Get the free Claiming Exemption or Relief Form -Draft.doc - haringey gov

Show details

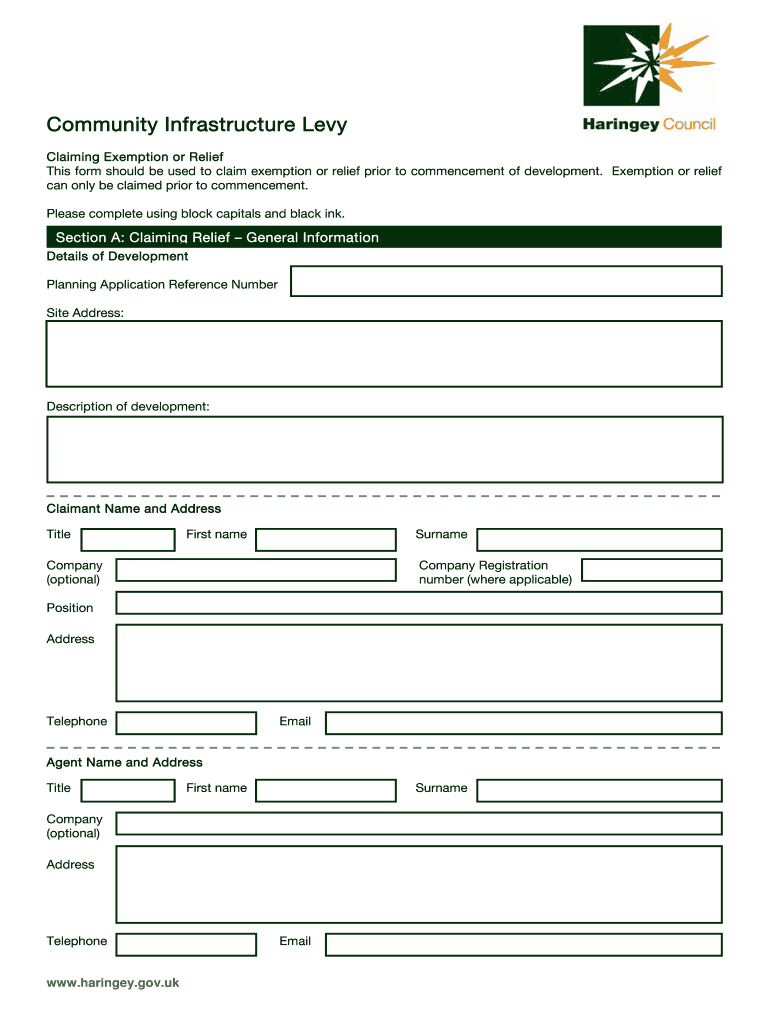

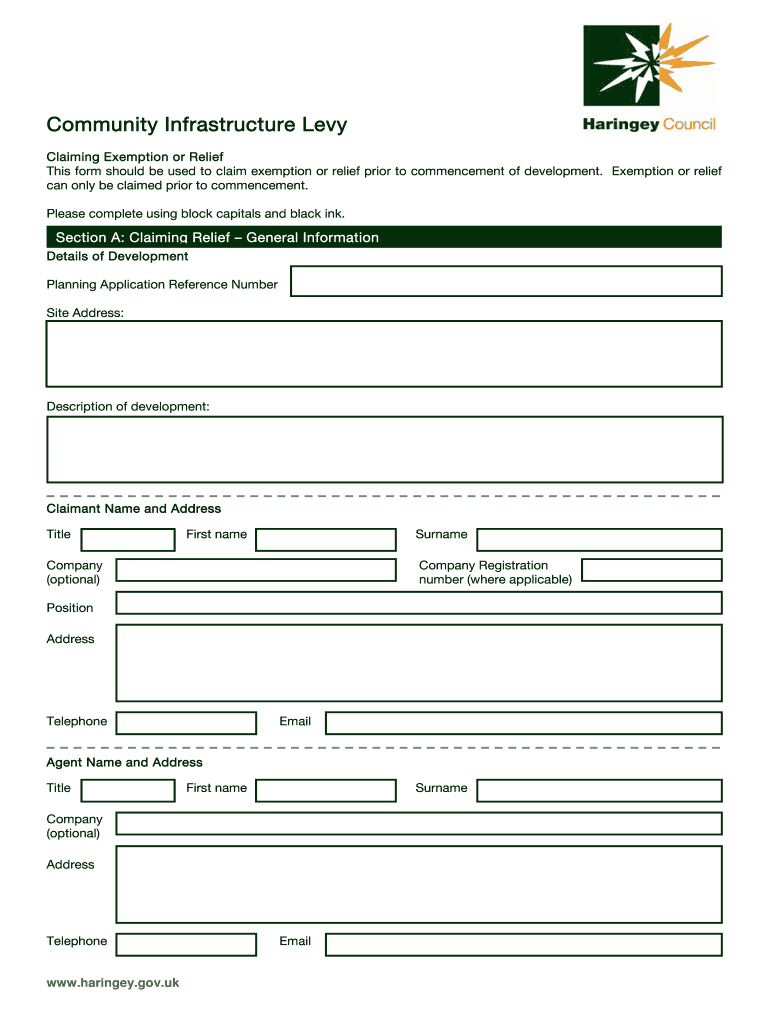

Community Infrastructure Levy Claiming Exemption or Relief This form should be used to claim exemption or relief prior to commencement of development. Exemption or relief can only be claimed prior

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claiming exemption or relief

Edit your claiming exemption or relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claiming exemption or relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claiming exemption or relief online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claiming exemption or relief. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claiming exemption or relief

How to fill out claiming exemption or relief:

01

Gather necessary documents: Before filling out the form for claiming exemption or relief, gather all the required documents such as income statements, tax receipts, and any other relevant paperwork. Make sure to have copies of these documents for reference.

02

Research eligibility criteria: Determine if you meet the eligibility criteria for claiming exemption or relief. This may vary depending on the specific exemption or relief you are seeking. Look into the specific requirements and conditions to ensure you qualify.

03

Obtain the appropriate form: Locate the specific form for claiming exemption or relief. This can usually be found on official government websites or through tax authorities. Ensure that you have the most recent version of the form to provide accurate and up-to-date information.

04

Read the instructions carefully: Before filling out the form, carefully read through the instructions provided. This will help you understand the necessary steps, supporting documents, and any additional information required. Following the instructions correctly will increase the chances of successfully claiming exemption or relief.

05

Provide accurate information: When filling out the form, ensure that all the information you provide is accurate and up-to-date. Double-check names, addresses, and financial details to avoid any errors that could potentially delay or invalidate your claim.

06

Attach supporting documents: Along with the completed form, attach all the relevant supporting documents as specified in the instructions. This may include proof of income, medical certificates, or any other documentation necessary to support your claim for exemption or relief.

07

Review and submit: After completing the form and attaching the required documents, review everything thoroughly. Check for any errors or missing information. Once you are satisfied that everything is correct, submit the form and supporting documents as instructed. Keep copies of all documents for your records.

Who needs claiming exemption or relief?

01

Individuals with low income: Those who earn a low income may be eligible for various exemptions or relief to reduce their tax liability or receive certain benefits.

02

