Get the free MORTGAGE BANKING ACTIVITIES

Show details

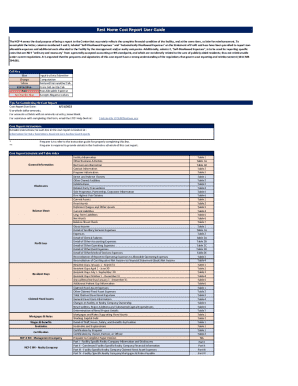

FAFIEC 031 and 041RCP MORTGAGE BANKING ACTIVITIESSCHEDULE RCP CLOSED END 14 FAMILY RESIDENTIAL MORTGAGE BANKING ACTIVITIES General Instructions Schedule RCP is to be completed by (1) all banks with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage banking activities

Edit your mortgage banking activities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage banking activities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage banking activities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage banking activities. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage banking activities

How to fill out mortgage banking activities?

01

Research and gather all necessary documentation and information related to the mortgage banking activities. This includes loan applications, financial statements, credit reports, and any relevant legal agreements.

02

Analyze the financials and creditworthiness of potential borrowers to assess their eligibility for mortgage loans. This involves evaluating their income, assets, debts, and credit history.

03

Calculate the appropriate loan amounts, interest rates, and repayment terms for borrowers based on their financial profiles and the current market conditions.

04

Complete the loan application forms accurately and thoroughly, ensuring that all required fields are filled out correctly. Be sure to include all necessary supporting documents and attachments.

05

Submit the completed loan applications to the appropriate mortgage banking institution or lender. This may involve using online portals, electronic submission systems, or physical mailing.

06

Monitor the progress of loan applications and communicate with borrowers, lenders, and other relevant parties to ensure a smooth and efficient loan processing and approval process.

07

Conduct regular follow-ups and provide any additional information or documentation requested by the lender or regulatory authorities.

08

Review and verify the accuracy of loan documents and financial disclosures before finalizing the loan agreements. This includes reviewing the terms and conditions, interest rates, repayment schedules, and any applicable fees or charges.

09

Coordinate with legal professionals and ensure that all mortgage banking activities comply with relevant laws, regulations, and industry best practices.

10

Maintain proper records and documentation of all mortgage banking activities, including loan applications, approvals, disbursements, and repayments.

Who needs mortgage banking activities?

01

Individuals or families looking to purchase a home or property and require financing through a mortgage loan.

02

Real estate investors who require funding for property acquisitions, development projects, or renovation activities.

03

Small business owners or entrepreneurs seeking commercial mortgage loans to finance their business operations or expand their commercial properties.

04

Developers or builders who require construction loans to fund their projects and obtain financing for land acquisitions, construction costs, and other related expenses.

05

Financial institutions and banks that offer mortgage banking services as part of their range of products and services.

06

Mortgage brokers and loan officers who facilitate the loan application process on behalf of borrowers and assist in finding the best mortgage loan options and lenders.

By following these steps, individuals and organizations can successfully fill out mortgage banking activities and access the necessary funding for their real estate and financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the mortgage banking activities in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit mortgage banking activities on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing mortgage banking activities right away.

How do I fill out mortgage banking activities on an Android device?

Use the pdfFiller Android app to finish your mortgage banking activities and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is mortgage banking activities?

Mortgage banking activities involve originating, servicing, and selling mortgage loans.

Who is required to file mortgage banking activities?

Financial institutions and mortgage companies are required to file mortgage banking activities.

How to fill out mortgage banking activities?

Mortgage banking activities can be filled out electronically through the designated regulatory agency's online portal.

What is the purpose of mortgage banking activities?

The purpose of mortgage banking activities is to provide funds for borrowers to purchase real estate.

What information must be reported on mortgage banking activities?

Information such as loan originations, servicing data, and loan sales must be reported on mortgage banking activities.

Fill out your mortgage banking activities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Banking Activities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.