Get the free Guide to MA Dealflow and MA Pipeline Management - Midaxo

Show details

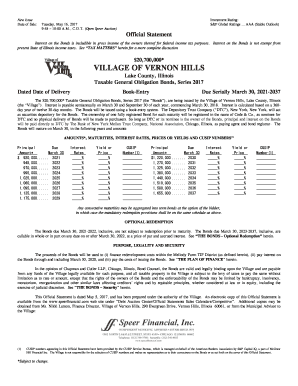

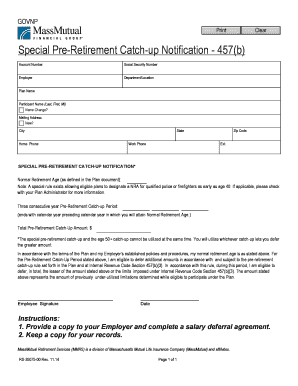

Guide Tom Deal Flow and Pipeline ManagementContents PAGE Overview3Managing Documents7Managing Issues and Risks7Managing Tasks8Using Idaho to Run M&A Meetings Efficiently9Pipeline Overview10Reviewing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to ma dealflow

Edit your guide to ma dealflow form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to ma dealflow form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guide to ma dealflow online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guide to ma dealflow. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to ma dealflow

How to fill out guide to ma dealflow

01

Start by gathering information about your potential investment targets.

02

Evaluate the potential risks and rewards of each deal.

03

Conduct thorough due diligence on the companies or assets you are considering investing in.

04

Develop a systematic approach for managing your deal pipeline and tracking progress.

05

Build relationships with key stakeholders and industry professionals to enhance your dealflow.

06

Continuously monitor market trends and stay updated on industry news to identify potential investment opportunities.

07

Utilize technology and software tools to streamline and automate dealflow management processes.

08

Regularly review and refine your investment criteria to ensure you are targeting the most promising opportunities.

09

Collaborate and network with other investors or professionals in the M&A industry to gain insights and broaden your dealflow.

10

Finally, document and analyze the outcomes of your investments to learn from past experiences and improve future dealflow strategies.

Who needs guide to ma dealflow?

01

Investors who are actively involved in mergers and acquisitions (M&A) activities.

02

Private equity firms, venture capital funds, and other investment management firms.

03

Business owners and entrepreneurs seeking opportunities for acquisitions or strategic partnerships.

04

Professionals working in investment banking, corporate development, or related fields.

05

Financial advisors and consultants assisting clients in M&A transactions.

06

Students or researchers studying M&A and dealflow management.

07

Anyone interested in learning about the process and strategies involved in managing dealflow for mergers and acquisitions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guide to ma dealflow without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your guide to ma dealflow into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit guide to ma dealflow online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your guide to ma dealflow and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the guide to ma dealflow form on my smartphone?

Use the pdfFiller mobile app to fill out and sign guide to ma dealflow. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is guide to ma dealflow?

Guide to ma dealflow is a document or tool that helps investors track and manage their M&A deal opportunities.

Who is required to file guide to ma dealflow?

Investors and individuals involved in M&A transactions are required to file guide to ma dealflow.

How to fill out guide to ma dealflow?

Guide to ma dealflow can be filled out by providing information on potential M&A deals, including the target company, deal value, status, and timeline.

What is the purpose of guide to ma dealflow?

The purpose of guide to ma dealflow is to help investors organize and prioritize their M&A opportunities, leading to more efficient decision-making.

What information must be reported on guide to ma dealflow?

Information such as target company details, deal value, status, timeline, and other relevant data related to M&A transactions must be reported on guide to ma dealflow.

Fill out your guide to ma dealflow online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Ma Dealflow is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.