MA TC001 2018-2025 free printable template

Show details

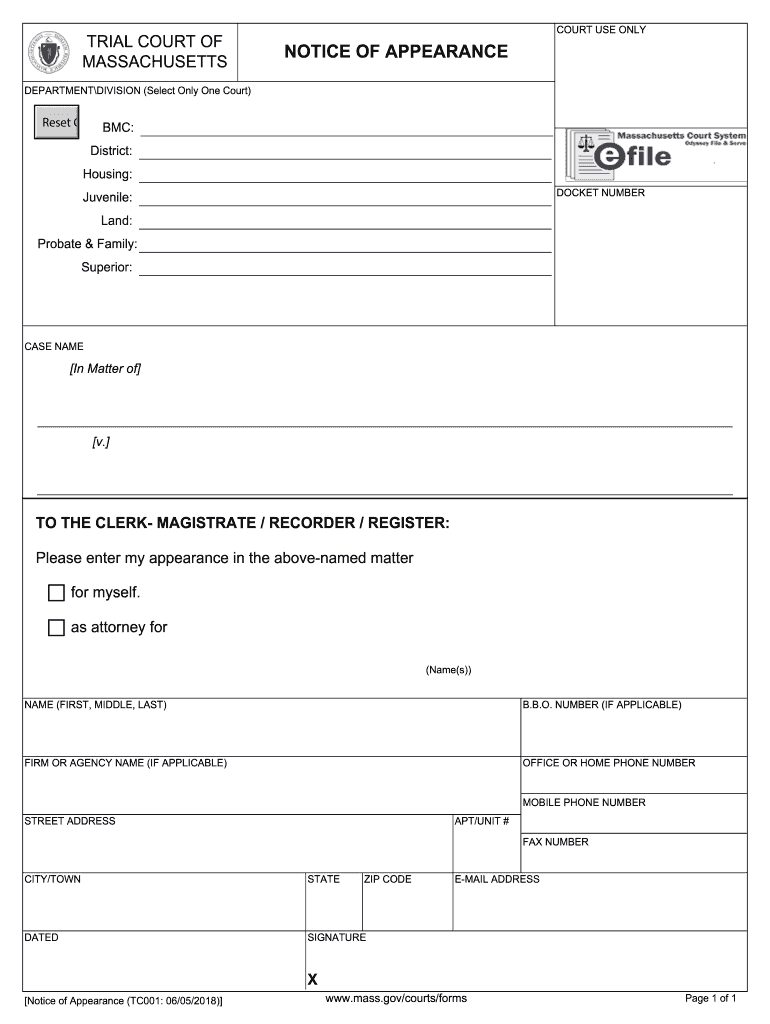

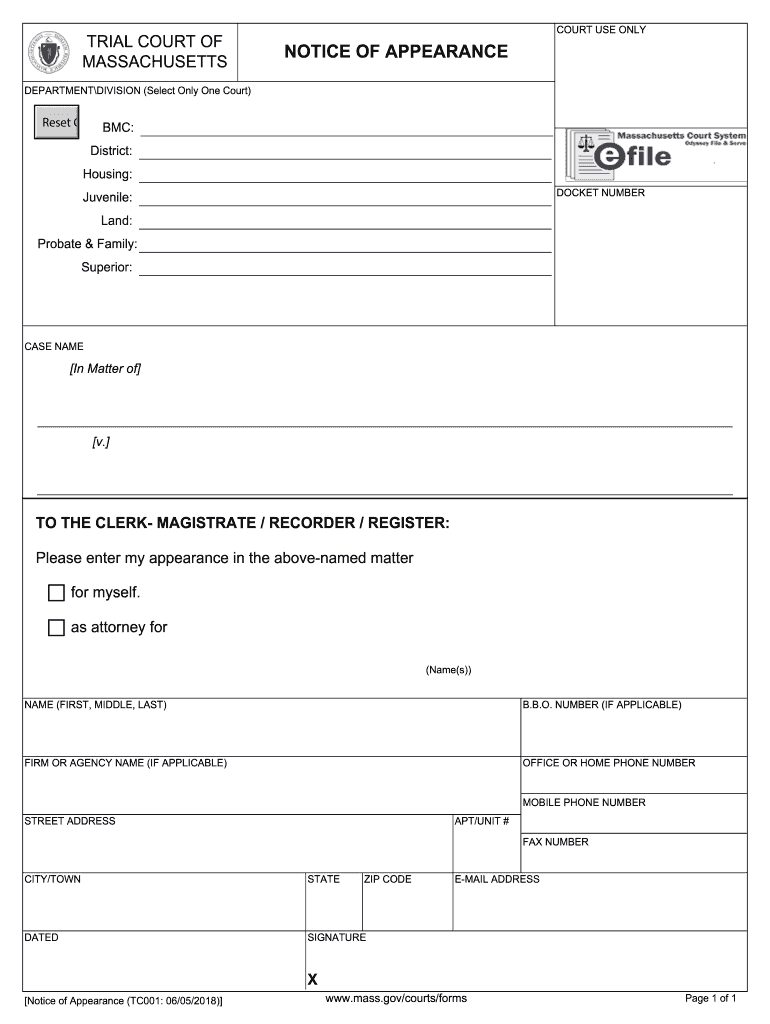

TRIAL COURT OF MASSACHUSETTSCOURT USE ONLYNOTICE OF APPEARANCEDEPARTMENTDIVISION (Select Only One Court)Reset Court BMC:District: Housing: DOCKET NUMBERJuvenile: Land: Probate & Family: Superior:CASE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA TC001

Edit your MA TC001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA TC001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA TC001 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA TC001. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MA TC001

How to fill out MA TC001

01

Begin by gathering the necessary personal information, such as your full name, address, and contact details.

02

Provide your Social Security number or tax identification number.

03

Fill in the section regarding your income sources, including wages, self-employment income, or any other earnings.

04

Report any applicable deductions or credits you may qualify for.

05

Carefully review the completed form for accuracy.

06

Sign and date the form before submission.

Who needs MA TC001?

01

Individuals who are filing their taxes and require assistance with claiming certain deductions or credits.

02

Tax preparers who need a standardized form to help clients report their financial information.

Fill

form

: Try Risk Free

People Also Ask about

How do you probate an estate in Massachusetts?

Massachusetts probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

When can you close an estate in Massachusetts?

Closing An Estate. One option to formally close the estate with the Court, after one year following death, is the Petition for Order of Complete Settlement. This petition may include requests to the Court to approve a final accounting, including proposed distributions to be made to the beneficiaries.

How do you close out an estate in Massachusetts?

Below are 4 options for closing down an estate in Massachusetts. Option 1 – Not filing Anything. Option 2 – Filing a Small Estate Closing Statement. Option 3 – Filing a Closing Statement. Option 4 – Petition for Complete Settlement of Estate.

How long does it take to close an estate in MA?