Students and educational institutions: Students and educational institutions often qualify for different types of exemptions or relief, such as exemptions on tuition fees or educational supplies.

03

Charitable organizations: Non-profit organizations and charitable institutions may be eligible for exemptions or relief on taxes or other financial obligations.

04

Individuals with disabilities: People with disabilities may be eligible for various exemptions or relief to support their special needs and alleviate financial burdens.

05

Senior citizens: Senior citizens may qualify for specific exemptions or relief programs designed to ease financial burdens during retirement.

06

Homeowners: Homeowners may be eligible for property tax exemptions or relief programs aimed at reducing the financial strain of owning a home.

07

Individuals facing hardship: Certain circumstances, such as sudden unemployment or significant medical expenses, may qualify individuals for exemptions or relief programs to alleviate financial hardship.

It is important to note that the specific eligibility criteria and types of exemptions or relief vary by country, state, or region. Therefore, it is recommended to consult official government resources or seek professional advice to determine the appropriate exemptions or relief programs applicable to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claiming exemption or relief without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your claiming exemption or relief into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the claiming exemption or relief in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your claiming exemption or relief right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit claiming exemption or relief on an iOS device?

You certainly can. You can quickly edit, distribute, and sign claiming exemption or relief on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is claiming exemption or relief?

Claiming exemption or relief is when an individual or organization requests to be excused from paying a certain tax or fee, or seeks assistance or support in the form of relief.

Who is required to file claiming exemption or relief?

Certain individuals or organizations may be required to file claiming exemption or relief, depending on their circumstances and eligibility.

How to fill out claiming exemption or relief?

To fill out claiming exemption or relief, individuals or organizations must provide relevant information and documentation to support their request for exemption or relief.

What is the purpose of claiming exemption or relief?

The purpose of claiming exemption or relief is to provide financial assistance or relief to those who qualify, or to exempt certain individuals or organizations from paying taxes or fees.

What information must be reported on claiming exemption or relief?

The information required on claiming exemption or relief may vary depending on the specific tax or fee being claimed, but generally includes personal or organizational details, financial information, and supporting documentation.

Fill out your claiming exemption or relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claiming Exemption Or Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.