Get the free Tariff Rate

Show details

BANGLADESH POWER DEVELOPMENT BOARD (BPD)Section III of Bid Document: QUALIFICATION DOCUMENT

FOR

IMPLEMENTATION OF

50 MW (AC) GRID TIED SOLAR POWER PROJECT ON BOO BASIS

AT

(A Site Near to Chuadanga

We are not affiliated with any brand or entity on this form

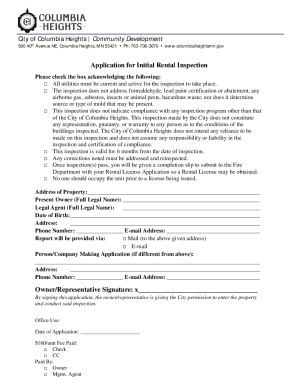

Get, Create, Make and Sign tariff rate

Edit your tariff rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tariff rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tariff rate online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tariff rate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tariff rate

How to fill out tariff rate

01

To fill out a tariff rate, follow these steps:

02

Gather all the necessary information such as the product description, HS code, country of origin, and customs value.

03

Determine the applicable tariff classification for the product using the Harmonized System (HS) code.

04

Identify the country in which the product is being imported or exported to.

05

Find the appropriate tariff rate for the specific product and country combination in the official tariff schedule or database.

06

Calculate the customs duty by multiplying the tariff rate with the customs value.

07

Complete the relevant customs forms or documents with the accurate tariff rate and other required information.

08

Double-check all the information entered and ensure its accuracy.

09

Submit the completed forms along with any necessary supporting documents to the customs authority for review and processing.

10

Pay the calculated customs duty, if applicable, according to the established payment methods.

11

Keep a copy of the filled-out forms and all related documentation for future reference and audit purposes.

Who needs tariff rate?

01

Tariff rate information is needed by various individuals and entities involved in international trade, including:

02

- Importers and exporters who want to determine the customs duty they need to pay or charge for their goods.

03

- Customs brokers or agents who assist clients in completing customs clearance procedures.

04

- Government agencies responsible for regulating and enforcing import and export regulations.

05

- Trade consultants or advisors who provide guidance to businesses on customs compliance and cost optimization.

06

- Researchers or analysts studying international trade patterns and policies.

07

- Legal professionals involved in trade disputes or negotiations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tariff rate?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tariff rate in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit tariff rate on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing tariff rate right away.

How do I fill out tariff rate on an Android device?

Complete your tariff rate and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is tariff rate?

The tariff rate is the rate at which a specific type of goods or services are taxed when they are imported or exported across international borders.

Who is required to file tariff rate?

Any individual or business involved in international trade and movement of goods across borders is required to file tariff rates.

How to fill out tariff rate?

Tariff rates can be filled out electronically through the customs authority's online portal or through a customs broker.

What is the purpose of tariff rate?

The purpose of tariff rates is to regulate trade, protect domestic industries, and generate revenue for the government.

What information must be reported on tariff rate?

Information such as the type of goods, value, origin, and destination must be reported on the tariff rates.

Fill out your tariff rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tariff Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.