Get the free truth in lending promissory note pdf

Show details

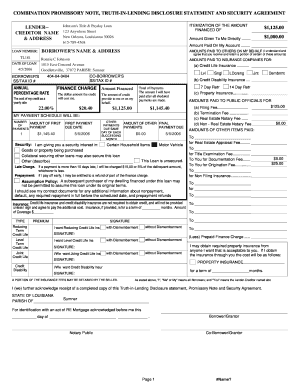

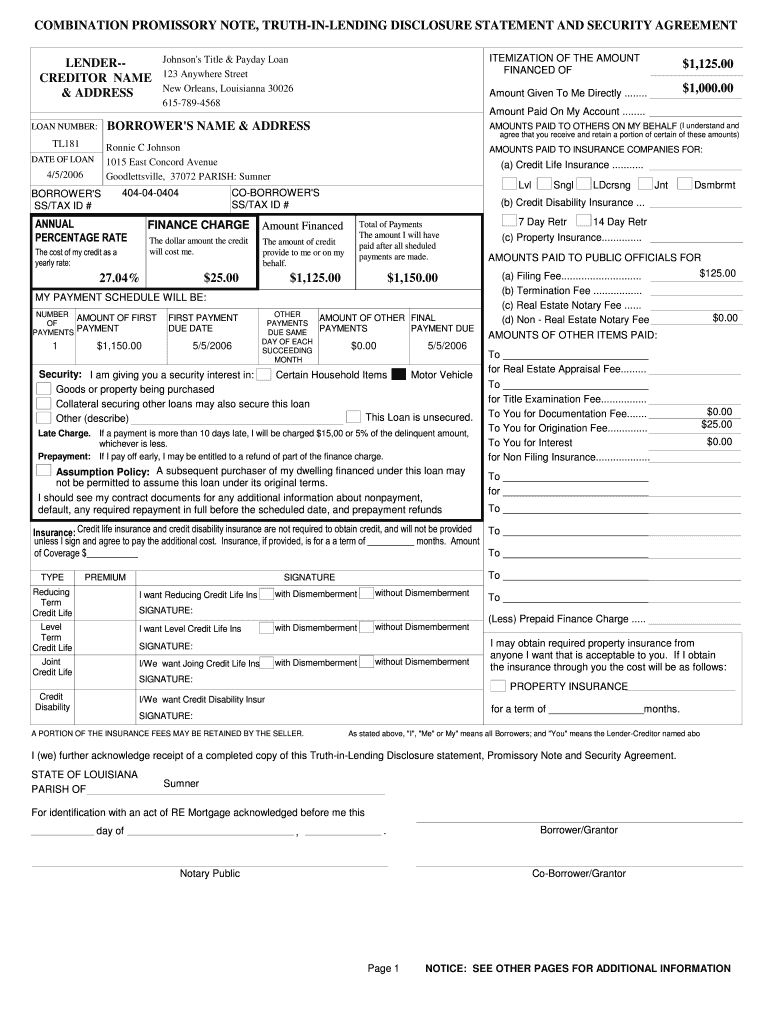

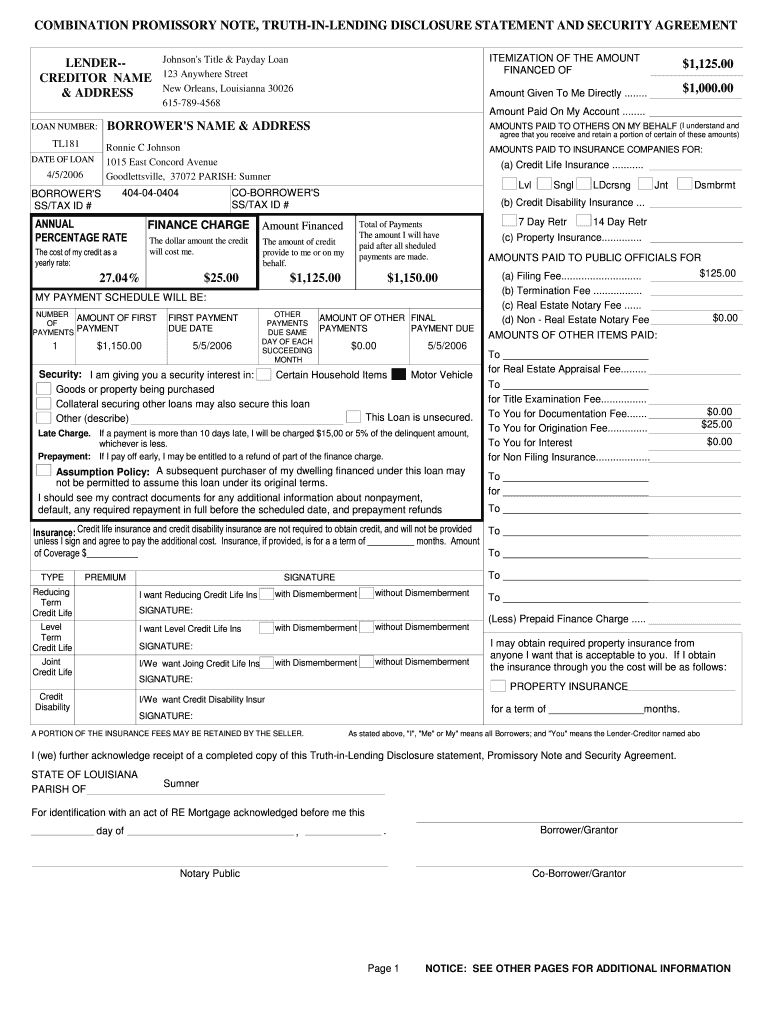

COMBINATION PROMISSORY NOTE, TRUTHINLENDING DISCLOSURE STATEMENT AND SECURITY AGREEMENT Johnson's Title & Payday Loan LENDERCREDITOR NAME 123 Anywhere Street New Orleans, Louisiana 30026 & ADDRESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign truth in lending promissory

Edit your truth in lending promissory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your truth in lending promissory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing truth in lending promissory online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit truth in lending promissory. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out truth in lending promissory

01

To fill out a truth in lending promissory, start by gathering all the necessary information. This includes the borrower's name, address, and contact details, as well as the lender's information.

02

Next, identify the loan details that need to be disclosed in the promissory note. This may include the loan amount, interest rate, repayment terms, and any additional fees or charges.

03

Include a clear and concise statement that indicates the borrower's intention to repay the loan in full, along with the agreed-upon repayment schedule.

04

Include any required or recommended disclosures mandated by law. This can include the Annual Percentage Rate (APR), finance charges, late payment penalties, and any potential consequences of defaulting on the loan.

05

Make sure both the borrower and lender understand and agree to the terms outlined in the promissory note. Consider seeking legal advice or consultation if needed to ensure compliance with applicable laws and regulations.

Who needs truth in lending promissory?

01

Individuals who are borrowing money from financial institutions such as banks or credit unions often need a truth in lending promissory. This is to ensure that borrowers are fully informed about the terms and conditions of their loan.

02

Business owners or entrepreneurs who are seeking funding from investors or lenders may also need a truth in lending promissory. This helps establish clarity and transparency in the lending agreement and protects the interests of both parties involved.

03

Anyone who is entering into a loan agreement, whether it is a personal loan, student loan, or mortgage, may benefit from having a truth in lending promissory. It provides legal protection and establishes the rights and responsibilities of the borrower and lender.

Ultimately, the truth in lending promissory is necessary for anyone who wants to ensure transparency, accountability, and legal compliance in their loan agreements.

Fill

form

: Try Risk Free

People Also Ask about

What is included in the Truth in Lending Act?

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

What makes a promissory note invalid?

Promissory notes are legally binding, but if a note becomes invalid, it may not be enforceable. A promissory note could become invalid if: It isn't signed by both parties.

