial backing.

02

Parents or guardians of students attending college who need to secure housing.

03

Co-signers who are willing to share the financial liability for the lease.

Fill

co signer release form

: Try Risk Free

People Also Ask about co signer agreement

Do I really need a cosigner?

If lenders see you as a high-risk borrower on your own, whether that's due to your credit, existing debt, income or other factors, a cosigner can lower the risk by vouching for you and promising to make sure the loan is repaid. You could get a better interest rate.

Are Cosigners owners?

What Is a Co-Signer? A co-signer is another person who is legally responsible for repaying your loan if you don't. Despite this obligation, the co-signer has no ownership stake in the property.

Does being a guarantor affect your credit for an apartment?

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent. This uncertainty makes cosigning for an apartment risky.

Does Cosigning hurt your credit?

How does being a co-signer affect my credit score? Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Who qualifies as a cosigner?

Your spouse, relative, guardian, or friend can be a cosigner. Only one person can cosign for a private student loan. For instance, if two parents are willing to be cosigners, only one will be able to do it. Your cosigner is equally responsible for repayment of the full amount of the loan, not just part of it.

Can I get approved without a cosigner?

While a cosigned loan is certainly possible, borrowers can get approved for all types of loans, including emergency loans, without a cosigner.

Can a landlord ask for a guarantor in Ontario?

In Ontario, landlords are legally allowed to ask for information on your income and credit as well as landlord references. Where appropriate, a landlord may request a co-signer or guarantor. A guarantor or co-signer is someone who agrees to pay your rent for you in case you are not able to pay.

What does it mean to be someone's cosigner?

A co-signer takes full responsibility for paying back a loan, along with the primary borrower. Often a co-signer will be a family member. The co-signer is obligated to pay any missed payments and even the full amount of the loan if the borrower doesn't pay.

Is there a way to get around a cosigner?

One option is to ask the lender for a co-signer release. In fact, it may already be a clause in your loan documents. Not all lenders will sign off on a co-signer release, but if you meet certain conditions—mainly, you made each loan payment on time for several years—the lender may agree to it.

What is the reason for a guarantor?

You might need a 'guarantor' so you can rent a place to live. A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

Why do I need someone to cosign?

If you are told that you need a co-signer for a loan, it means that the lender will not offer you the loan based solely on your own income and credit record. The lender wants another person to also promise to pay the loan. This is what a co-signer does.

What happens if you are a cosigner?

If you co-sign a loan, you are legally obligated to repay the loan in full. Co-signing a loan does not mean serving as a character reference for someone else. When you co-sign, you promise to pay the loan yourself. It means that you risk having to repay any missed payments immediately.

Is it possible to rent without a guarantor?

Paying a larger deposit or more rent in advance You may be able to persuade your landlord to waive the need for a guarantor by offering them a larger deposit or 6 months' rent in advance. This may give them the greater sense of security they are looking for.

Is it legal for a landlord to ask for a guarantor?

However, a landlord has the right to request a rent guarantor whenever they think there is a risk their new tenant might not pay their rent as and when they should.

Why is my landlord asking for a guarantor?

A landlord might ask for a guarantor to provide proof that they are able to pay rent on behalf of the tenant and might ask for proof of income or ask if the guarantor is a homeowner.

What happens if you don't have someone to cosign?

Get a loan from a nontraditional source Try arranging a private loan with a friend, family member or anyone who's willing to loan money to you. This may allow you to borrow money using a more favorable arrangement, rather than a bank's potentially stricter terms and higher interest rates.

Who is a co-signer?

A co-signer is a person who agrees to be legally responsible to pay a debt if the borrower does not pay back a loan as agreed. A co-signer may be an option if you are trying to make a large purchase, such as a car, and if you are unable to qualify for the loan on your own.

How do you get around to have a cosigner?

Four Alternatives to Having a Co-Signer Become a Subtenant or Roommate. Use a Co-Signer Service. Try a Peer-to-Peer Lender. Establish or Rebuild Your Credit History.

Why you shouldn't be a cosigner?

The debt you co-signed will increase your debt-to-income ratio, affecting your ability to get approved for your own credit cards and loans. When creditors and lenders consider any application you may for a credit card or loan, they'll consider that co-signed loan just like all your other debts.

What can a landlord legally ask for in Ontario?

Choosing tenants A landlord can ask you about your income, but they must also look at any available information on your rental history, credit references and credit rating (such as through Equifax Canada).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send co signer agreement form for car for eSignature?

To distribute your cosigner lease agreement, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in co signer agreement pdf?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your cosigner form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out co signer for apartment lease form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your apartmet cosigner form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Asheville Rent Co-Signer Agreement?

The Asheville Rent Co-Signer Agreement is a legal document that outlines the responsibilities and obligations of a co-signer who agrees to support a tenant's rental application, ensuring that rent payments are made in case the primary tenant defaults.

Who is required to file Asheville Rent Co-Signer Agreement?

Typically, the co-signer is required to file the Asheville Rent Co-Signer Agreement along with the primary tenant when the tenant does not have sufficient credit history or income to secure a rental lease agreement on their own.

How to fill out Asheville Rent Co-Signer Agreement?

To fill out the Asheville Rent Co-Signer Agreement, the co-signer must provide personal information, including their name, contact information, and financial details. It’s important to read the entire agreement carefully and sign where required.

What is the purpose of Asheville Rent Co-Signer Agreement?

The purpose of the Asheville Rent Co-Signer Agreement is to provide a safety net for landlords by ensuring that if the primary tenant fails to pay rent, the co-signer is legally bound to fulfill the financial obligations.

What information must be reported on Asheville Rent Co-Signer Agreement?

The information that must be reported on the Asheville Rent Co-Signer Agreement includes the co-signer's full name, address, social security number, the tenant’s details, the property address, and any financial obligations they agree to assume.

Fill out your Asheville Rent Co-Signer Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cosigner Application is not the form you're looking for?Search for another form here.

Keywords relevant to co signer agreement template

Related to co signer application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.