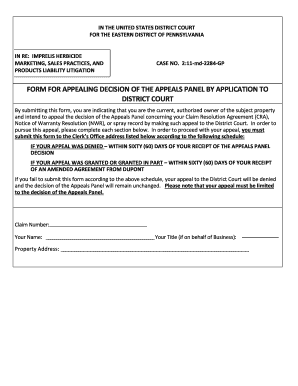

Get the free M Y TR N R FO HIGHWORTH RUNNING CLUB 27th ANNUAL RACE THE HIGHWORTH 5 MILE E Start a...

Show details

M Y TR N R FO HAYWORTH RUNNING CLUB 27th ANNUAL RACE THE HAYWORTH 5 MILE E Start and Finish at Warner School, Shriven ham Road, High worth, SN6 7BZ Sunday 29th April 2012 11.00am Race No. 4 of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign m y tr n

Edit your m y tr n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m y tr n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit m y tr n online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit m y tr n. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out m y tr n

How to fill out your tax return:

01

Gather all necessary documents: Before starting to fill out your tax return, make sure you have all the required documents on hand. This includes your W-2s or 1099 forms, any receipts or documents related to deductions or credits you plan to claim, and your previous year's tax return (if applicable).

02

Understand the form: Familiarize yourself with the tax form you will be using. This could be Form 1040, Form 1040A, or Form 1040EZ, depending on your individual situation. Each form has different requirements and may have different sections to complete.

03

Provide personal information: Start by providing your personal information, such as your name, address, and Social Security number. Make sure all the information you enter is accurate and up to date.

04

Report your income: Next, report all sources of income you received during the tax year. This includes wages, self-employment income, interest, dividends, rental income, and any other income you may have earned.

05

Claim deductions and credits: Deductions and credits can help lower your tax liability. Depending on your eligibility, you may be able to claim deductions for expenses such as mortgage interest, student loan interest, medical expenses, and charitable contributions. Additionally, there are various tax credits available for different situations, such as the Child Tax Credit or the Earned Income Tax Credit. Make sure to carefully review all available deductions and credits and accurately fill out the corresponding sections.

06

Calculate your tax liability: Once you have reported all your income and claimed any eligible deductions and credits, calculate the total amount of tax you owe. You can do this by following the instructions provided on the tax form or by using tax software or an online tax filing service.

07

Pay any taxes owed or request a refund: If you owe taxes, make sure to submit the payment along with your tax return. If you are entitled to a refund, provide your bank account information for direct deposit or request a paper check to be mailed to you.

Who needs to fill out a tax return?

01

Individuals with taxable income: Anyone who earned income above the threshold set by the IRS is generally required to file a tax return. The income threshold varies based on filing status (such as single, married filing jointly, or head of household) and age.

02

Self-employed individuals: If you are self-employed and have a net income of $400 or more, you are generally required to file a tax return. This includes people who work as freelancers, independent contractors, or own their own business.

03

Individuals with certain types of income: Even if your income is below the threshold, you may still need to file a tax return if you have certain types of income, such as self-employment income, rental income, or income from investments that exceeds a specific limit.

04

Individuals who qualify for tax credits or deductions: If you qualify for certain tax credits or deductions, it is beneficial to file a tax return to claim these benefits. These could include credits like the Child Tax Credit, the American Opportunity Credit for education expenses, or deductions for mortgage interest or student loan interest.

05

Individuals who are requested to do so: In some cases, the IRS may request that you file a tax return, even if you don't meet the usual filing requirements. This could occur if the IRS suspects you may have unreported income or if you are eligible for certain tax benefits.

Note: The information provided above is a general overview and does not substitute professional tax advice. It is recommended to consult with a tax professional or use a reliable tax software for personalized guidance in filling out your tax return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit m y tr n online?

With pdfFiller, it's easy to make changes. Open your m y tr n in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the m y tr n in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit m y tr n on an iOS device?

You certainly can. You can quickly edit, distribute, and sign m y tr n on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is my tax ID?

Your tax ID is a unique identification number assigned to you by the tax authorities.

Who is required to file my tax ID?

Individuals and businesses are required to file their tax ID.

How to fill out my tax ID?

You can fill out your tax ID by providing accurate information about your income and deductions.

What is the purpose of my tax ID?

The purpose of your tax ID is to report your income and calculate your tax liability.

What information must be reported on my tax ID?

You must report your income, deductions, credits, and any other relevant financial information on your tax ID.

Fill out your m y tr n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

M Y Tr N is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.