What are at least 6 things Truth in Lending Act must clearly disclose to consumers?

Sample disclosures required under TILA include: Annual percentage rate. Finance charges. Payment schedule. Total amount to be financed. Total amount made in payments over the life of the loan.

What violates the Truth in Lending Act?

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures. Under TILA, a creditor can be strictly liable for any violations, meaning that the creditor's intent is not relevant.

What must be disclosed in Truth in Lending?

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms. TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested.

What are the 6 things in the Truth in Lending Act?

Lenders must provide a Truth in Lending (TIL) disclosure statement that includes information about the amount of your loan, the annual percentage rate (APR), finance charges (including application fees, late charges, prepayment penalties), a payment schedule and the total repayment amount over the lifetime of the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my truth in lending promissory in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your truth in lending promissory and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute truth in lending promissory online?

Filling out and eSigning truth in lending promissory is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit truth in lending promissory on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign truth in lending promissory. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is truth in lending promissory?

A truth in lending promissory is a legal document that outlines the terms of a loan agreement, ensuring that borrowers are informed of the costs and obligations associated with the loan. It is designed to promote transparency and prevent deceptive lending practices.

Who is required to file truth in lending promissory?

Lenders that offer credit or loans to consumers, including banks, credit unions, and other financial institutions, are required to provide a truth in lending promissory to borrowers.

How to fill out truth in lending promissory?

To fill out a truth in lending promissory, providers must include information such as the loan amount, interest rate, payment schedule, total repayment amount, and any fees or charges associated with the loan. It should be completed accurately to ensure compliance with lending laws.

What is the purpose of truth in lending promissory?

The purpose of a truth in lending promissory is to ensure that borrowers are fully informed about the terms and costs of a loan, enabling them to make informed financial decisions and protect them from unfair lending practices.

What information must be reported on truth in lending promissory?

The information that must be reported on a truth in lending promissory includes the loan amount, annual percentage rate (APR), payment schedule, total finance charges, total amount payable, and any potential fees or penalties.

Fill out your truth in lending promissory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Truth In Lending Promissory is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.