The probate process can take about 12-18 months. Per Massachusetts law, “an estate must be probated within three years.” Many factors can delay the probate process. As a Massachusetts probate lawyer, I can help work to avoid the delays and ensure that any complications that occur are resolved quickly.

How much does it cost to probate an estate in Massachusetts?

Letters and probate fees Type of pleadingFiling feeFormal Probate of Will, Adjudication of Intestacy and Appointment of Personal Representative, Petition$375Formal Appointment of Successor Personal Representative, Petition$375Formal Removal of Personal Representative, Petition$100General Petition, Probate$15027 more rows

How long does an executor have to settle an estate in Massachusetts?

Is there a deadline to probate an estate? The general rule is that an estate has to be probated within 3 years of when the decedent died. However, this deadline doesn't apply to: A voluntary administration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MA TC001 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your MA TC001 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the MA TC001 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your MA TC001 in seconds.

How can I edit MA TC001 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing MA TC001, you need to install and log in to the app.

What is MA TC001?

MA TC001 is a tax form used by individuals or entities to report and pay certain taxes in the state of Massachusetts.

Who is required to file MA TC001?

Individuals or entities that meet specific income or tax liability thresholds in Massachusetts are required to file MA TC001.

How to fill out MA TC001?

To fill out MA TC001, gather the required financial information, enter your personal details, report your income, deductions, and credits, and ensure all sections are completed before submitting.

What is the purpose of MA TC001?

The purpose of MA TC001 is to ensure that taxpayers report their income accurately and pay any taxes owed to the Commonwealth of Massachusetts.

What information must be reported on MA TC001?

MA TC001 requires reporting of personal information, total income, deductions, credits, and any tax liabilities.

Fill out your MA TC001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA tc001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.